November dip ends second double-digit year hope for super returns

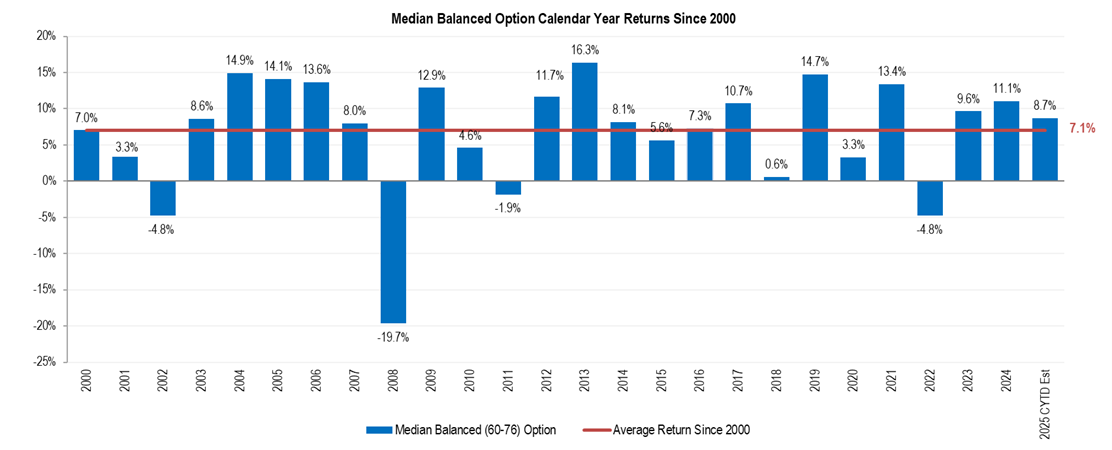

A second consecutive double-digit calendar year for superannuation fund returns is now “unlikely”, SuperRatings director Kirby Rappel says, after a weak November pulled performance into negative territory.

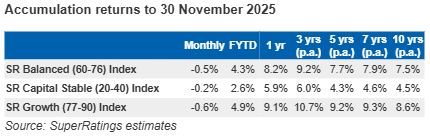

SuperRatings’ new figures have estimated the median balanced option returned -0.5% in November, ending a seven-month stretch of gains that had been steadily lifting members’ balances.

“We expect most asset classes to have delivered negative returns over the month with Listed Property and Australian shares seeing a pullback,” Rappel said.

“While this month breaks the strong run, 2025 is well on track to be an above average year for member balances, with the 11 months to 30 November 2025 estimated to have returned 8.7% against a median of 7.1% for the full year since 2000.”

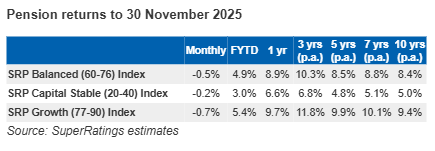

The data suggests pension returns have also softened with the median balanced pension option falling -0.5%.

Furthermore, the median capital stable pension and median growth pension options were estimated to have fallen by -0.2% and 0.7% respectively.

“However, members should be pleased that returns remain strong over the long term with the median balanced option providing an estimated 7.1% per annum over the last 25 years,” Rappel said.

“For pension members, the results have been even better with the median balanced pension product is estimated to return 9.5% for the 11 months to 30 November 2025.”

SuperRatings said members who hold steady could stand to benefit, especially if the ups and downs increase in the second half of FY 2026.

Wow, they put the fund on a super platform at SQM's lowest investment grade?? Just wow.

Scum bag Jones pulled Govts funding of 1st year CSLR out. Scum bag Jones exempted MIS and failed to deliver…

Spot on Rob

"ASFA chief executive, Mary Delahunty issued a statement suggesting that including APRA-regulated funds in the levy catchment “risks undermining trust…

The sooner we are delinked from stockbrokers the better