The erosion of Australia’s super administration duopoly

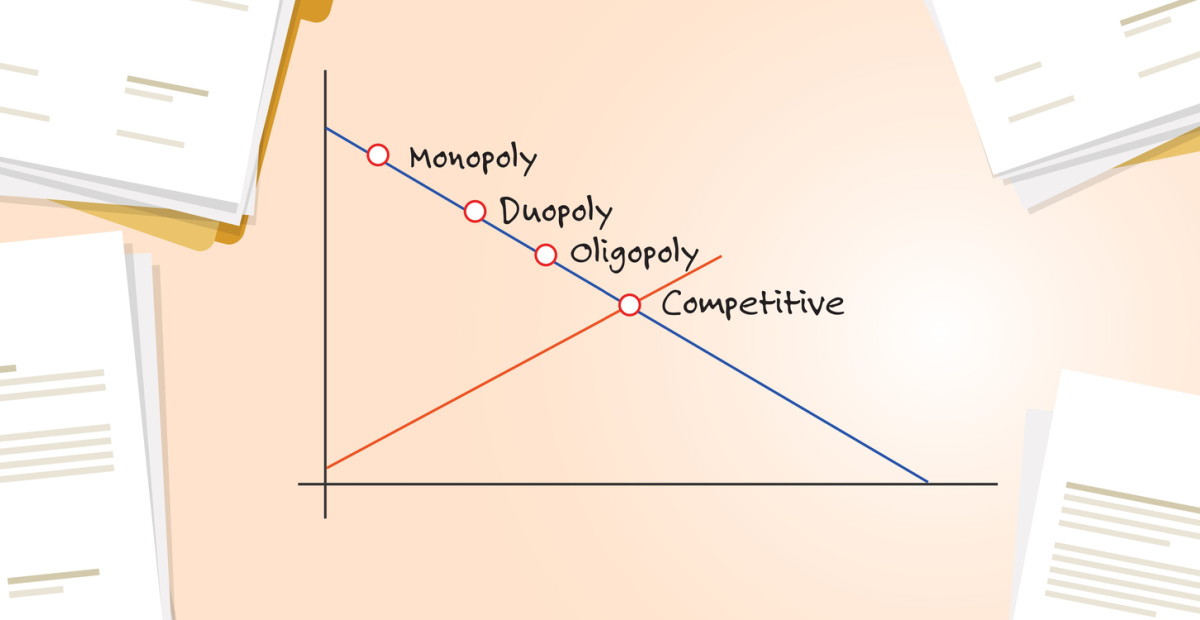

The market dominance of Australia’s two largest superannuation fund administration companies – Link Group and Mercer – has been eroding with multiple funds choosing to shift to smaller competitor firms or to self-administration arrangements.

In a week during which Link Group used its full-year results to acknowledge the loss of the mandate for major client, HESTA, industry consultants have confirmed to Financial Newswire the magnitude of the shift in clients between administrators.

They said that while much of the shift had been driven by the merger of superannuation funds encouraged by the Australian Prudential Regulation Authority, others had occurred because of the competitive approach being adopted by newer players such as Grow Inc and technology-based players such as SS&C and Tech Mahindra.

According to analysis conducted by Financial Newswire the shift in the administration market has seen HESTA shift from Link to Grow Inc in a move which mirrored that of Australian Ethical.

At the same time, Mercer client TWU Super will move to being administered by SS&C, while corporate funds Alcoa and Commonwealth Bank Group Super have merged into Australian Retirement Trust (ART) which means that they will fall within ART’s self-administration arrangements.

The merger of EISS Super with Cbus will see its members being administered by Link instead of Mercer while Care Super’s recently announced move to merge with Spirit Super will see a similar change in administration arrangements.

Commenting on the impact on administrators, Deloitte consultant, Russell Mason said that there had been a lot of activity over the past 12 to 18 months with clients looking to consider their options on fund administration.

“They are willing to consider a broader range of options and to try relatively new players,” he said.

“A decade ago, the choices were pretty simple between Link and Mercer but that has changed significantly,” he said.

The biggest test for this market will come the year after next, when AustralianSuper decides on who will administer its three million members. The tender process has already been announced and work commenced, with the contract with Link extended (twice) to June 30, 2025. AustralianSuper has been with SuperPartners, which Link took over in 2016, swince its inception in 2006. It’s by far the biggest contract the industry has seen. What are the chances of the fund internalising admin?

If you’re talking about them building their own administration systems?

My question would be where would they get the capital from?

The cost to these things is breathtaking.

The capital question is a good one as they are a profit for member. Unless they have been false advertising and they are retaining profits!

Mercer’s need to get a proper External Adviser Web based Interface organised, like Vanguard has in place. Until they do, they are not serious about providing a wide level of financial advice to their members. They’re just running a pokey little tied agency, with woefully insufficient advisers to do the job they now have on their hands.

Any super administrator with a lot of union funds as clients will never prioritise a good adviser portal. In fact a poor or non existing adviser portal is a positive for union funds, as it is consistent with their approach of discouraging third party adviser involvement with their clients.

It is one of the reasons advisers are reluctant to recommend union super funds, regardless of performance. Helping clients with good advice and strategy implementation can add far more to a client’s retirement outcome than performance alone. But most union funds actively block their clients from receiving those benefits from an adviser of choice.