Vanguard Super launches with 0.58% low balance fee

Vanguard Australia has finally launched its long-touted superannuation product – Vanguard Super.

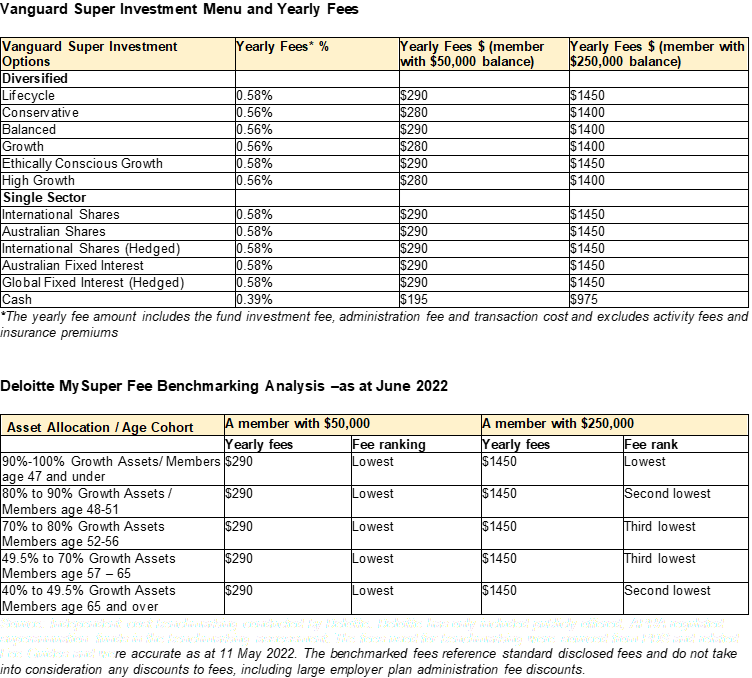

The company announced the launch today spruiking a 0.58% fee on its default option which it claimed was the lowest in the Australian superannuation market for member balances under $50,000 and for members aged 47 and under.

The fund, which goes public offer today, is launching with an accumulation product -Vanguard Super SaveSmart – which includes a MySuper default fund called Lifecycle, as well as a range of index-based diversified and single sector investment options as part of the choice menu.

The company said that adviser access would be via a new Vanguard Adviser Portal currently under development.

While there are other reasons why one may not use CFS, the cost isn’t one of them. For example, most of the latest CFS Index Options have a maximum total fee of 0.35% flat. ie their latest PDS shows $175 pa total fee for a $50,000 member fund. And only a $875 total fee for a $250,000 member fund.

Australian Retirement trust are cheapest index provider in the market. For $200,000 investment and admin fees all up (no buy/sell) it’s $482.40.

$1 million balance is $1,964.40 all up.

My clients love all the features that come with ART too.

Yes, agreed, but check out the underlying MER, not just the stated investment fee. Very valid when comparing against Vanguard, but less so when you use higher-performing funds.

I just check performance net of fees and taxes.. only one winner

Do your clients love the fact that their super is being used to support unions? Perhaps they should think it over next time they’re struggling to get to work due to yet another transport strike.

ART is one industry fund that does not have union influence. It’s run from Brisbane and union power is not as strong up there. They are also happy to deal with advisers and are more transparent than the other industry funds. Also, not part of the compare the pair rubbish. They are worthy of consideration, though their reporting is nowhere near the level offered by retail funds.