Super diversification blunts Trump tariff impact

The degree to which superannuation fund members should avoid being spooked by the impact of the US Trump tariffs has been demonstrated by new analysis from Chant West which suggests the impact through March and April is actually around a relatively modest 2%.

With most financial advisers urging their clients to not be spooked into crystallising their losses, Chant West’s latest assessment said the median super fund (61 to 80% in growth assets was down 1.9% in March.

It said this brought the median return back to 5.5% over the first nine months of the current financial year.

Looking at April, so far, Chant West estimates that the net effect is that the median growth fund is only down about 2%, albeit it cautions that this could change given US policy volatility.

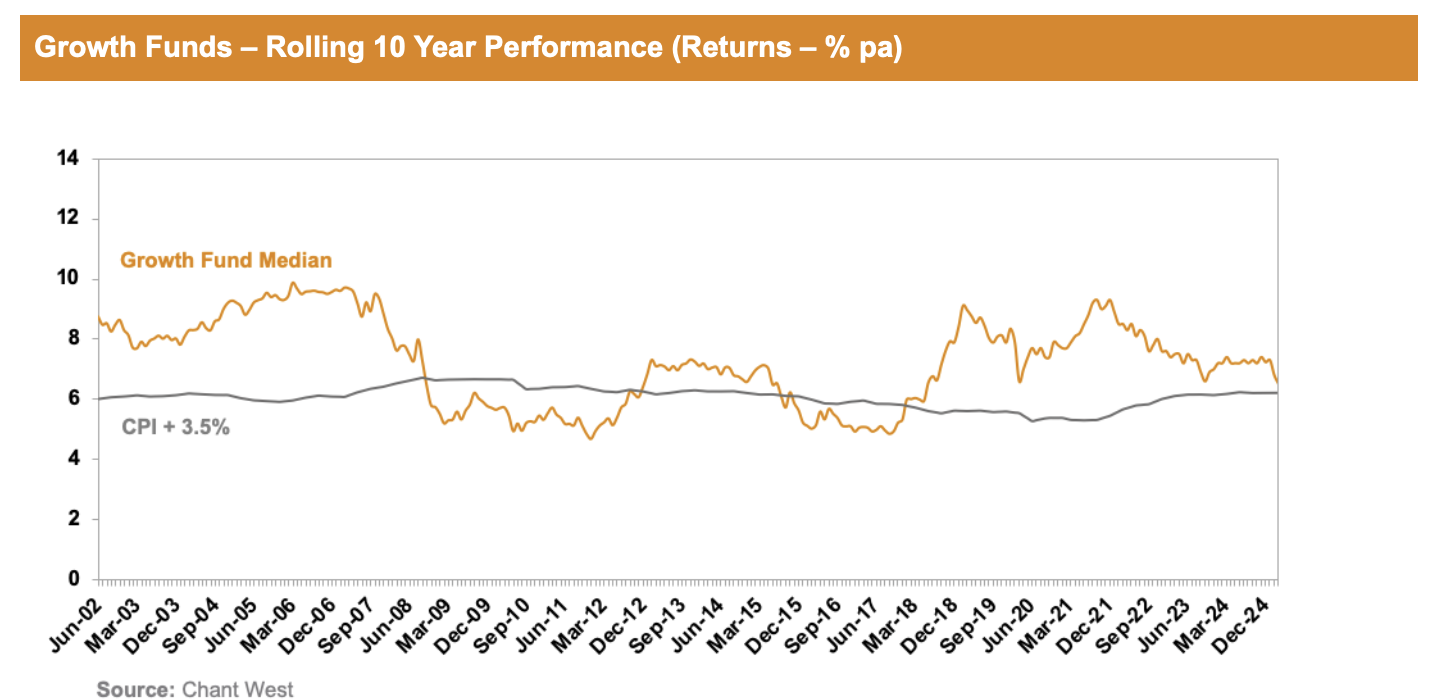

Commenting on the situation, Chant West Senior Investment Research Manager, Mano Mohankumar, said that with the heightened volatility being seen in share markets, it’s critical that super fund members keep in mind that super is a long-term investment and there are going to be periods of market weakness through their super journey.

“While we appreciate that members all have different tolerance levels for seeing their account balance going backwards, the majority can afford to remain patient, even many older members. A lot of Australians don’t take out all of their super as a lump sum at retirement, so a substantial amount is likely to remain the super system in the pension phase, often for many years. Their investment horizon is longer than they may think it is.

“When markets fall sharply, there is a tendency for some people to think about moving to lower-risk options or cash, with a view to moving back later, either out of fear or as an attempt to time the market. But far more often than not, that strategy results in a worse long-term outcome than if you stay the course. Not only do you convert paper losses into real ones, but you also risk missing part, or all of the subsequent market rebound.”

Mohankumar added that super fund members need to also remember the power of diversification, which has returned to the fore in 2025.

“Taking the full month of March as an example, we saw Australian shares retreated 3.3% over the month while international shares were down 5% and 4.7%, in hedged and unhedged terms, respectively. However, the median growth fund’s loss was limited to 1.9%, benefitting from diversification across a wide range of growth and defensive asset classes including alternative and unlisted assets.

“At the same time, growth funds still have about 55% invested in listed shares on average, and are able to capture a meaningful proportion of the upside when those markets perform strongly as we saw in CY23 and CY24, when the median growth fund returned 9.9% and 13.4%, respectively.”

I think these numbers are too low. Especially if you live in major cities. I try to ensure none of…

Are Interprac / Sequoia going to pay the 10’s of $$ millions in AFCA complaints ? Even after Macquarie &…

Always back self interest when a body is marketing a submission to the government

In other words the system is achieving what the government wanted to happen.

Every day I come on here it feels like it is just the SMC trying to lobby to make one…