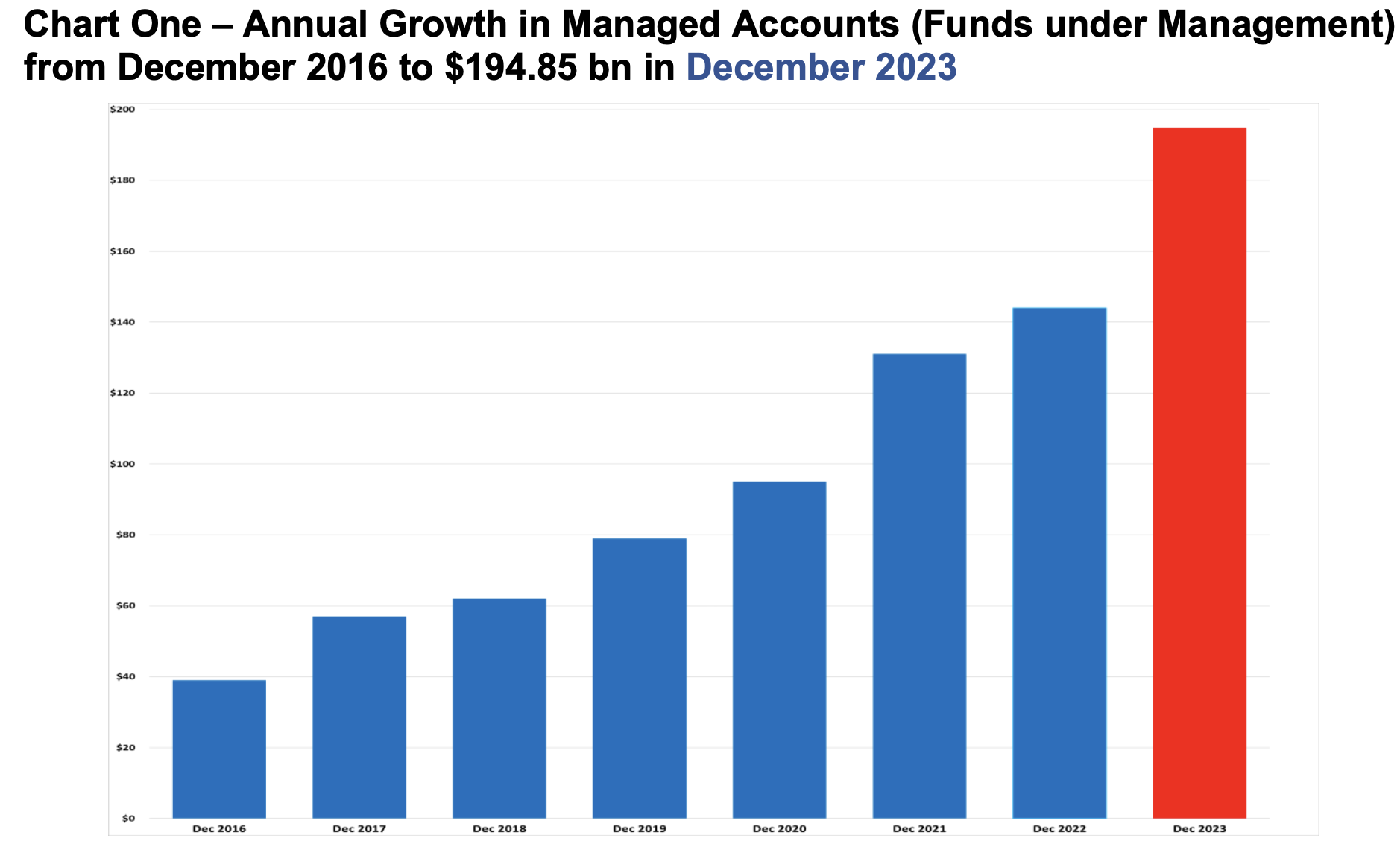

Managed accounts FUM increases by 20.47% to $194.85b

A combination of factors, not least investment markets and support by platforms, has seen funds under management in managed accounts increase by 20.47% to $194.85 billion over the six months to 31 December.

The latest Institute of Managed Account Professions (IMAP) Census conducted in conjunction with Milliman has emphasised the degree to which managed accounts have become deeply embedded in the Australian financial services eco-system.

Explaining the Census findings, Milliman practice leader in Australia, Victor Huang pointed to investment markets having recorded improved growth in the second half of 2023 with a 7.6% increase in the value of the ASX/S&P 200 Accumulation Index, giving an annual growth rate of 12.11% in 2023.

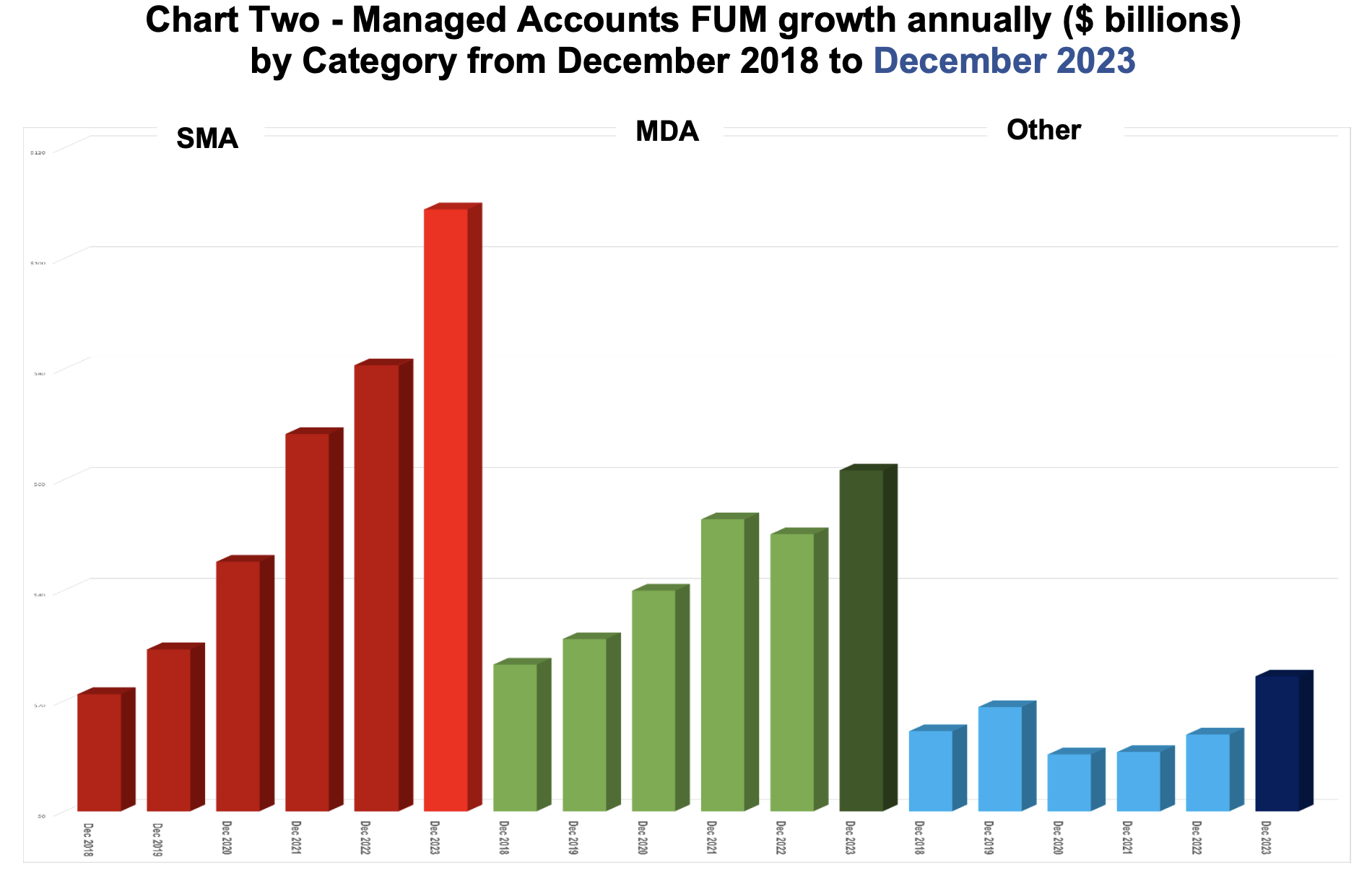

As well, IMAP chair, Toby Potter said that the platform providers’ expansive use of separately managed accounts (SMAs) as a vehicle to service the adviser/licensee market had helped drive FUM growth.

Potter said managed discretionary accounts (MDAs) were also continuing to grow helped by the tailoring, efficient implementation, and operation of MDA programs.

He pointed out that the FUM Census collected data from 46 large and smaller organisations with varied offering.

So someone in India who isn't licensed provided personalised financial advice and ASIC's response is to tell them to be…

Seeking Regulatory relief from Regulation. Industry Super Funds want to control $1.6 Trillion $$$ and ever growing with almost zero…

If Kalkine has officially been released and operates under a legitimate license to provide general advice, it raises an important…

Not sure what they're seeking regulatory relief from. In my view is they get tickled with a warm lettuce leaf…

Will they ever be named & shamed, fined and banned for life ??? Unlikely hey ASIC & APRA, especially for…