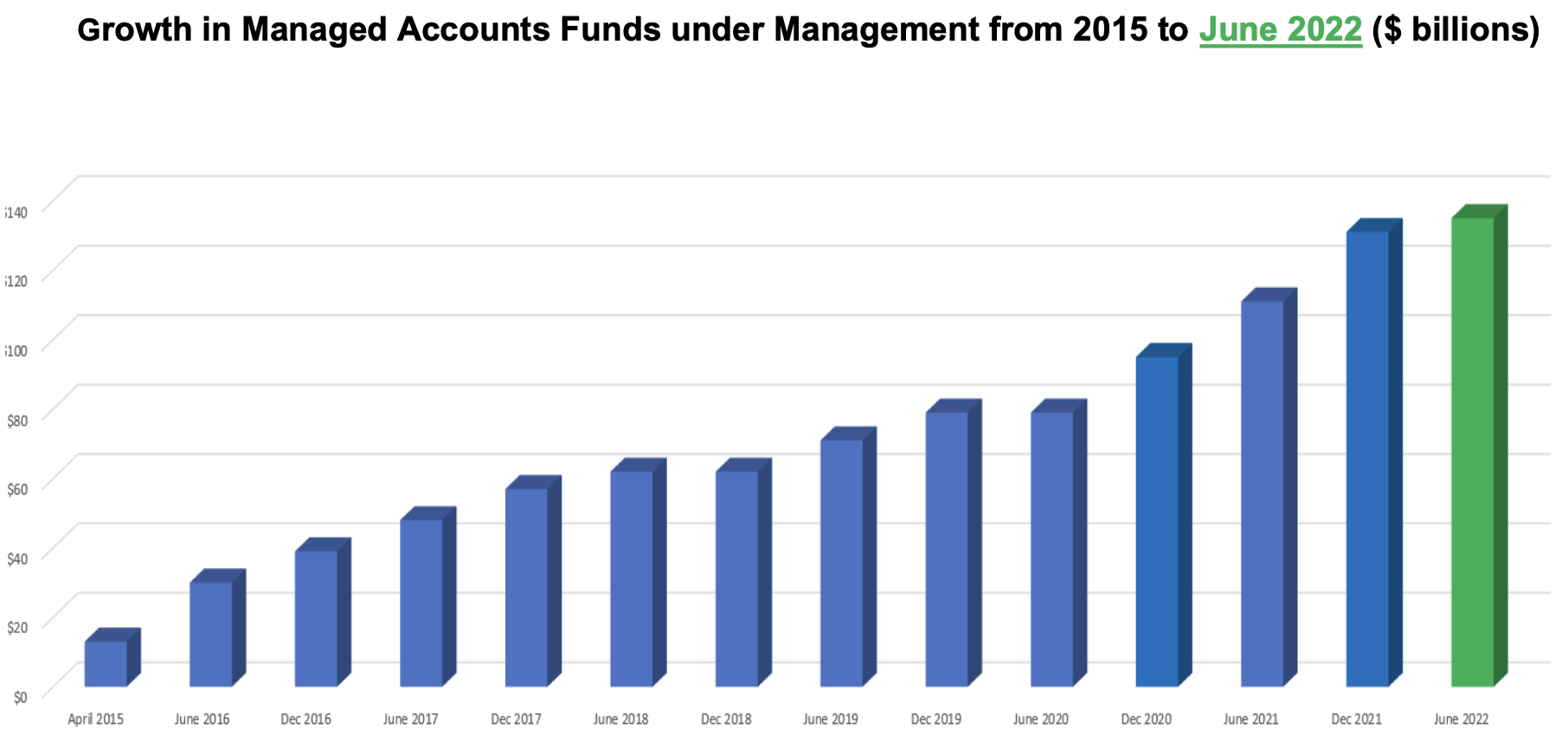

Managed accounts census reveals exponential growth

The use of managed accounts has continued its exponential growth, rising by 22% in the past financial year to represent $132.8 billion, according to the latest Institute of Managed Accounts Professionals (IMAP) census.

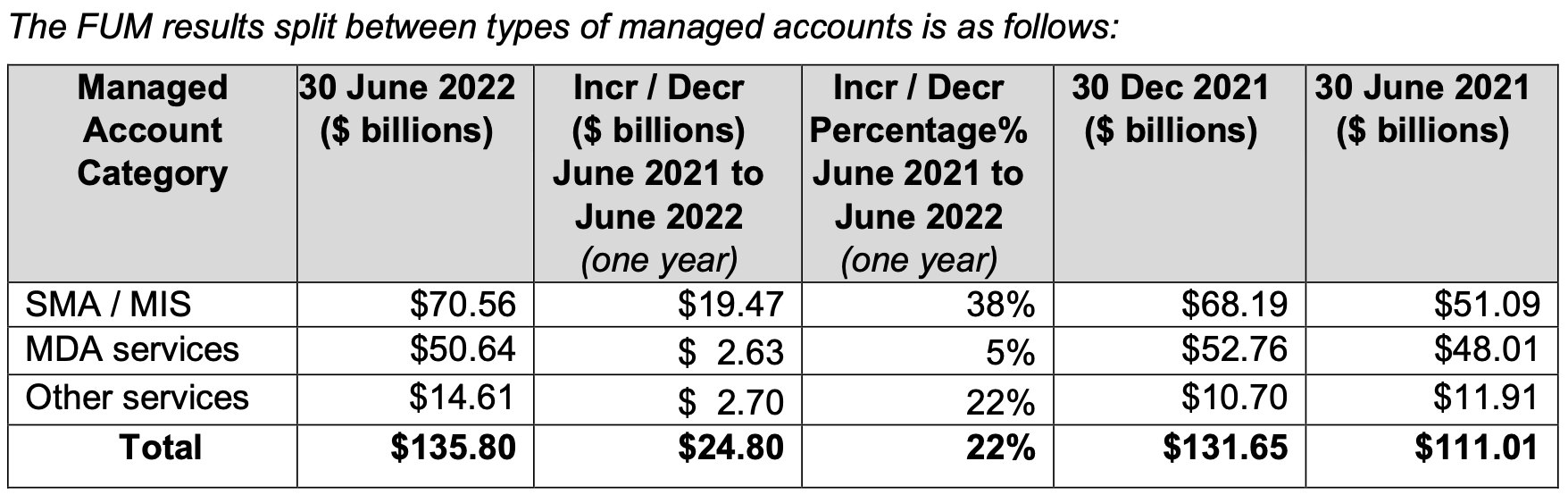

The census, conducted with Milliman, showed that the managed accounts sector had shrugged off the market volatility and COVID-19 impacts to grow by $24.8 billion during the period, with most growth driven by separately managed accounts (SMAs).

IMAP chair, Toby Potter attributed the growth to the influence of financial advisers.

“The investment in client education by financial advisers and investment providers is clearly resulting in a greater focus on clients investing to achieve their longer term goals, and using the structured process that managed accounts provide,” he said.

“There has been little sign of clients withdrawing funds when market fluctuations occur. Plus, the efficiencies of managed accounts means that advisers have more time to focus on communicating with clients.” Potter said.

He noted that the 22% growth year on year compared to a declined of 0.5% in total superannuation, despite mandated inflows.

Milliman Australia practice leader, Victor Huang said a turbulent period in investment markets delivered market sell-offs across both equities and fixed interest, with the value of the ASX / S&P 200 Accumulation Index falling -9.9% over the 6 month period (compared with a 3.8% increase in the prior 6 month period).

“Milliman is seeing an increased need for explicit risk management strategies to be used in this new regime of high inflation and low growth” Huang said.

The IMAP/Milliman census covered 51 organisations operating in the managed accounts sector.

FAR followed by an existing duplication where Advisers had to personally register the same info again. And now FSC want…

Licensee actions against advisers should never be publicly reported, because all but the smallest licensees are totally conflicted in their…

And how much has been applied to offset the ASIC Adviser levy as we were told would happen ? $…

Incredible that regulators are raking in hundreds of millions from the guilty, yet they force the innocent to pay compensation…

....and bugger all of that was ever from unionised industry superfunds! Not because, as they would have you falsely believe,…