New APRA data confirm industry funds’ unlisted preference

New, more detailed superannuation data collected by the Australian Prudential Regulation Authority (APRA) has confirmed the degree to which industry superannuation funds outmuscle retail funds on unlisted investments.

The data confirm a significant disparity between the proportion of money invested in unlisted property and unlisted infrastructure, with industry funds allocating 9.8% on unlisted infrastructure compared to just 1.5% for retail funds.

Where unlisted property is concerned the difference is 5.4% for industry funds versus 1.5% for retail funds.

The more detailed data is a result of APRA’s Superannuation Data Transformation project with the regulator’s Quarterly Superannuation public for the March quarter driving home the dimensions of the challenge APRA faces in seeking to apply the performance test to choice products.

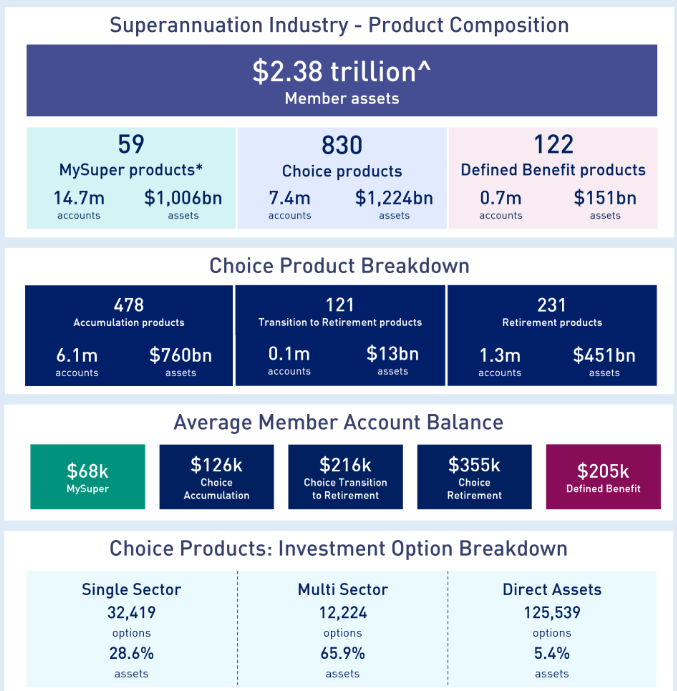

In a graphic covering product composition, APRA pointed to the existence of just 59 MySuper products covering 14.7 million accounts and covering $1,006 billion in assets.

By comparison, it showed 830 choice products covering 7.4 million accounts and $1,244 billion in assets.

By comparison, the data confirmed that while retail funds had higher allocations towards listed investments, they were only slightly larger than those of industry funds.

Where listed equities are concerned, retail funds had an allocation of 59.7% compared to 55.4% for industry funds. For listed property the difference was 4.6% for retail funds versus 1.9% for industry funds.

Unlisted Assets and made up valuations that never go backwards.

Just ask Wayne Swanny his CBUS fund has managed to have the best of the best of the best commercial property in the entire Galaxy and thus it hasn’t gone backwards like the rest of the globes asset class.

Amazing stuff to be that corrupt.

Amazing stuff for Govt Regulators to green light magic pudding valuation’s.

Amazing stuff that Industry Super BS so much and believe their own BS