Why avoiding tariffs super knee-jerk paid off

Yet more evidence has emerged of the good sense in superannuation fund members not being panicked by events such as US President, Donald Trump’s ‘Liberation Day’ tariffs approach, with confirmation that super fund returns have weathered the initial storm.

Australia’s two specialist superannuation research and ratings houses, SuperRatings and Chant West both confirmed that despite the US tariff approach, investment returns had remained in the black.

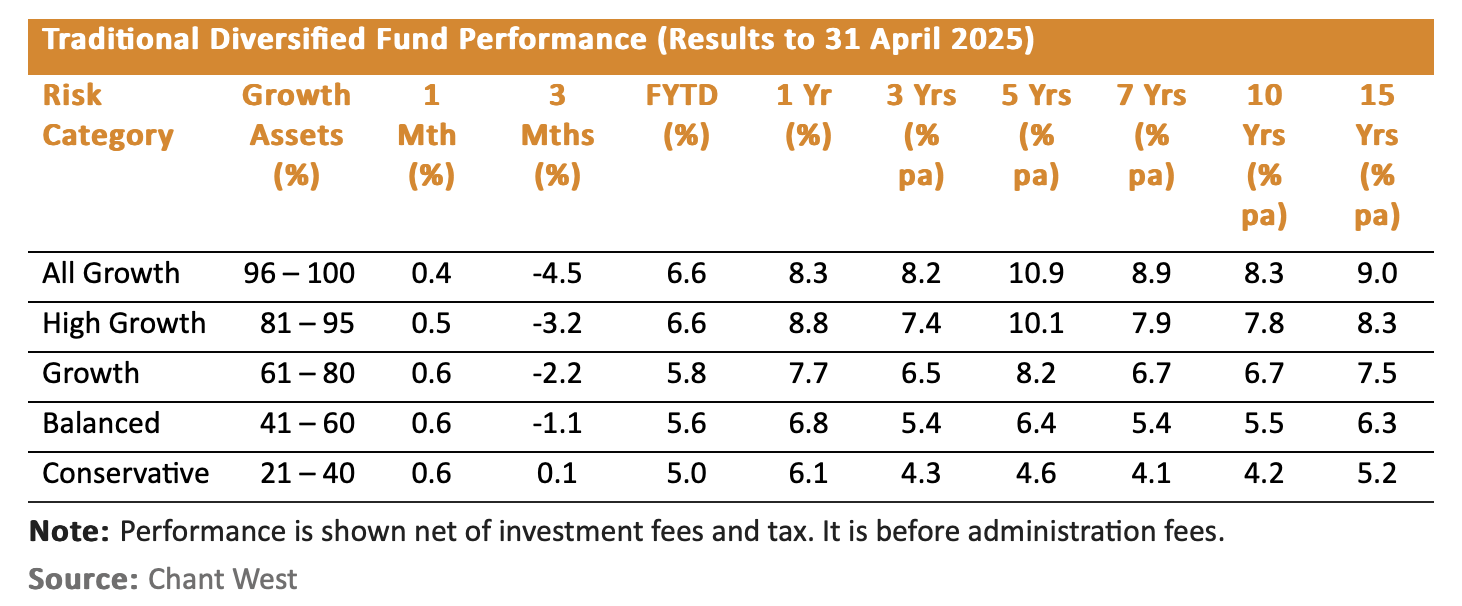

Chant West on Friday reported that super funds finished April in positive territory with the median super fund (61% to 80% growth) up 0.6%, bringing the return for the first 10 months of the financial year to 5.8%.

Chant West senior investment research manager, Mano Mohankumar said the April result had illustrated the importance of remaining patient and not getting distracted by short-term noise.

He made the point that if members had panicked in early April and switch to a lower risk option or cash, not only would they have crystallised their losses but they would have also missed the market upturn.

“The higher-than and broader-than expected tariff announcements made by Trump early in the month sparked extreme market volatility, with Australian shares and hedged international shares down 6.5% and 10.2% respectively over the first week of April. However, his subsequent pause on tariffs on most countries resulted in a strong market rally, which has continued into May so far,” he said.

“Over the full month of April, developed international shares were only down 1.8 per cent and 0.4 per cent in hedged and unhedged terms, respectively, with the US underperforming most other regions.”

I think these numbers are too low. Especially if you live in major cities. I try to ensure none of…

Are Interprac / Sequoia going to pay the 10’s of $$ millions in AFCA complaints ? Even after Macquarie &…

Always back self interest when a body is marketing a submission to the government

In other words the system is achieving what the government wanted to happen.

Every day I come on here it feels like it is just the SMC trying to lobby to make one…