Why platform-based super matters

Platform-based superannuation products are closing in on representing a third of all choice products, according to the latest data released by the Australian Prudential Regulation Authority (APRA).

The APRA September quarter superannuation data has been released at a time when, due to the collapse of the Shield and First Guardian funds there has been increased attention on platform superannuation products.

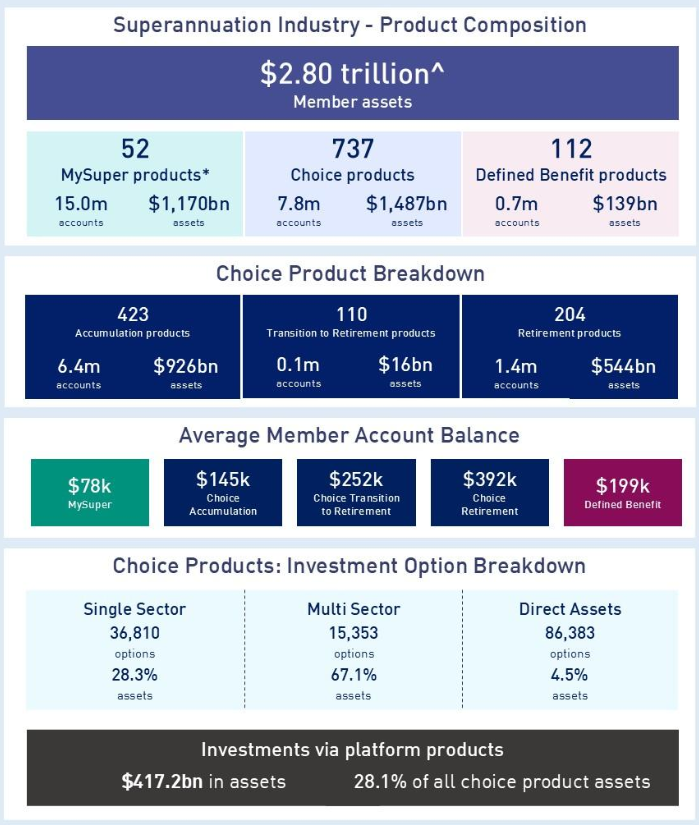

The APRA analysis noted that, in terms of investment via platform products, they represent 28.1% of all choice product sales equating to $417.2 billion in assets.

The data also confirms the dominance of the choice superannuation sector in terms of assets, if not members, with slightly more than half the number of accounts accounting for significantly more assets.

It noted that choice products accounted for $1,487 billion in assets across 7.8 million accounts, and 737 products, compared to $1,170 billion in MySuper assets across 15 million accounts.

The APRA data also pointed to the dominance of multi-sector options with respect to choice products, representing 67.1% of assets, while single sector accounting for 28.3% and direct assets accounted for 4.5%

Across the entire APRA-regulated superannuation sector, total member assets stood at $2.80 trillion.

Here we go. The current test is rubbish, notably the Trustee Directed Product one, yet this feels like rationale for an expansion.

The idea that investments are made on passing on some arbitrary test with crap methodology, rather than actual long term fundamentals is an absolute joke.

Australia really is idiotic when it comes to Governance in this space. So are the so called consumer advocates that support this nonsense.