Vast majority of failed TDP super products have ‘ceased’

The Australian Prudential Regulation Authority (APRA) has revealed the degree to which it cracked down on Trustee Directed Products (TDPs) which failed the superannuation performance test, stating the “vast majority have ceased to plan to cease”.

The regulator used its annual report to confirm how it had dealt with the high fail rate of the TDP superannuation products, particularly those on platforms.

It said that following targeted engagement with trustees of the failed products, APRA had been provided with their remediation plans

“As of 30 June 2024, the vast majority have ceased, or plan to cease, their failed TDPs and have moved members to alternative products. Other trustees plan to take actions to improve outcomes of failed TDPs,” the annual report said.

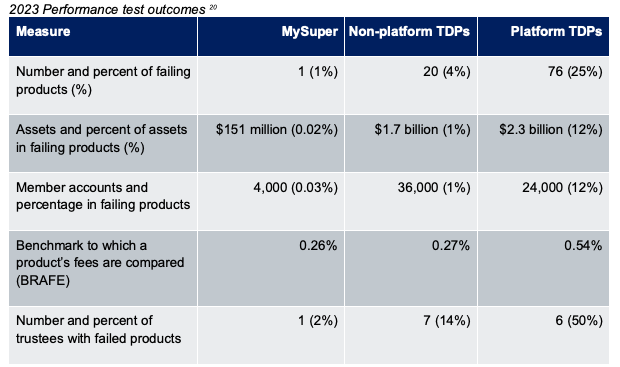

The document confirmed that 25% of trustee directed products (76) accounting for $2.3billion in assets and involving 24,000 members had failed the performance test.

This compared to just 4% (20) non-platform TDPs accounting for $1.7 billion which had failed the performance test.

“The 2023 performance test was extended to also capture trustee-directed products (TDPs), a subset of the choice segment,” the APRA annual report said.

“This has shone a light on the level of underperformance, particularly TDPs offered on platforms. While most MySuper products and non-platform TDPs outperformed the investment component of the performance test, more than half of all platform TDPs failed to meet the benchmark,” the regulator said.

Elsewhere in the annual report APRA signalled that it will soon be releasing the detailed findings of a review of how superannuation funds are valuing unlisted assets.

It said that it had conducted a deep dive review of 23 trustees’ valuation practices for various unlisted asset classes and how trustees manage liquidity risk relating to unlisted assets.

Deliberate adviser blocking tactics by union super funds. Some are OK, such as ART and and Aware. But Australian Super…

Of course the SMC supports ASIC’s IDR naming and shaming proposal—this is entirely in line with its broader strategic playbook.…

Has anyone noticed that most platforms try to classify complaints as feedback instead of complaints nowadays? Even when you stipulate…

No this would be analogous with Industry Funds being named and shamed for individual breaches and incidents in IDRs and…

ASIC & Industry Super Fund audits done in member paid for Sporting boxes whilst enjoying free food and alcohol. All…