Index providers the performance test winners

There are at least some winners from the superannuation performance test regime and it appears to be the providers of the major investment indices – MSCI, Standard & Poor’s, FTSE and Bloomberg.

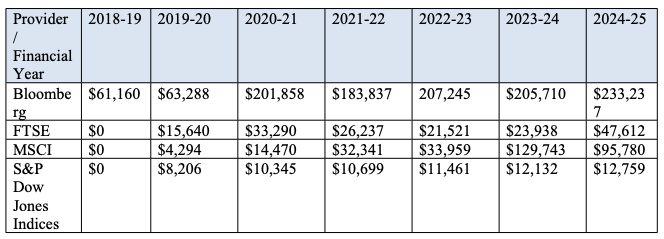

The Australian Prudential Regulation Authority (APRA) has told Senate Estimates just how much it spends on the indices providers with the greater proportion going to Bloomberg and MSCI.

Indeed, the amount being spent has increased four-fold over the past seven years.

And while APRA says that what it spends on the index providers is not entirely devoted to the performance test, the data shows that its expenditure on the indices has risen significantly since 2018-19.

In 2018-19 APRA spent just $61,160 with Bloomberg and by 2024-25 this had reached $233,237, while the amount spent on MSCI rose from $4,294 in 2019-20 to reach $129,743 in 2023-24 before moderating to $95,780 last financial year.

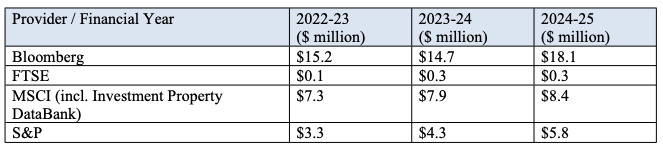

But the amount paid by APRA to the index providers appears insignificant when compared to what the millions of dollars being paid by the superannuation funds it regulates.

APRA provided a table to the Senate Economics Committee revealing that in 2024-25 the funds paid $32.6 million to the index providers.

Again, Bloomberg took the lion’s share of revenue, with $18.1 million, followed by MSCI with $8.4 million and S&P with $5.8.

Always back self interest when a body is marketing a submission to the government

In other words the system is achieving what the government wanted to happen.

Every day I come on here it feels like it is just the SMC trying to lobby to make one…

Well our compliance and red tape costs average around $200-$250k per adviser. Go ask the government why advice is so…

Personal Financial Advice should be offered, but it needs to be independent of the Industry Funds and their trustees of…