Outflows see Vanguard drop down sustainable fund rankings

Research and ratings house, Morningstar has pointed to “huge second-quarter outflows” having seen Vanguard fall down the rankings of Australia’s sustainable share managers.

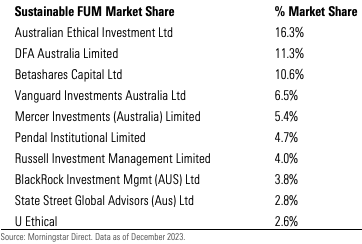

Morningstar’s Global Sustainable Fund Flows report for the final quarter of 2023 emphasised the continuing concentration of the Australian sustainable funds market with the top 10 firms accounting for more than two-thirds of total assets in sustainable funds.

In terms of market share it said that Australian Ethical had continued to be the dominant manager, while Dimensional had supplanted Vanguard in second place as a result of the second quarter outflows.

It said Betashares had taken second position, with Vanguard dropping to fourth position.

The Morningstar analysis said global sustainable funds experienced net quarterly outflows for the first time on record in the final quarter of last year, with investors withdrawing $US2.5 billon while the broader market of open-end funds and exchange traded funds also suffered redemptions against a continuously challenging macroeconomic backdrop.

Where Australia and New Zealand was concerned it said sustainable funds attracted $IS567 million of subscriptions which represented a strong recovery from the muted flows reported in the previous quarter of just $US30.1 million.

It said the total size of Australian sustainable investments is estimated at $US31.2 billion as at 30 November, last year – $US100 million higher than the previous quarter.

Morningstar senior manager research analyst, Shamir Popat said that while global sustainable funds reported negative outflows, the Australian and New Zealand market continues to report positive inflows despite the challenging conditions.

The big news in this announcement is the prospect of multiple large scale firm failures that are likely to hit…

And what I should be happy about this like China is with the USA dropping their levy from 145% to…

Notice everything in this country is now about compensating for some grievance? The mind boggles how the investor never seems…

So someone in India who isn't licensed provided personalised financial advice and ASIC's response is to tell them to be…

Seeking Regulatory relief from Regulation. Industry Super Funds want to control $1.6 Trillion $$$ and ever growing with almost zero…