Govt proposes advisers can self-assess into experience pathway

The Federal Treasury has put meat on the bones of the financial adviser experience pathway with a consultation paper which makes clear that it will be available to 1 January, 2026, and will entail advisers self-assessing via their licensee to access the regime.

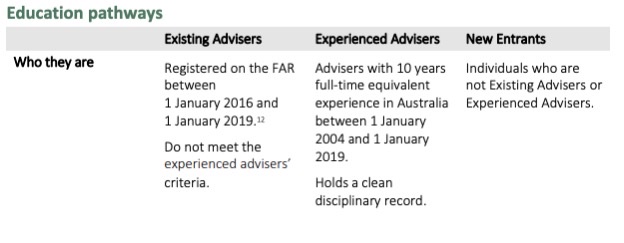

The Treasury consultation paper makes clear that experienced advisers will need to have 10 years full-time equivalent experience in Australia between 1 January 2004 and 1 January 2019 and hold a clean disciplinary record.

Importantly, it suggests the 10 years will not have to be consecutive and that the “ten years of full-time equivalent experience out of a 15-year window allows consideration for time out of the industry and part-time work”.

“Importantly, the period between 1 January 2004 and 1 January 2019 covers significant historical events, such as the global financial crisis, ensuring eligible experienced advisers have lived experience in volatile economic conditions. Additionally, this ensures that the 10 years’ experience is relatively contemporary,” it said.

“It is proposed that individuals seeking to access the experienced pathway will self-assess their eligibility through their licensee, taking into account the prescribed criteria and additional guidance that would be provided,” it said.

“If an adviser considers that they have met the eligibility criteria, they will be required to self-declare on an application to access the pathway.”

“It is not proposed that ASIC will assess applications to determine an adviser’s eligibility. Instead, it is proposed that ASIC will audit a sample of applications for compliance with the eligibility criteria. This will not prevent ASIC from deciding to scrutinise a specific application from an adviser where ASIC is aware that an adviser may be ineligible. For example, if the adviser has had disciplinary actions recorded against them on the FAR.”

Elsewhere in the discussion paper, Treasury has proposed a streamlining the core knowledge areas of approved degrees from the current 11 to five comprised of Taxation law, Commercial law, Financial advice regulatory and legal obligations, Ethics and Professionalism and Behavioural finance and client engagement.

It stated: “The streamlining of the core knowledge areas ensures that all financial advisers share a common foundation of knowledge and learning outcomes that will be applicable in a range of financial service industry roles. This is not to say that those core knowledge areas that have been removed are not relevant to the financial advice profession, rather this emphasises that not all core knowledge areas will be relevant for every financial adviser, and it may be more appropriate for potential financial advisers to choose those knowledge areas as electives or to develop those core knowledge areas ‘on the-job’ during their professional year. We expect that the core knowledge areas and learning outcomes would for the most part mirror the existing learning outcomes”.

A quick read of this proposal is indicating a very sensible approach to retain experience in the industry

What a travesty. Back to the future for financial advice. The road to professionalism just took a major Uturn

so totally agree

it is an insult to the advisers that have done everything that was asked of them and put in place through hard work the necessary steps to move this industry into a profession

another slap in the face

being a long-term Labor supporter I will definitely be rethinking my vote next election if this becomes the new law

is this not sensable and the same as what happened with the Nursing profession?

How long have you been in the industry? Me since 1996 so why should I have to go study some BS diploma to keep my job. I Have 2 degrees already (1 is B.Comm Commerce), have done CPD every yr for 20 yrs, have taught Investment Analysis and Derivatives at 2nd yr Uni level, have applied and owned 3 AFSL’s, have been through and survived the 1997 Asian Crisis, the dot com bust of 2000, the GFC of 2008/2009 and the COVID meltdown of 2020. No recent BS uni (fin planning) degree teaches you how to keep you clients in the black during those times.

This is spot on Andy and while uni and assessment are the way for the future you cannot forget the past which created the industry in the first place

As long as your AFSL is sensible Andy, my reading is that they make the call on your eligibility, based upon your self assessment. The only requirement for you – based upon what you wrote here – appears to be a tertiary Code of Ethics unit.

I agree, a three months course at Kaplan on Ethics and Professionalism. I just wrote and passed it, learn’t a few things to!

There is something in what you say in terms of problems in letting the odd unscrupulous advisor avoid scrutiny however, however I think you are being a bit harsh on those experienced practitioners with a pristine complaints history, who wish to transition to retire between their 60’s and 70’s..

For example I have had almost 40 years experience as a Financial Advisor, have passed the ludircrous FASEA exam, have University Degrees in Accounting and Economics, have served as a Director on the FPA and as a Director of FICS, and have qualified as a Chartered Accountant, Certified Financial Planner and Expert Witness in Financial Planning matters, and quite frankly am fed up with the woke box ticking compliance regime we are having imposed upon us.

In my view you can’t teach most of the things that fall under the term “Ethics” – you are either a good person or you are not.

I guess it keeps us on more of a level playing field with the accountants, mortgage brokers, bookkeepers, supermarket cashiers etc who Michelle Levy will soon be recommending can also give out financial advice

Great news.

Now how about something logical for the people who have been doing all of this with no complaints but can’t pass a flawed exam?

If you have operated for 20 years with no complaints it is not likely you have an :”ethics” issue.

The problem you might find with this thinking could be that after passing the “flawed exam”, you’ll still need to pass ‘at-a-minimum’ the professionalism and Ethics course at masters level…

Not too sure I agree with this proposal. I was happy when the experience pathway counted for 10 years up to 2026, as it then meant that post-FOFA Advice weighting really counted. I have to say that as a Licensee, I have more issues with Advisers thinking in their pre-FOFA brain than with the newer Advisers who “grew up” with FOFA as their knowledge base.

I tend to agree with your thoughts here.

problem is, Alan, those Post-FOFA advisers have never seen a severe mkt downturn. Should one happen again they won’t know how to deal with it and they’ll be the first people let go when financial firms are on the brink of collapse. This happened during the GFC. Reading about what the GFC was like is nothing compared to working through it.

Andy are you then saying that these advisers who came in post FOFA, will then know how to deal with a severe market downturn if they complete the additional units that are imposed on them or a relevant degree?

I agree with Alan that it should be up to 1 January 2026 as it includes advisers who have been in the industry for 15 years but only became an adviser post 2009.

So … where do we begin? FSCP / Disciplinary Body MIA 8 months into the extended regime, ASIC readily handing out individual AFSLs to a bunch of advisers who thought institutional and mid-tier licensee compliance was too harsh (and many who had numerous fee-for-no-service and other compliance issues) and you’re asking these advisers (many who should have hung up the cape because they had no intention of meeting the educational requirements under FASEA and were just kicking the can down the road to the end of 2025) to assess their own “get out of jail free card” to continue poor advice, churning product and fee for no service? And for the larger and mid-tier licensees that are left – more cost! I certainly hope “the prescribed criteria and additional guidance” is robust and earnest. What does it say about all the poor schmucks who spent $1000’s doing the extra study and doing their utmost to realise the vision sold to us of a professionalised advice industry? It’s an admission by the government that, whoops, sorry, we/they – meaning both Labor and Liberal since pre-FoFA (Rudd-Gillard-Rudd-Abbott-Turnbull-Morrison) – killed the goose that laid the golden egg and now need to save an industry that’s on its knees, even if we have to carry the bad apples with us for a few more years and we’re all replaced by robo-algorithms and industry fund intra-fund advice drones. WTF?

If you really think that is what is happening, you are delusional.

The industry is now in a good place.

Which part (for both statements)? If you reckon it’s all delusional, depends on which side your bread is buttered on. The QOAR is fantastic for product issuers (and their attendant salespeople) and Industry funds and intra-fund advice got away Scott-free during the Royal Commission (VI and conflict of interest too hard). But financial advisers and licensees have absolutely carried the can. And it amazes me that those advisers who have done the hard yards and spent the time and money to do what was expected effectively get told “you should have just thumbed your nose at the whole thing and waited out the change in government and you could have saved your hard-earned and time away from family doing assignments at the kitchen table at 10.30pm.” So tell me, how exactly is the (I’ll assume you mean “advice” industry) in a good place? We were a political football and, in a race to the bottom to win votes at the expense of a lot of sacrifice and hard work from many people to professionalise the advice industry, Labor got it’s wish.. Now we need to carry the deadweight for another 5 or more years. If you think all advisers are tip top, I’ve known too many that aren’t (and most of them are underqualified, too focused on making money/sales at the expense of client best interest and many of these are in the 10 year plus camp and only have a clean disciplinary record because licensee senior management like/protect advisers that can make money). .

For what it is worth. I am degree qualified and would not have had to complete the additional study requirements. I know and work with approx 30 Financial Advisers, reasonably closely. I believe they all act in the best interests of their clients and work closely with their clients to improve their financial situation. It sounds as though you know plenty of advisers that may not do this. If you know or work with Advisers that aren’t acting in the clients best interest, are underqualified and focused on making money and sales at the expense of client best interest, perhaps it is your duty to report them as per the FASEA code of ethics Standard 12

Rob, you are spot on.

By not reporting them or at least checking whether they have breached the code, you yourself would breach the code!

I’d suggest having a discussion with said ‘errant’ advisers firstly to ensure that you are’nt missing something that a discussion with that adviser might clarify and end your concerns.However, if the “errant’ adviser isn’t prepared to ‘do the right thing’ then report them to the advisers compliance team / or to ASIC…

This should have been an acceptable pathway from day 1.

The current regime was highly discriminatory to professionals with 15yrs+ experience. Personally anyone who has been in the game pre-AFS Licensing (that’s 2002) should have been grandfathered in.

The fact that regs were put in place to make advisers who where already experienced, degree qualified then have to go study some BS diploma to keep their job was BS. Relying on the latest group of zero bear mkt experience advisers who came out of Uni with their new Fin Planning degree in the last 10 yrs was a joke. Finally some common sense has been applied. Next can we acknowledge that Stockbrokers are mkt specialists and shouldn’t be in the same category as fin planners most of whom wouldn’t know their elbow from their backside when it comes to direct mkt investments

Your tone and choice of language is reason enough for you to get some formal education. Experience and education make a professional and, some self awareness is a sound quality that help reduce the temptation to “spray” like a child when you are aggrieved.

I mightn’t know a lot about “direct mkt investments’ but I know a lot about whole of balance sheet planning including the absolute top of the pops for the nest 10 years – the succession piece. I am not better than you and you shouldn’t be disrespectful of my education, experience and knowledge either. We are a part of the same industry that was hoping to move to a profession but, without education we have to wait for the next gen to come through to have this fulfilled.

Unless you are a stockbroker we’re not part of the same industry.

As for your assertion about my tone meaning I need some formal education lets see your quals vs my 26 yrs experience, 2 degrees, taught at 2nd yr uni lvl for 2 yrs, have applied for and owned 3 AFS licenses and published a book on Derivatives

Also, while AFSL’s are compulsory members of AFCA, there can’t ever be a professional body representing financial advisers because one of the perks about being in a professional body (like CPA) is limited liability which is contradictory to AFCA. But I guess you know that because you know about ‘whole of balance sheet planning.’

That’s an impressive resume and time as an investor. With those qualification and time investing, you must be sitting very pretty.

Given the implementation date is 1 Jan 2026, but only experience prior to 1 Jan 2019 can be used for the experience exemption, it will effectively be an exemption for 17+ years experience when implemented.

Well this is to be expected…yes after we have all been

done overagain in time , money and stress. It`s consistent!&

We wont mention the legion of Advisers that have already left the industry because of this of course.

Spot on Brad

This is a real kick in the guts for those who gave up their weekends and took time away from their business, friends and family to complete the minimum education requirements. Where do we send the invoice for the loss of income and time from our business over the last 2,3 even 4yrs?

I love the quote ” Don’t take advice from someone, who’s never achieved what you want to”

Consumers will just need to be more vigilant when seeking advice, and decide whether the 30yr experienced Adviser, still working 38hrs pw, that was happy to carve commission from their accounts without providing advice, and are only working as they haven’t practiced what they preach, is the better option over the Adviser with the higher education, no fee for no service record, has 5-10yrs in the game, and is on track to retire at 45-50.

What an absolute joke this proposal is.

How is it fair that advisers who have been practicing since FOFA, assuming they have done all the right things will still be required to get a degree under this legislation yet those who some would argue created the issues that have tainted this profession in the first place which resulted in the Royal Commission are excused of a degree.

Although there are a lot of very good financial advisers who did the right thing between 1 Jan 2004 and FOFA, many would argue that the behavours of advisers during this time contributed towards the reputation of Financail Advice which resulted in the Royal Commission, behavours such as overinsurance and churning, percentage based product fees that influenced advice, fees for no service amongst many other quesionable practices that we don’t see today by ‘not experienced’ advisers.

Again, further proof that there is absolutely no integrity, credibility or understanding by either side of politics when it comes to financial advice.

Name one industry that forced the people working successfully in that industry to go and complete some BS diploma in order to keep their job?

Being taught ethics doesn’t make you ethical. You either are an ethical person or you are not.

It was the four banks who screwed the Fin Planning sector – they just hired anyone they could get to push their own financial products. the vast majority of complaints to the Royal commission in the financial sector centred squarely on the 4 big banks.

What a joke! Where should I send my bill for all the time and money I have spent on the education requirements?

When you consider the Grad dip (minimum) was an additional 6 subjects for most, it’s going to get messy for treasury. 6x 120hrs @ $550ph.

So the ones saying its going to be a step back I cant decipher if you’re annoyed you did the required training, which is now not required and want everyone to do what you did that is now no longer…..And further if you think its going back to the future for Fin Advice you must have only just joined and to the ones that did the extra courses it will never go to waste – so stop complaining, mind you everyday practical experience is invaluable and difficult to put a real value on.

Hi Herbert

I would suggest the onces complaining about this carve-out want the ‘industry’ to transition to a profession so that we can self-regulate and in doing so, get rid of ASIC / AFCA and the bad regulations…

Until our industry has transformed, we will never be accepted by the community or the regulators as a profession. These carve-outs simply retain our ‘industry status’ and allow certain members of the media, consumer groups, government, the numerous regulators, AFCA, etc. to continue to bully, demonise, vilify, impose mental anguish, upon the outstanding, dedicated and qualified professional financial advisers who want to focus on serving the public (rather than watching their backs for the next attack.)

Make sense?

Appears to be a sensible approach that finally recognises invaluable prior experience, sound compliance, existing tertiary studies and CPD etc done along the way during those many years of experience including the need to do the FASEA Exam (Masters level).

It should however be widened to include anyone that qualifies up to Jan 2026 not just 2019. 10 years experience is 10 years experience and plenty of challenging periods/issues already in the last 10 years and now doubt the years left till Jan 2026. Someone who commenced in say 2010 will have 15 years experience by 2026 and should be included and would be fair and proper and not to mention sorely needed given the desperate state of adviser no’s which is going to persist for many years to come!

This recognition was supposed to have been done initially some years back and good to finally see this key wrong being righted! Whilst all of us would proponents of suitable theory/study, experience and competency are far more important than any study any of us have done or will do in the future.

When similar changes have occurred in other industries such as accounting in the past, past experience was properly recognised similar to this and inidviduals were not required to take on additional studies. To lumber experienced advisers with such a requirement and previously proposed is a waste of their time and an insult to their professionalism etc not to mention another significant and unnecessary cost burden on top of so many others we have had to bear which has seriously degraded cost and access to advice.

Agreed. I started as an AR in 2010 and haven’t missed a day since. Apparently all those years between 2019-2026 haven’t meant a thing to the industry.

I read this article and then made the mistake of reading these comments. It was like reading the toilet wall of a local pub.

Tidy up, people. Respect your colleagues. Use appropriate language and provide benefit of the doubt for the arguments of those you disagree with.

The proposed legislation has pro’s and con’s. The Government is trying to make sense of the baying crowds of radicals pushing their particular luggage barrows.

The bigger picture here is the extinguishing of personal financial advisers from the lives of everyday Australians. If you’re ok with this then rant on. If you think advisers have a role in helping everyday Australians cope with the vagaries and complexity of modern finance then go a little easy on your colleagues. Walk in their shoes. Be just a little flexible in expecting everyone to look like you, to agree with you, and to want exactly the same things you want. “Professionalism” doesn’t mean we all have to agree on everything.

Understand that at some stage the Byzantine legislation and processes of financial planning will be torn down – but that’s not going to happen if legislators, and the public, look down on us as some plebian rabble raging through the Hippodrome.

Here’s my – by now pretty much pointless – thought on the article content…

There aren’t many years left for lots of transition units for many who are not used to uni study. Help them by adding certainty. There should be some sort of “experience pathway”. It should try to reduce “double jeopardy” for those who have finished similar units but did so in an earlier epoch. The government is trying to make it more broadly acceptable and reduce the slide in adviser numbers. I don’t care what the rules are – just make them. And do it fast.

As someone who is 6 months short of the 10 years is there a logic behind the 1/1/2019 date? Doesn’t really matter because I don’t think the Green’s will pass the required legislation but just curious but not curious enough to use Google.

Whether there is logic or not, we need to stop referring to it as a “10 year” experience requirement when it will actually be a 17 year experience requirement from when it takes effect in Jan 2026.