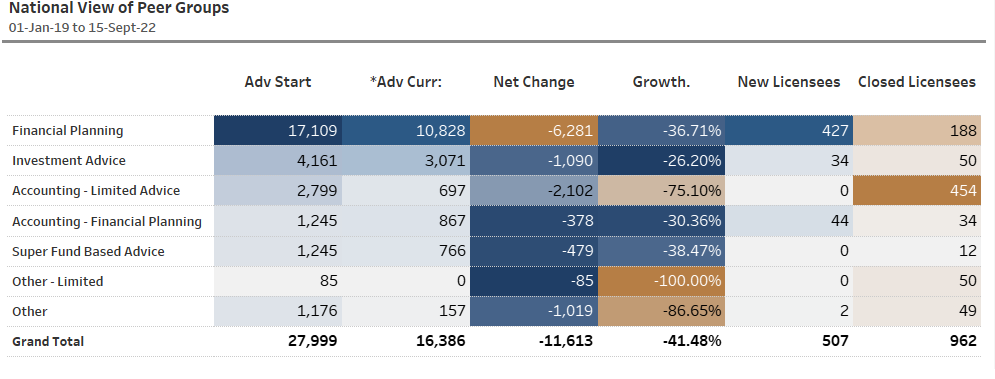

Super fund adviser numbers down 38.5%

Superannuation funds are being touted as the vehicles for the delivery of affordable advice, but new analysis reveals that, overall, the number of advisers they employ have been in decline.

According to analysis undertaken by WealthData, superannuation funds have recorded a net loss of 479 advisers since 1 January, 2019, or just over 38%.

And the reason for that decline is a combination of fund mergers and strategy changes, not least the shortcomings of the Sate Super Financial Services (SSFS) which once touted itself as one of the largest financial planning firms in Australia.

State Super rebadged itself to Aware Financial Services and the Financial Adviser Register reveals that over the past three years the number of financial advisers working under its license has declined by 133 to stand at 149 today.

What is more Aware merged with VicSuper with the result that it went from 51 advisers working under its license to zero, with those that remained having moved under the Aware license.

Importantly, even licensees designed to provide financial planning services on a contractual basis to superannuation funds such as Mercer Financial Advice and Industry Fund Services down by 19 and four financial advisers, respectively.

Mercer Financial Advice now boasts 41 financial advisers, while Industry Fund Services has 113.

The reasonably rapid pace of superannuation fund mergers has tended to disguise adviser losses in the super fund sector, with many assuming that when mergers occur advisers have moved under a single license but the net loss of 479 advisers proves this has not been the case.

The biggest merger impacting financial advisers this year was that between Sunsuper and QSuper with the latest FAR analysis showing that Sunsuper has lost 25 advisers since 2019 while QInvest lost 38 advisers, with the merged entity, Australian Retirement Trust currently having 93 advisers between them.

The FAR analysis shows that superannuation fund LUCRF went from 19 advisers to nil, but that was a result of its merger with AustralianSuper, while BUSSQ also shows as having zero advisers, but it has been party to a merger with Cbus.

Similarly,LGIA Super shows zero advisers but has merged with Energy Super.

ISA Funds don’t need Advisers when they want their Funds sold by uneducated, unqualified, unlicensed & unregulated call centre jockeys.

Didn’t Aware get done for fee for no service as well?