Funds lament Govt’s failure to legislate purpose of super

With the clock ticking towards the 2025 Federal Election Australia’s major superannuation fund group is lamenting the fact that legislation enshrining the objective of superannuation has not passed the Parliament.

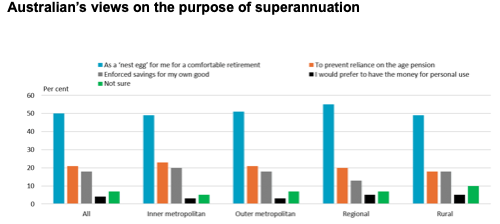

The Association of Superannuation Funds of Australia (ASFA) has produced new research which it says reinforces that a large majority of Australians believe superannuation should be used to fund a comfortable retirement.

That research, made public just before the ASFA national conference in Sydney, runs counter to continuing calls by the Federal Opposition for the use of superannuation for home deposits.

ASFA chief executive, Mary Delahunty said the survey results showed overwhelming support for the use of superannuation in retirement.

“Around 70% of survey respondents view superannuation as either ‘a nest egg to fund a comfortable retirement’, or a means ‘to prevent reliance on the Age Pension’,” she said adding that it supports the need to enshrine the objective of superannuation in law.

The Superannuation (Objective) Bill seeks to enshrine the objective of super being ‘to preserve savings to deliver income for a dignified retirement, alongside government support, in an equitable and sustainable way.’

“Despite the fact that compulsory superannuation is arguably one of Australia’s most successful public policy initiatives over the past 50 years, there is no legislated objective of superannuation,” Delahunty said.

“The findings of this latest research highlight the need to have the bill passed into legislation to ensure that choices the Parliament makes around laws that govern this country meet the expectations and desires of the vast majority of Australians when it comes to superannuation – that super is there to fund retirements.

“The preservation of superannuation for retirement income is a cornerstone of trust between Australians and their retirement savings,” Delahunty said.

“This trust allows Australians to plan for their future with confidence, knowing that their super is being protected and that they will have the income needed to enjoy a dignified and secure retirement.”

How much red carpet did Netwealth and Mr Saroghan roll out to Venture Egg to attract an uplift in FUM?…

Please explain ? We dont have problems

When a rental property leaves the rental market, it is usually because a renter has become an owner occupier. There…

So let me get this right - Netwealth break their own rules in placing First Guardian on the super platform.…

But the super fund doesn't get anything out of an adviser fee so hence why that is not a priority