Super returns deliver record member satisfaction

New data from Roy Morgan Research has confirmed the degree to which the ability of Australian superannuation funds to navigate a year of tariff-induced volatility and geopolitical uncertainty has seen member satisfaction rise to record levels.

What is more, retail funds have benefited almost as much as industry funds.

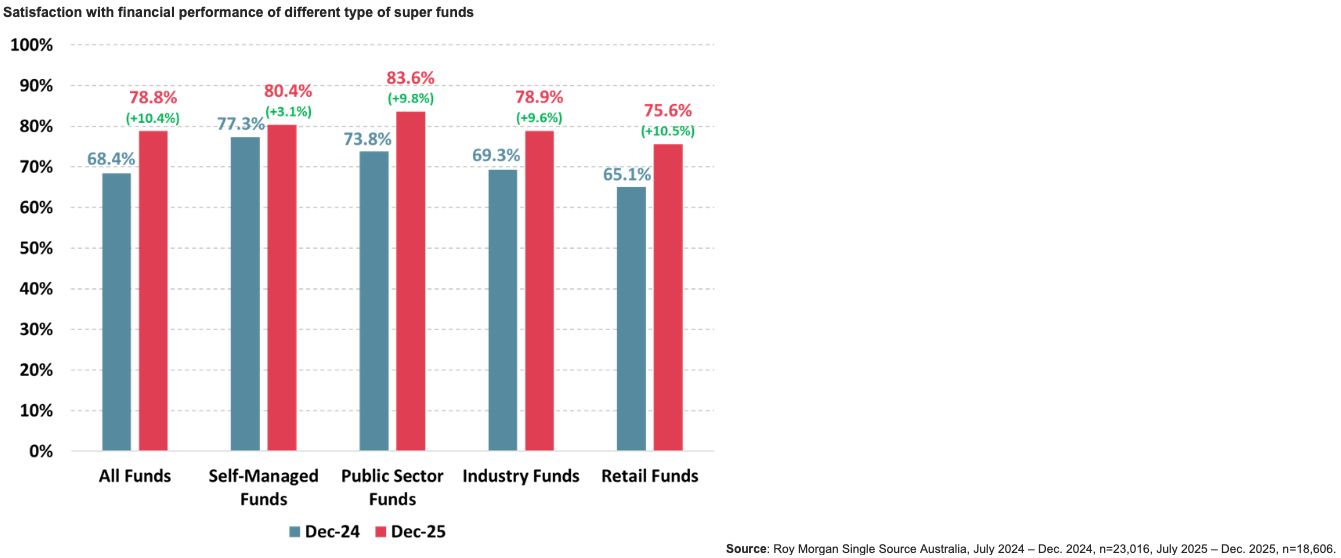

The latest Roy Morgan Superannuation Satisfaction Report shows an overall super fund satisfaction with financial performance rating of 78.8% in December 2025 – an increase of 10.4% points from a year ago and up 13.8% points from the post-pandemic low in July 2023 (65.0%).

The Roy Morgan commentary said superannuation satisfaction has increased significantly since the post-pandemic low and has hit record highs in the last few months to be now 19.2% above the long-term average of 59.6% since 2007.

It said there has been significant improvement across all four different categories of super funds over the last year with the largest increase for Retail Funds, with customer satisfaction up a stunning 10.5% points to 75.6% – a new record high for the category.

“Customer satisfaction with Retail Funds has now been at record highs for the past eight months although it is still the lowest of the four categories,” the Roy Morgan commentary said.

It said there has also been a significant increase in customer satisfaction for Industry Funds from a year ago, up 9.6% points to 78.9% – a record high level of satisfaction in Industry Funds and 18.2% points higher than the average customer satisfaction for Industry Funds since 2007 of 60.7%.

In addition, the commentary said customer satisfaction with Public Sector Funds is up 9.8% points from a year ago to 83.6%, and now clearly the highest of any of the four categories. Customer Satisfaction with Public Sector Funds increased above 80% for the first time in the last few months.

Although customer satisfaction with Self-Managed Funds is up 3.1% points from a year ago to 80.4%, this remains below the record high satisfaction for this category of 83.6% reached in December 2007 just before the onset of the Global Financial Crisis.

Commenting on the data, Roy Moran chief executive, Michele Levine noted that “One factor likely to be driving the rapidly increasing satisfaction for Retail Funds over the last year compared to other categories is the higher investment exposure Retail Funds tend to have to equities. The strong share-market returns over the last year will have a bigger impact on the bottom line for Retail Funds than their industry peers.

“Several retail funds have performed exceptionally well over the last year including AMP (an impressive increase in customer satisfaction of 16% points since December 2024), MLC (+14.2% points), Colonial First State (+12.2% points), BT (+7.8% points) and OnePath (+6.3% points).

“Industry funds to stand out with large increases are led by Australian Retirement Trust (an impressive increase in customer satisfaction of 16.7% points since December 2024), HOSTPLUS (+15.2% points), HESTA (+14.5% points), CARE Super (+9.3% points), UniSuper (+8.5% points), AustralianSuper (+8.2% points) and REST Super (+6.7% points).

“Australian Retirement Trust is the superannuation fund with the highest customer satisfaction of any Industry Fund ahead of HOSTPLUS, UniSuper, HESTA and AustralianSuper. All five of these funds have customer satisfaction of over 80%,” she said.

She was also there during the worse asleep at the wheel issues asic ever had. Asic need to appoint outside…

IFPA sure DON'T represent advisers or SMC or Choice or FSC - these are all self interest anti adviser groups.…

If only Jim Chalmers would replace himself with a (suitably qualified) woman, maybe the economy would have half a chance…

So you want to fight the tide because...??? Those who are able to change tack and navigate around the obstacle...…

More anti adviser boffins. Ifs didnt understand the legislation around using the word independent and haven't been called out for…