Transformative reporting season for advice licensees

If one thing distinguishes the current reporting season for Australia’s financial planning licensees it is that Insignia Financial and AMP Limited have substantially reduced or removed financial advice exposure from their balance sheets.

In the case of AMP Limited it has reduced its advice exposure via its transaction with Paul Barrett’s AZ-NGA and Entireti (Fortnum) while in the case of Insignia Financial much of its advice exposure has been moved out to the new entity, Rhombus Advisory.

The bottom line for AMP and Insignia is that they have removed the drag of financial advice businesses which were not even breaking even, while the businesses themselves have been outside often burdensome cost structures.

As for the rest of Australia’s publicly-listed financial planning licensees the picture this reporting season has been one of mostly improved but certainly not stellar results perhaps best exemplified by Count Limited in the wake of its acquisition of Diverger.

The bottom line for Count Limited is that it has still yet to realise the full benefits of the Diverger acquisition and it will not have been lost on shareholders that net profit after tax was down 55% to $1,104,000 notwithstanding that underlying NPAT was up 39% to $8,049,000.

Count chief executive, Hugh Humphrey was on Friday accentuating the positives pointing to strong underlying financial outcome and the potential for further growth.

Somewhat more definitely improved was Centrepoint Alliance which lifted net profit after tax by $1.5 million to $7.8 million on the back of an increase in net revenue to $36.1 million reflecting its acquisition of Financial Advice Matters.

The result was enough to see Centrepoint’s share price move from 29 cents to 34 cents.

One of the few remaining vertically-integrated players, Fiducian turned in a 22.1% increase in net profit for the period with its funds under advice growing to $4,798 million.

For its part, Sequoia Financial Group continued to benefit from its sale of 80% of Morrison Securities with net profit after tax rising to $24 million.

However, it reported that at a divisional level revenue rose 27% with operating profit up 91% for the Licensee and Adviser Services division.

It noted that all of the growth was organic as adviser income supported by the move from commissions to annual fees, the increase in clients per adviser and the need for advice increasing.

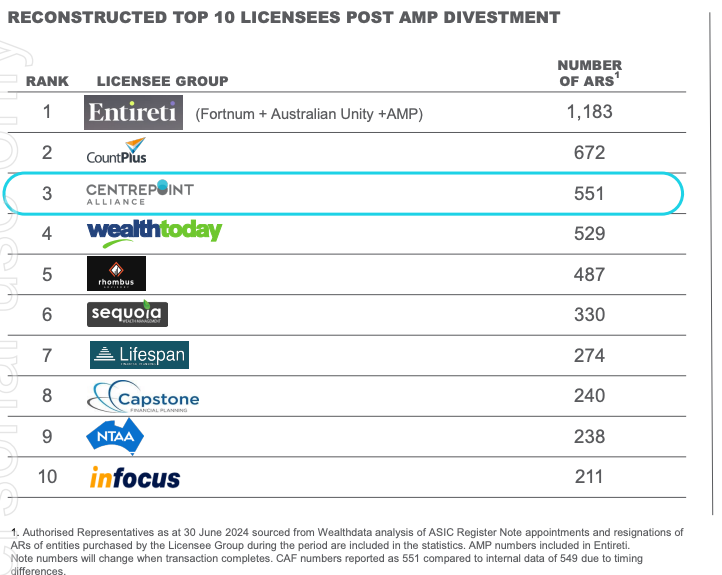

According to market analysis of the new environment published by Centrepoint Alliance in its investor briefing the new licensee hierarchy looks like the following table:

The PHD in economics is the scariest. How many academics actually understand the real world

Money is leaving at a slower rate with this being considered by AMP management as a positive. Australia's Money Pit…

"Our recently launched digital advice solution for AMP Super members is providing simple, intuitive retirement advice at no extra cost.”…

Assistant to Bill Shorten...FoFA, A time when dozens of submissions were made, 90 odd submissions ranging from clients be sent…

Only way to get that 1.25 times back will be to move clients from Brighter Super into their SMA on…