CEO of Cbus administrator MUFG refuses to apportion blame

The chief executive of MUFG Pensions & Market Services has declined to reveal to a Senate Committee hearing who his business believes is to blame for delays in handling death benefit claims for members of under fire industry fund, Cbus.

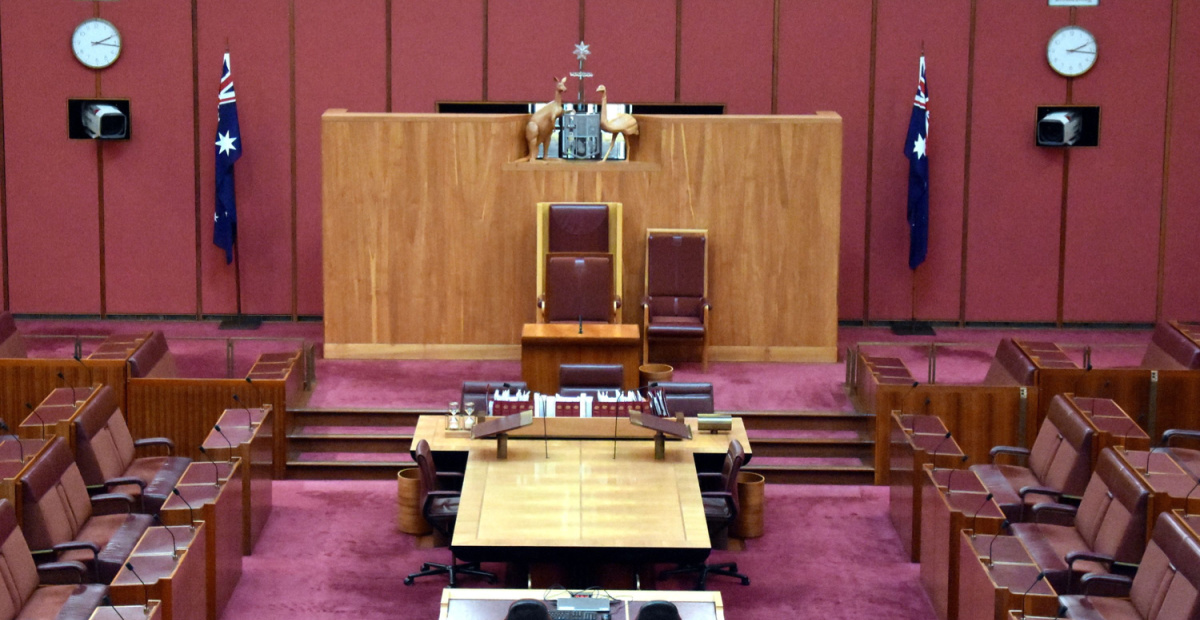

MUFG chief executive, Vivek Bhatia acknowledged the concerns being expressed on the issue but declined to answer specific questions from the chair of the Senate Economics References Committee, NSW Liberal Senator Andrew Bragg.

Bragg had sought to draw from Bhatia his view on comments by Cbus chair and ALP president, Wayne Swan, which appeared to blame MUFGH, formerly known as Link Market Services.

Bragg said Swan had suggested the cause of delays “lay principally with a third party operator”.

“What do you say to Mr Swan who wants to blame your company?” Bragg asked.

Bhatia declined to specifically answer citing ongoing investigations and actions on the part of the Australian Securities and Investment Commission (ASIC) and the Australian Prudential Regulation Authority (APRA).

“The Insurance claims process is a pretty complex process with multiple stakeholders. We operate under different rules that funds provide us,” Bhatia said.

“[It is] very difficult to point fingers at one party or the other. To be honest we need to have clear standards, cycle times end to end and then set clear expectations on what claimants and beneficiaries and ensuring binding nominations,” he said.

Pointed to comments attributed to Swan, Bhatia said: “I can’t speak on behalf of the chair. From our perspective we have strong and long tenure relationships with 20 superannuation funds in some cases more than 20 years”.

Pressed on the issue by Senator Bragg, Bhatia said; “I think given the matter of the ASIC investigation and providing evidence to ASIC I would decline to answer that”.

“I think, from my perspective, we have submitted a lot of evidence as part of the ASIC investigation and lot of conversation and given its an ongoing investigation would not like to comment on where the fault lies,” he said.

“From my perspective given open ASIC investigation would rather not answer at this time,” Bhatia said.

ASIC will sweep it under the carpet for their union buds.

We would never know anything about this @ crap” that has been going on for years if not for some insightful questions from x adviser Andrew Bragg He is asking the questions but everyone is side stepping them

I agree this will all bubble up like water in jug and cool down to a non event even quicker

New reforms allowing these cowboys to provide free financial advice won’t bother me, but we should all be very concerned for Australians when we let these foxes be in charge of the hen house.

Whilst retail funds were busy paying commissions to Financial Advisers to get clients, these Industry Super funds were busy paying off Public Servants (come work for us when you finish here Mr APRA and Mrs ASIC Official…. I’ll double that salary)…and making political donations to ignore Australian Advertising standards and basic regulations. Not to mention Bank bashing is a great way to deflect all of our problems. The perfect combo for them.

The questions these Industry Super funds need to ask is….. who forgot to pay the bill.