Industry Super cites BT Super failures to APRA on best interests

Industry Super Australia (ISA) has specifically cited the double superannuation performance test failure of BT Super MySuper in a submission to the Australian Prudential Regulation Authority (APRA) around meeting members best interests.

In doing so, the industry superannuation funds lobby group has claimed that, despite these failures, BT had claimed on its web site that it had promoted member best interests.

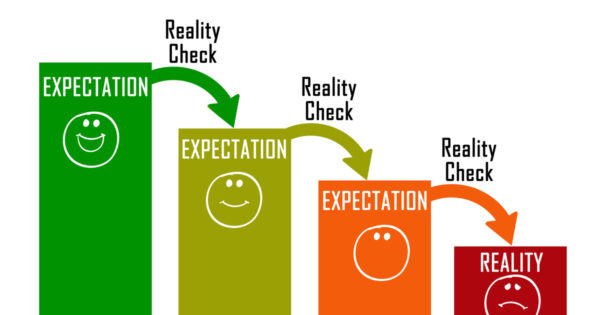

The industry funds body has backed the benefit of the superannuation performance test and APRA’s superannuation funds heatmaps but has claimed that the SPS 515 member outcomes framework is falling short because it allows funds to self-assess whether they have promoted the financial interests of their members.

“This ‘bottom-up’ approach requires RSE licensees to self-assess whether they have promoted the financial interests of their members and prescribes documents that RSE licensees must produce to demonstrate member outcomes are reflected in strategic objectives and business operations,” ISA said.

“While this approach can be useful guidance for RSE licensees in understanding how to ensure member outcomes are central to business operations, it can also lead to a procedural, check-box approach which does not necessarily lead to superior outcomes for members, and which can result in a focus on compliance with process, rather than on performance and member outcomes.”

“For example, BT Super MySuper has recently failed the annual performance test for the second consecutive year. However, in the annual member outcomes statements published on its website, BT claimed they promoted their members’ best interests.”

“Similarly, in its thematic review, APRA highlighted the inclination amongst some RSE licensees to employ a narrow interpretation in respect of the requirements of SPS 515 and supporting guidance and to undertake only limited analysis or testing to support claims made in relation to outcomes and performance.”

The ISA submission suggested that APRA undertake a mapping exercise of SPS 515 against other legislative elements to identify areas of duplication and regulatory gaps, and to consider the level of prescription necessary in respect of how RSE licnesees operate their business.

“We note that APRA has undertaken this type of work previously in relation to the interaction between the member outcomes obligations and design and distribution obligations. We suggest APRA takes a more holistic approach in the context of its upcoming review of the prudential architecture (including this current review of SPS 515) in order to better streamline compliance obligations and provide clarity to RSE licensees.”

Do they really want to play this game. How is mis labelling balanced funds that are over 95% invested in growth funds in members best interests. How is spending members funds on corporate sponsorships in members best interests? How is over valuing unlisted assets in members best interests. How is charging all members for services that the majority will not use in members best interests? How is making donations to unions and the ALP using member funds in members best interest?

Correct. The bunny at the lower end of the escalator may not be the bunny at all.

Like the two hand bit one above the other, Does that mean that this is what we say we are earning and the bottom one is saying this is what you get,

What about ME bank which only paid one dividend in like 10 years and only after people being made aware they ME bank had paid no dividends to the investors ISA which then sold it off shortly after this coming to light… you can’t make this stuff up, how was ME bank in the clients best interest?

So true.

members contributions leaking their way through to Trade Unions, who in turn make donations to the ALP — now this is what members’ best interrests are all about ???????????