Diversification the name of the super return game

Diversification has been the key element underpinning Australian superannuation fund returns in the face of continuing geopolitical uncertainty and market volatility, according to Morningstar’s inaugural Super Fund report.

The report covering superannuation funds performance over the second quarter noted relative performances but, in the end, concluded the fundamental importance of diversification.

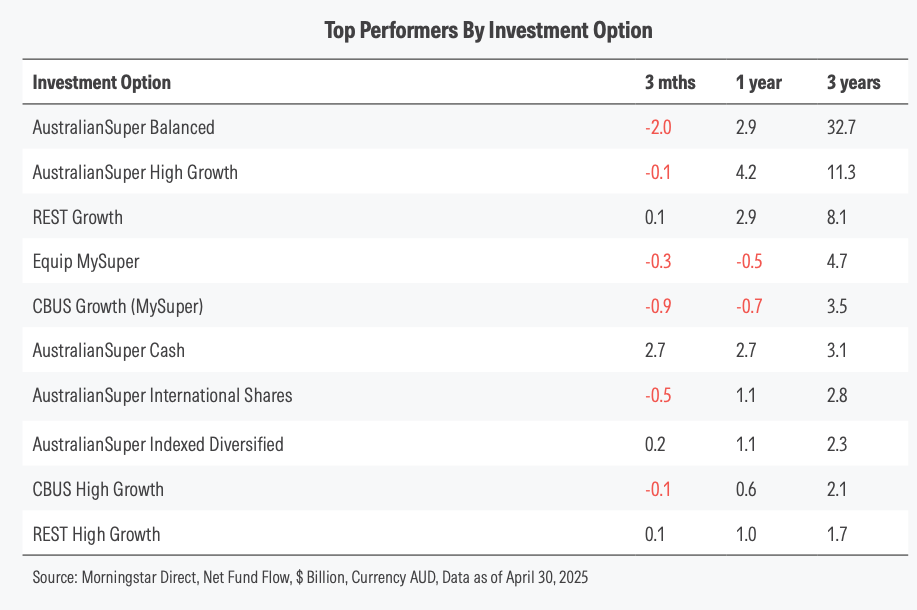

However, its break-down of the top superannuation fund performers by investment option, revealed the dominance of industry funds particularly that of AustralianSuper which boasts a strong in-house investment team.

“Style performance diverged sharply in Q2 2025, highlighting shifting investor preferences. Growth stocks staged a strong comeback, with the MSCI World Growth index up 11.89% for the quarter, reversing Q1’s sharp losses,” the analysis said. “Quality stocks also recovered, gaining 3.83%, while Value lagged with a flat 0.20% return.”

“The rotation back into growth was driven by renewed optimism in technology and innovation-led sectors, particularly in the U.S., as inflation fears eased and earnings remained resilient.

“Style dispersion remains elevated, reinforcing the importance of diversification across factors,” it said.

Morningstar said multi-asset portfolios delivered strong gains across the second quarter with performance improving across all risk profiles.

“After a soft Q1, diversified strategies rebounded sharply, led by Aggressive (+7.13%) and Growth (+6.03%) allocations, reflecting the broad equity market rally and improved sentiment. Balanced portfolios also performed well (+4.77%), while more conservative strategies posted steady gains.”

“The recovery was driven by strong domestic and global equity returns, stable domestic bond yields, though the macro backdrop remains uncertain. The quarter highlighted the benefits of diversification, particularly portfolios with higher equity exposure,” it said.

Surely "implemented consulting" belongs to a bygone era given the question marks over governance in term of separation of powers,…

Agree. LIF has been a joke. Actually pretty much everything that Canberra has been involved with has turned into a…

The current super products offered by platforms are now under huge threat, due to the regulatory risk of acting as…

Let's not forget FSC promoting aggressively LIF. As they wanted the Life companies to flog Dodgy Direct Life Insurances. Wow…

You wrote, "Decades of unlawful conduct" That's a massive statement. Where's the evidence of their conduct? (Not banks etc.)