Australasia investors defy global retreat of ESG funds

Investors in Australia and New Zealand are braving the global trend of retreating from sustainable investment as they continue to pour money into environmental, social, and governance (ESG) funds despite accelerated pull back across the US and Europe.

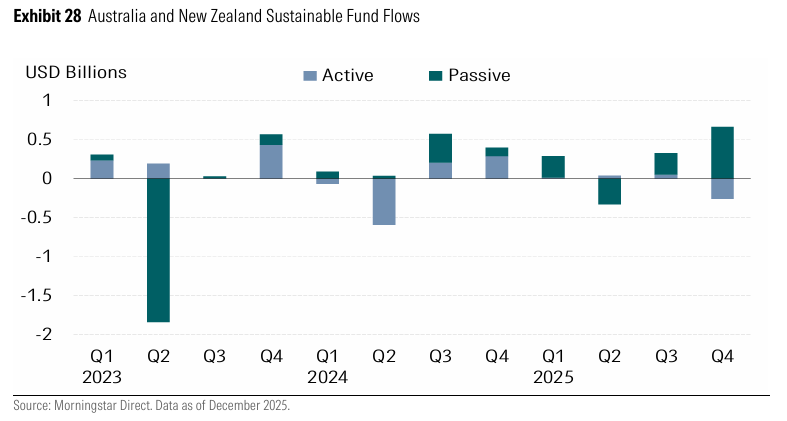

The Morningstar’s latest Global Sustainable Fund Review showed sustainable funds in two neighbouring countries attracted an estimated $US400 million in net inflows in the December quarter, lifting total 2025 investment to about $US730 million.

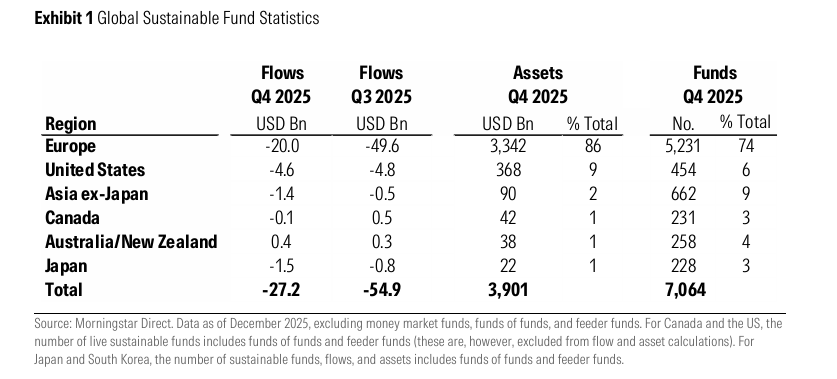

The gain stand in stark contrast to a global exodus which saw funds suffer $US27 billion in outflows in the quarter, taking the annual tally to $US84 billion, a sharp reversal from the $US38 billion in inflows recorded in 2024.

As per the report, much of the global withdrawal has been driven by large UK institutional investors restructuring ESG exposures, alongside broader investor caution.

Meanwhile, the surge in Australasia was powered by passive funds which absorbed more than $US660 million in quarterly inflows with most of the top 15 quarterly inflows going to passive global equity strategies.

In contrast to passive funds, the active funds in the region saw net estimated outflows of $US260 million in the fourth quarter of 2025.

Senior Analyst at Morningstar, Shamir Popat said the data showed the region has more resilient investors base, but their demands are changing.

“The strength of passive inflows, particularly in global equities, suggests investors are still engaging with sustainability themes, but are increasingly favouring simple, transparent, and cost-effective vehicles,” Popat said.

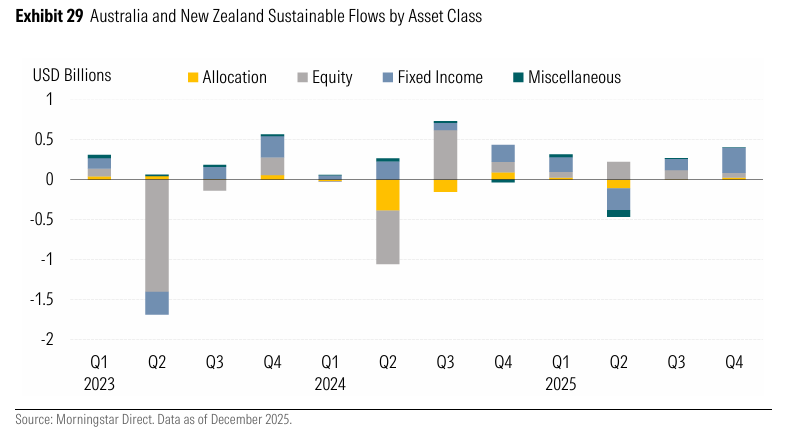

The flows were positive across the four major asset class categories, led by fixed income with net estimated inflows of around $US315 million, followed by $US60 million in equities.

Furthermore, allocation funds received almost $US25 million in net inflows while miscellaneous was up by almost $US5 million.

The report further highlighted that Australian sustainable funds market remains quite concentrated with the top 10 firms accounting for approximately 71% of total assets.

Moreover, the fourth quarter of 2025 saw considerable activity in fund launches and closures as ten new funds launched, consisting of nine in New Zealand.

Notably, the four closures seen in the quarter were all driven by the closure of Stewart Investors, which saw its investment management responsibilities in emerging and worldwide equities transferred to FSSA Investment Management, together with the termination of the locally domiciled funds.

So the FAAA and professional adviser bodies should and must call for this funding to be deducted from this ASIC…

Yet bother reason I’m glad I left the FAAA. Haven’t represented the betterment of their members for a long time.…

Why isn't the FAAA making the profession better for their existing members? As it currently stands you would be mad…

Using migrants to increase financial adviser numbers is not in the interests of the FAAA membership. Is this something the…

And have rocks in their head.