Personal contributions lift super flows

The increase in the superannuation guarantee to 11.5% from July last year has underpinned a modest but healthy increase in total contributions but failed to obscure a 0.8% decrease in assets for the March quarter to $4.1 trillion.

At the same time data collected by the Australian Prudential Regulation Authority (APRA) revealed a significant level of growth in personal contributions.

The March quarter data, released by APRA has pointed to a superannuation regime which was weathering the early months of the year but had yet to encounter the volatility generated by the tariffs approach of US President, Donald Trump.

APRA noted that superannuation returns had grown modestly over the 12 months to the end of March generating 5.9%.

Looking specifically at larger, APRA-regulated funds, it said total contributions were $46.8 billion for the quarter and reached $202.8 billion in the year ending March 2025, an increase of 14.4% from the previous year. Employer contributions were $36.7 billion for the quarter and $147.1 billion for the year ending March 2025, 10.3% higher compared to the previous year.

The APRA analysis said the annual growth included the effect of an increase in the super guarantee contribution rate from 11.0% to 11.5% starting July 2024.

Member contributions were $10.1 billion for the quarter and $55.7 billion for the year ending March 2025, 26.9% higher than the previous year. The increase was driven by growth in personal contributions.

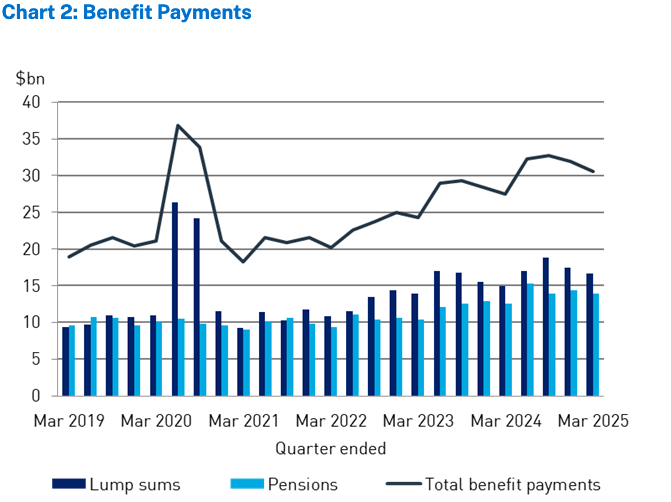

Benefit payments totalled $127.5 billion for the year ending March 2025, a 11.6% increase from the previous year. APRA said the increase was attributable to a 14.9% increase in pension payments and a 9.1% increase in lump sum payments over the year ending March 2025. Total benefit payments for the quarter comprised of $16.7 billion of lump sum benefit payments and $13.9 billion of pension payments.

Net contribution flows (contributions plus net benefit transfers, less benefit payments) were $11.7 billion in the quarter. Net contribution flows for the 12 months to March 2025 increased by 13.4% to $67.0 billion.

Personal contributions likely higher due to increased contribution caps for FY25.