Small licensees now make up quarter of advice profession

Financial advice licensees employing less than 10 financial planners now make up a quarter of the Australian financial planning landscape.

What is more, more than half of those licensees employ fewer than five advisers, underscoring the fact that the small licensee segment has been one of the few areas of proportionate growth for the financial planning profession over the past three years.

It also goes some way to explaining why some of the largest financial planning dealer groups have set up specific “dealer group service” offerings to meet the needs of this growing cohort.

According to analysis undertaken by WealthData there are now 1,344 licensees with fewer than five advisers registered on the Financial Adviser Register, and a further 255 licensees with less than 10 advisers.

Between these two groups, they employ 2881 advisers out of 16,113 registered on the FAR.

WealthData principal, Colin Williams said that while the small licensee segment had not been immune from adviser exits over the past three years, the proportion of advisers working for small licensees had grown by around 6%.

Key Adviser Movements This Week:

Net Change of advisers (-16)

18 Licensee Owners had net gains for 22 advisers

27 Licensee Owners had net losses for (-38) advisers

1 new licensee commenced and (-2) ceased

6 Provisional Advisers (PA) commenced and (-2) ceased.

Summary

The number of advisers dipped below 15,900 with a net loss of (-16) advisers, despite 6 new entrants being added as Provisional Advisers (PA). A quiet week of reporting which may have been hindered a little by the public holiday in Victoria and the non-official public holiday in all other states.

Growth This Week

At the licensee owner level, Diverger Group out on their own with net growth of 3, with two joining Paragem including one PA and an adviser coming back after a break to join GPS. A new licensee came in with 2 advisers with one also being a PA. Spark Partnership up by 2 with another PA and an adviser joining from MTIS Private Wealth.

A tail of 15 licensee owners with growth of net 1 including Fiducian, Sequoia, Morgans and PSK.

Losses This Week

WT Financial Group are down (-5) after losing 3 last week. Their losses this week being 4 advisers at Synchron and 1 at Wealth Today. Perpetual down (-3) and 5 licensee owners down by (-2) including Count, AMP Group and Insignia who appointed 2 and lost 4.

20 licensee owners down (-1) including Centrepoint, Alteris Financial Group and 2 licensees that closed.

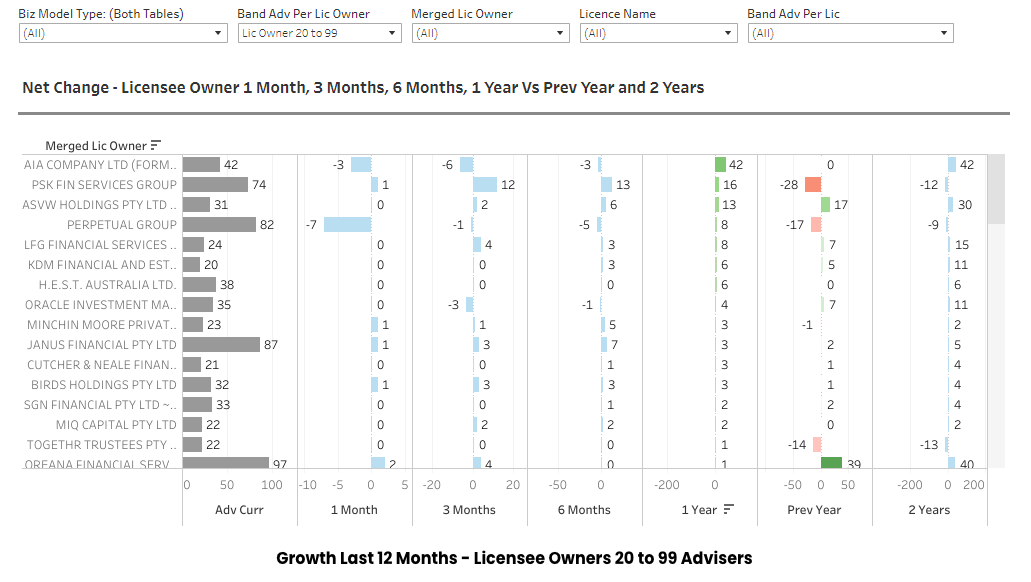

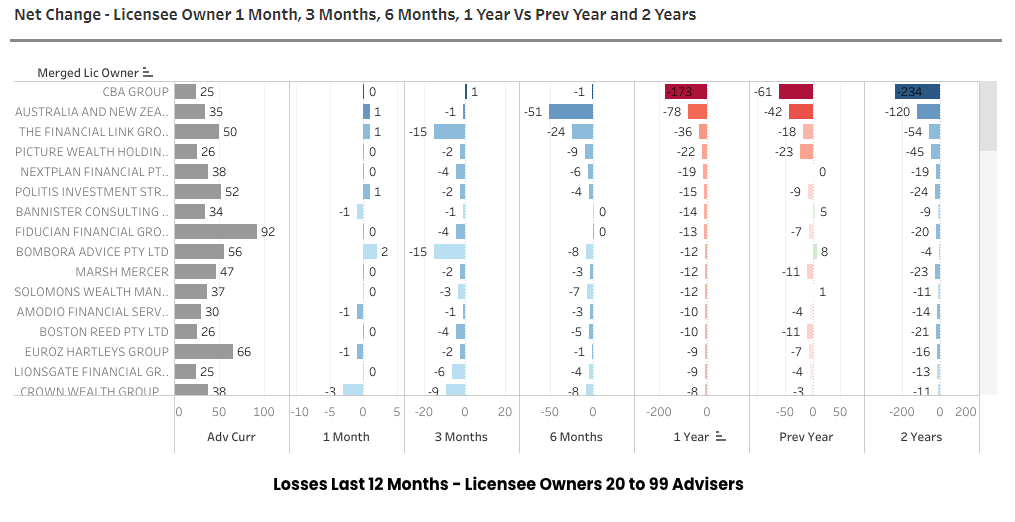

Gains / Losses Last 12 months – Licensee Owners With Between 20 and 99

This week we take a look at the ‘mid tiers’ licensee owners that currently have between 20 and 99 advisers. The first chart highlights the gains over 1 year. Out on top is AIA which commenced with advisers from CBA. However, over recent months it has been steadily losing advisers. Next comes PSK, noting that this licensee was previously known as Ipac, hence the losses over 2 years are showing up. Then comes ASVW Holdings which has performed strongly over most time periods.

As for losses, some are in this category of 20 to 99 after some significant losses. Two banks lead the way with CBA down (-173) and ANZ down (-78). Financial Link at (-36) and thereafter, a fairly large group of firms with steady losses indicating that many in the cohort have found the last 12 months to be tough going.

WealthData alongside Financial Newswire is a part of FST Media’s Wealth Division.

Similar experience however due to health issues I am stuck with Zurich. Tried to make a trauma claim for cancer…

Using FSC's logic, a lack of indexation applying to income tax thresholds means that eventually every taxpayer in Australia will…

It would be interesting to know how many of those 15,587 licensed advisers have authorisations to provide insurance advice? My…

Meanwhile in the UK commissions increased to over 100% and the insurance level corrected. Australian Government Treasury and FSC are…

Congratulations Canberra!! Well done!! Fantastic outcomes...