Super returns 30%+ over past 3 years

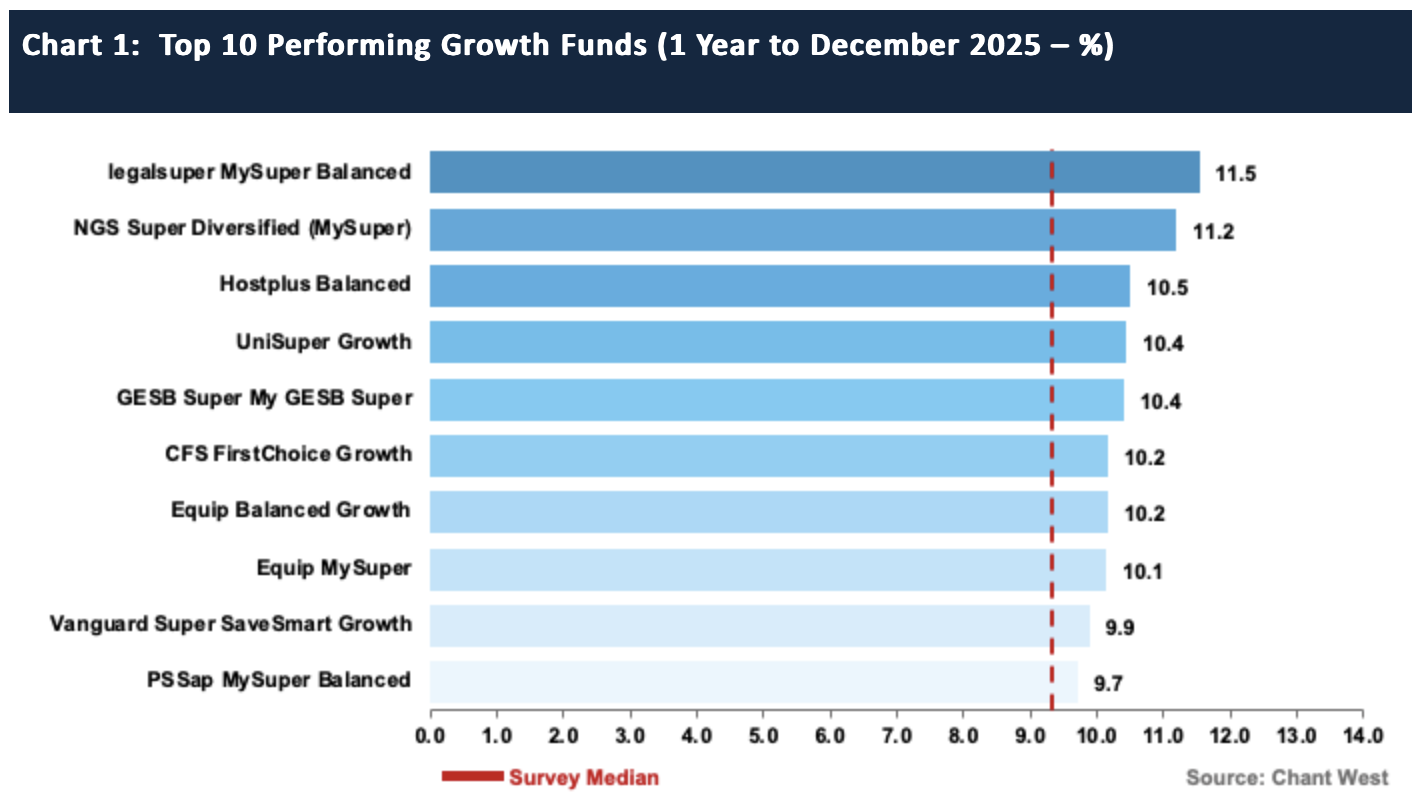

There has been further confirmation of how well Australian superannuation funds navigated 2025, with the median growth fund (61-80% growth assets) returning 9.2%, according to specialist superannuation research house, Chant West.

Taken together with returns of 9.9% in 2023 and 11.4% in 2024, translating to nearly 35% growth over the past three years.

The Chant West analysis also pointed to the Top 10 performing growth funds with relative minnows, legalsuper and NGS Super topping the table ahead of big players, Hostplus and UniSuper.

Commenting on the result, Chant West senior investment research manager, Mano Mohankumar said international share markets had proven the key driver of 2025’s strong performance, delivering 18.6% on a currency hedged basis.

He said this was despite the uncertainty around tariffs and geopolitical tensions.

“International shares in unhedged terms was lower, with a 12.5% return due to the appreciation of the Australian dollar over the year (up from US$0.62 to US$0.67). On average, growth funds have 31% in total invested in international shares and 25% allocated to Australian shares, with Australian shares also contributing meaningfully, returning 10.7 per cent. It also helped that all major asset classes generated positive returns over the period.

“We’re still in the process of collecting final returns for unlisted asset classes such as unlisted property, unlisted infrastructure and private equity, all of which were in positive territory,” Mohankumar said.

“We estimate that unlisted infrastructure finished with gains in the 7% to 10% range, with private equity likely to finish with a low double-digit return. Unlisted property, which was in the red in each of the two previous years, is expected to finish with a positive return in the 3% to 6%.

“Listed real assets were also up, with Australian listed property returning 9.7%, while international listed property and international listed infrastructure yielded gains of 7.5% and 11.6%, respectively. Within the traditional defensive asset classes, cash, Australian bonds and international bonds returned 4%, 3.2% and 4.4%, respectively.

“With share markets performing so well in 2025, particularly international shares, naturally the better performing super funds generally had higher allocations to those asset classes. Funds that had lower allocations to unlisted property, cash and bonds would have also benefitted, as did those with lower exposure to the US dollar,” said Mohankumar.

Writer: why is it 'teenage women' and 'teenage boys'?

Don't know about responsibilities being any longer. 2 years is far enough in a distorted premium market.

The upfront premium discounting must stop. I have a client who premium has increased 20.58% without any indexation. It would…

ASIC has been ignorant in its handling of the issue of Duration Based Pricing. I’ve yet to find a PDS…

You would think accountants were smarter... Skilled migration under this current regime is a furphy. The more likely outcome is…