Super lump sums still trumping pensions

More Australians are opting for lump sum payments from their superannuation than those opting for pensions, according to the latest data produced by the Australian Prudential Regulation Authority (APRA).

As the Government seeks to push further on the Retirement Income Covenant, APRA’s superannuation performance statistics for June quarter reflected the increasing number of superannuation fund members moving out the retirement phase.

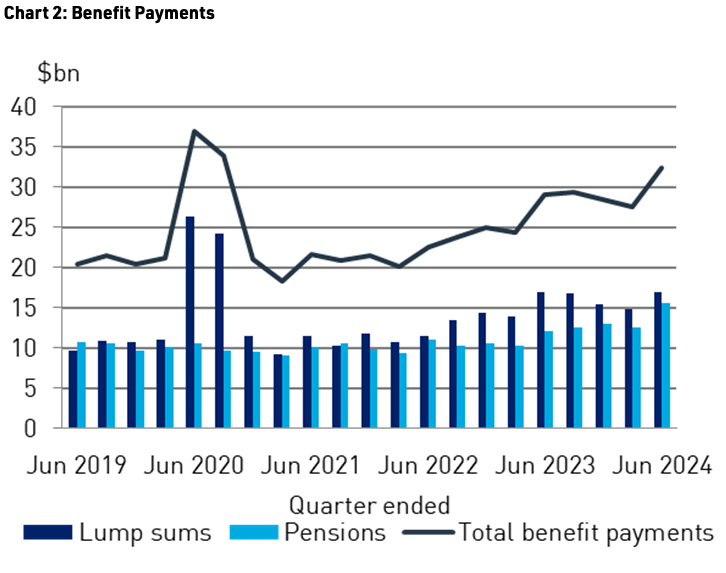

It said benefit payments had increased 15.3% to $117.7 billion and attributed the rise to a 23.7% increase in pension payments and a 9.2% increase in lump sum payments.

It said total benefit payments for the quarter were comprised of $16.9 billion of lump sum benefit payments and $15.5 billion in pension payment.

The data showed the degree to which corporate funds were merging into other entities, with assets managed by corporate funds decreasing by 18.9% while assets managed by retail and industry funds increased by 9.6% and 14.1% respectively.

It said that total superannuation assets increased by 0.4% to reach $3.9 trillion of which $2.7 trillion are in APRA-regulated funds.

I can see this going the way of LIF. Trumped up and misdirected government conclusions based on spurious or poor analysis.

With the change in contributions for NCC’s out to 75 the old cash out and recont is back with a vengeance.

Div 296 has already caused some trustees to panic prematurely.

How much of the withdrawals were for small accounts?

Nuanced analysis is not a skill set of Canberra bureaucrats but paternalistic, expensive and poorly drafted legislation is.

All the advised clients doing recontribution strategies would have skewed these figures

Of course they would but don’t let the facts get in the way of a trumped up policy opportunity via false stats.

Sounds like a perfect way to rope Industry Super Fund members into compulsory Lifetime Annunities, so the FUM stays with Industry super to keep clipping the ticket.

Maybe people realise how much control the ATO have over your super. The ATO can release super funds without notice and without needing a reason. No one advises of this worry. You find out when your balance is raided.

I wonder if a cash out recon is picked up as a lump sum and skewing these figures