Higher SG disguises super drawdowns impact

The degree to which Australian superannuation funds are having to adjust to members entering the draw-down phase has been reinforced by the latest quarterly data revealing an 11.4% increase in benefit payments over 12 months.

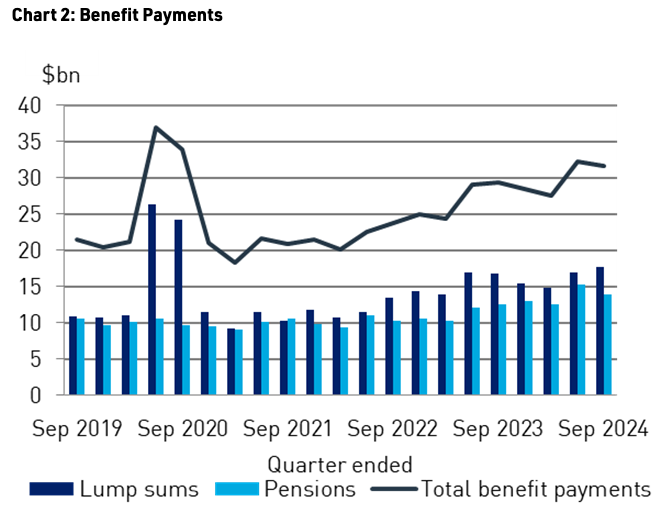

The Australian Prudential Regulation Authority (APRA) said the increase was attributable to a 20.3% increase in pension payments and a 4.9% increase in lump sum payments over the year to September 2024.

It said total benefit payments for the September quarter comprised o $17.7 billion of lump sum benefit payments and $14 billion of pension payment.

Much of the impact of members entering draw-down is being obscured by increases in the superannuation guarantee and higher wages.

The APRA analysis said total contributions were $49.4 billion for the quarter and reached $191.3 billion in the year ending September 2024, an increase of 13.1% from the previous year.

It said that, of this, members contributed $50.5 billion over the year and $14.9 billion in the September quarter, a decrease of 21.0% compared to the June quarter, noting that the decrease was expected with members maximising their annual contribution limits before the end of the financial year.

“Employer contributions were $34.5 billion for the quarter and $140.8 billion for the year ending September 2024, 11.4% higher compared to the previous year,” it said. “This growth was driven by the increases in the super guarantee rate to 11.0% from July 2023 and 11.5% from July 2024, and seasonally adjusted wages rising by 3.5% for the year.

Total superannuation assets in Australia increased by 3.7% in the quarter to reach $4.1 trillion s at September, of which $2.8 trillion are in APRA regulated funds.

APRA noted that superannuation funds wre strong with a 13.4% return in the year to September.

Right...FSP's only off shore services because they need to keep a lid on ever increasing costs like ASIC Industry Levy…

So the very same ASIC that said it is too risky to have Australian based Accountants doing the SMSF Financials…

So you reckon 1,000 paraplanners, compliance officers, customer service representatives, responsible managers, and BDMs have continued on FAR, regardless of…

I’m yet to see one that can’t be climbed or tunnelled under

Silver has outperformed gold since May. Check out macrotrends gold silver ratio chart on Google. Ever since Biden took Russia…