Super returns still positive despite volatility

Volatility returned to superannuation fund returns in August but, overall, funds managed to stay in positive territory, according to the latest research from SuperRatings.

The analysis said that August had proved a turbulent month with a strong downturn in the first two weeks followed by a swift recovery.

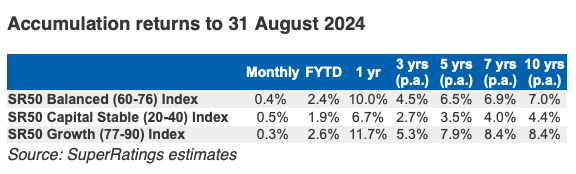

The result was that, overall, the median balanced option returned 0.4% while the the median growth option grew by an estimated 0.3% and the median capital stable option, buffered by lower exposure to shares, rose by an estimated 0.5%,

Commenting on the data, SuperRatings executive director, Kirby Rappell said the first two months of the new financial year had seen greater volatility with share markets impacting fund returns.

He said that it was in these circumstances that members needed to focus on long term outcomes rather than daily movements.

“Superannuation is a long-term investment for most and funds have consistently delivered good long-term outcomes” Rappell said.

“However, for those worried about how their super is doing in these conditions there are a lot of resources available to support members in making the choice most suitable for their situation.”

So someone in India who isn't licensed provided personalised financial advice and ASIC's response is to tell them to be…

Seeking Regulatory relief from Regulation. Industry Super Funds want to control $1.6 Trillion $$$ and ever growing with almost zero…

If Kalkine has officially been released and operates under a legitimate license to provide general advice, it raises an important…

Not sure what they're seeking regulatory relief from. In my view is they get tickled with a warm lettuce leaf…

Will they ever be named & shamed, fined and banned for life ??? Unlikely hey ASIC & APRA, especially for…