No need for knee-jerk on negative super returns

Superannuation fund members have been cautioned against knee-jerk reacting to geopolitical events after returns turned negative in February while remaining under pressure in the early weeks of March.

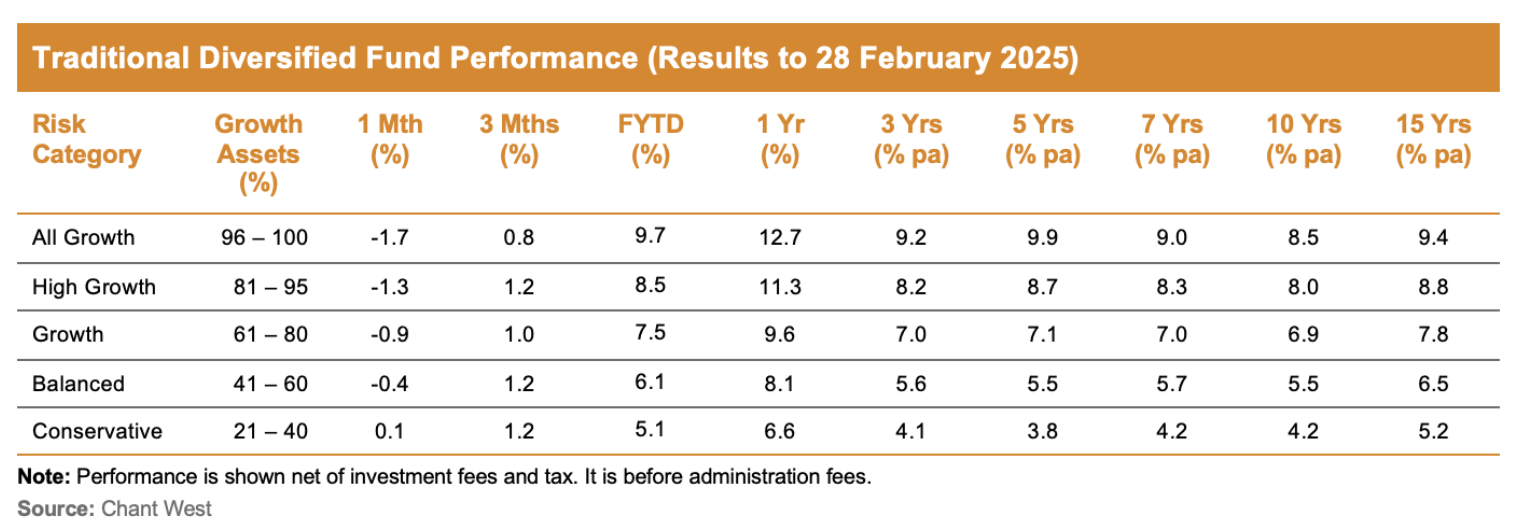

Superannuation research house, Chant West said that after a strong January, superannuation funds experienced “a small pull-back” in February with the median growth fund (61 to 80% in growth assets) down 0.9%.

It attributed the pull-back to the return of volatility to share markets on the back of weaker US economic data and concerns around the potential impact of Trump’s tariff announcements.

Commenting on the outcome, Chant West senior investment research manager, Mano Mohankumar said both Australian and international shares had been down in February.

“With share market volatility continuing into March, and an uncertain economic and geopolitical backdrop, it’s an important time to remind members that superannuation is a long-term investment and that throughout their superannuation journey, there will be periods of choppiness,” Mohankumar said.

“We caution members who may be thinking about switching from a growth fund to cash or a more conservative option with the intention to switch back later. More often than not, it results in poorer long-term outcomes than if they ride out the ups and downs. And we know that over the long term, there are far more ups,” he said.

The Chant West analysis pointed to long-term super performance remaining above target, with Mohankumar stating that since the introduction of compulsory super in July 1992, the median growth fund has returned 8% a year.

It is the purpose of PI insurance to protect customers from professional negligence. So, when customers are hit with investment…

This is nothing to do with ASIC.

Unbelievable, you can settle anything if you are a large organisation. What ASIC get away with is sick, they destroy…

Strong governance? How many trustee fines have been dished out? More illiquid assets? Is this a good idea? Where's the…

Because Industry Super Funds have such poor customer interest and advice, they need this stuff. And if ISFs ask the…