Ratings houses – People and process the deciding factors

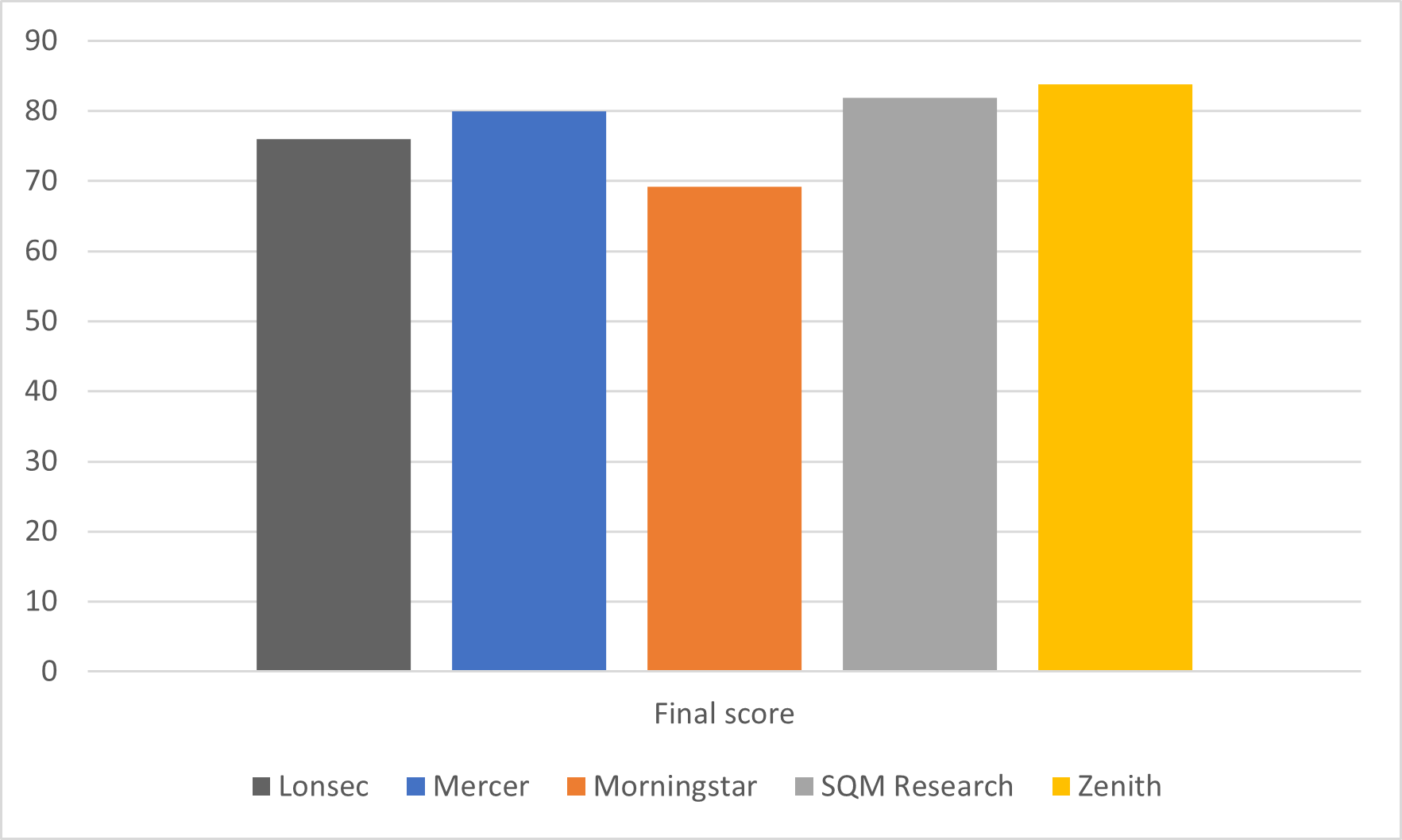

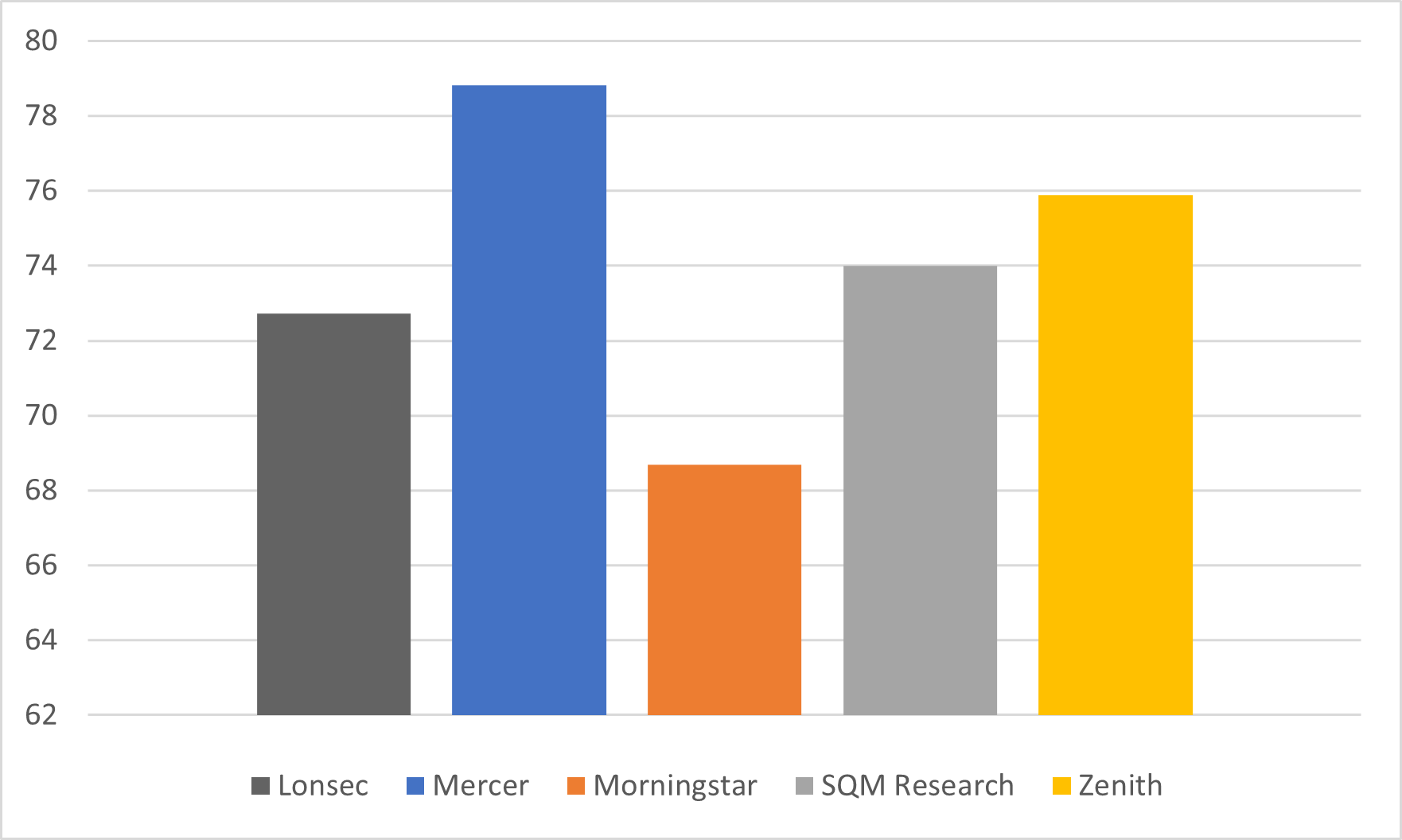

Zenith Investment Partners and SQM Research have emerged as the dead-heat winners of Financial Newswire’s Rating the Ratings Houses research, with people and clarity of process defined as the key differentiators.

Mercer was rated third by fund manager representatives, with Lonsec and Morningstar at the tail end, respectively.

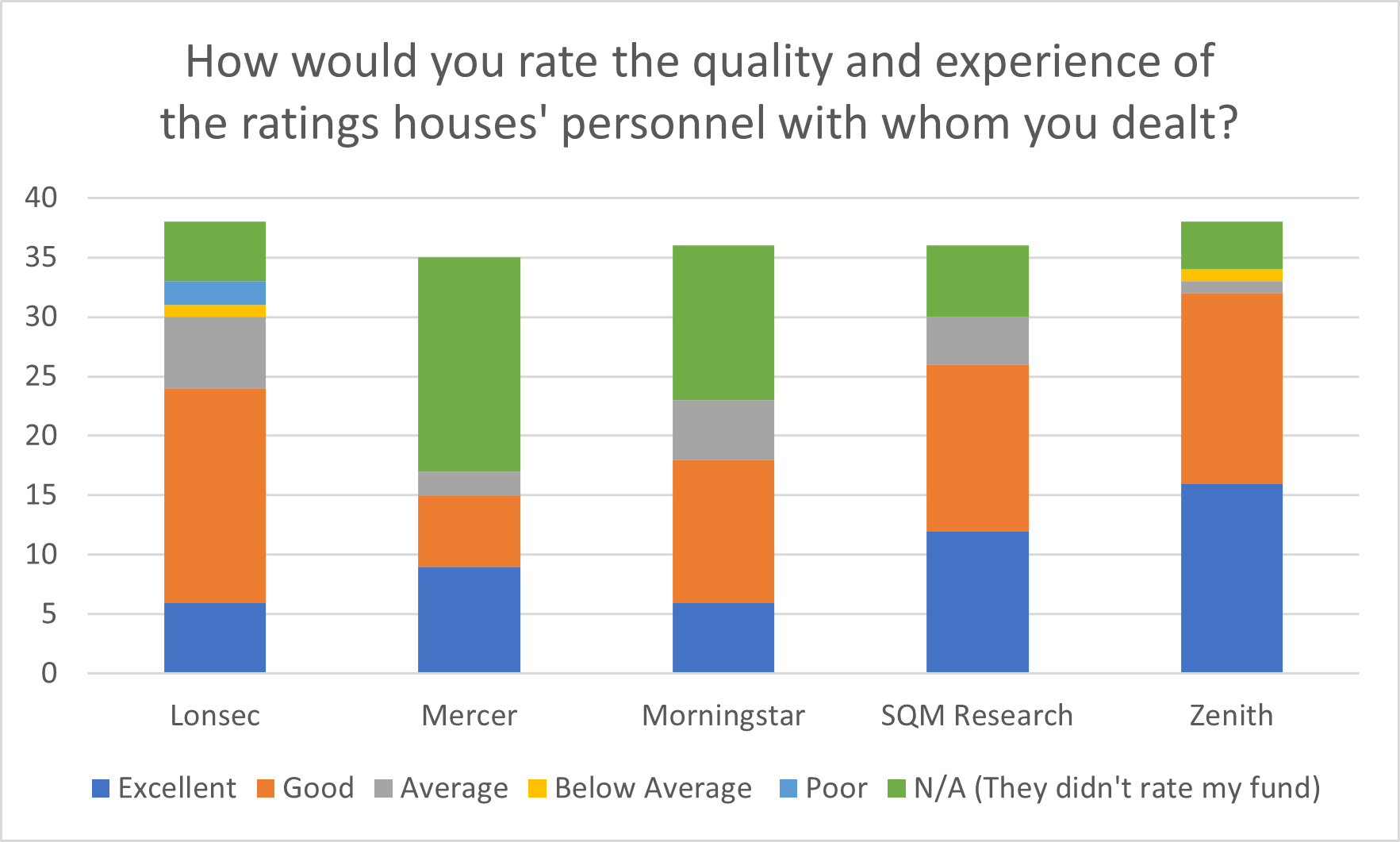

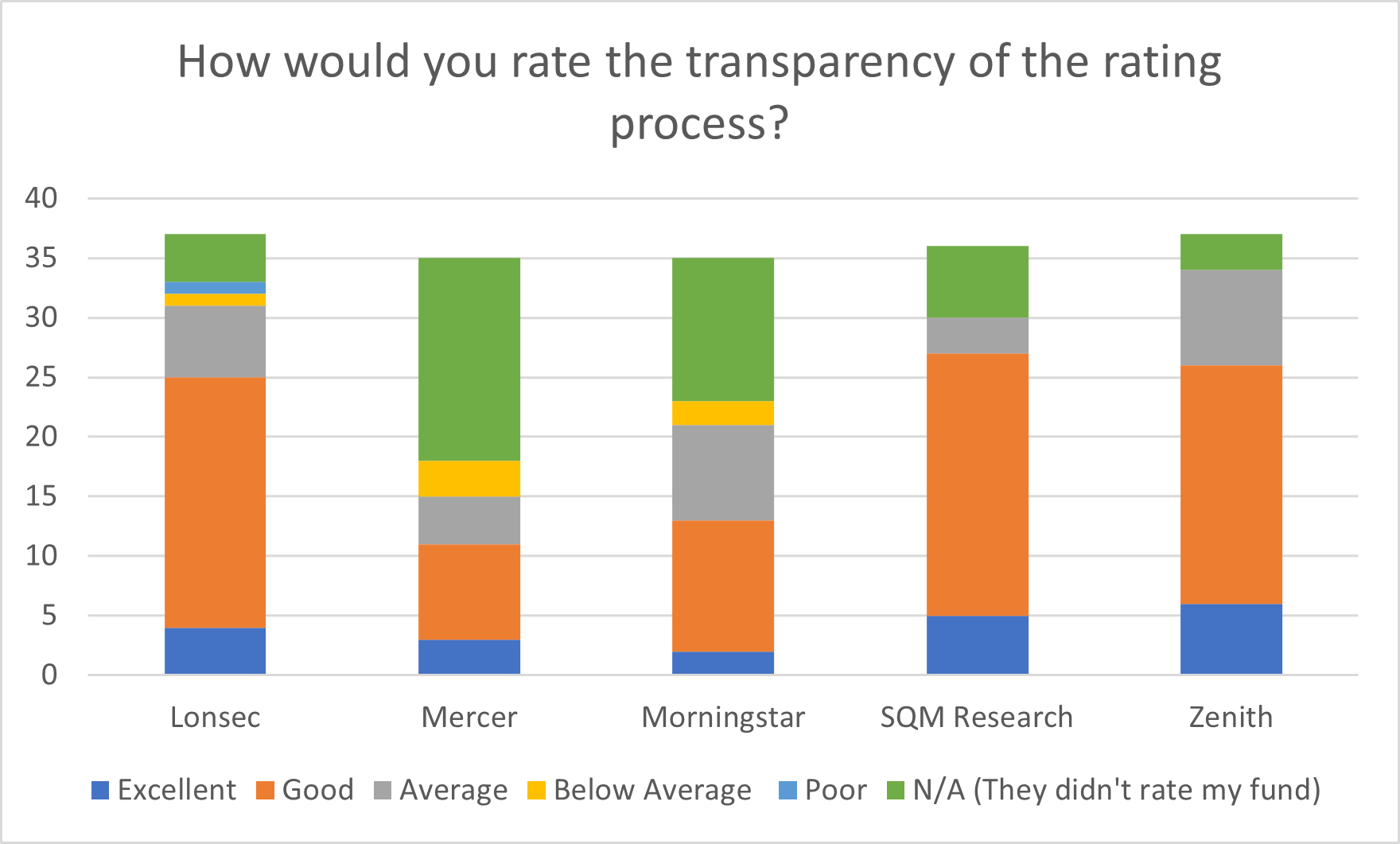

While managers awarded top marks to SQM Research for its transparent approach to the ratings process and Zenith and Mercer shared the honours for the quality and experience of personnel, they also felt these were the factors the ratings houses could most improve on.

Respondents found that “Zenith was not as detailed during the review meeting” and its “focus at the review meeting” was “unclear”, with such sentiments also supported in the quantitative analysis of the survey after the firm recorded more ‘Good’ (47 per cent) and ‘Average’ (13 per cent) ratings than ‘Excellent’ (40 per cent).

Other managers said “the understanding of our business and products were not well understood by Lonsec” and was in “stark contrast” to their experience with Zenith. This comes as Lonsec recorded the highest number of ‘Below Average’ (three per cent) and ‘Poor’ (six per cent) ratings from survey respondents for their quality of personnel.

Representatives also voiced their concerns that high levels of staff turnover results in “far less continuity each year in who is covering the fund” and discrepant levels of experience that “aren’t what is expected in some research houses”. They also found a wider “lack of understanding” came from individuals not “having managed money or worked in a funds management firm”.

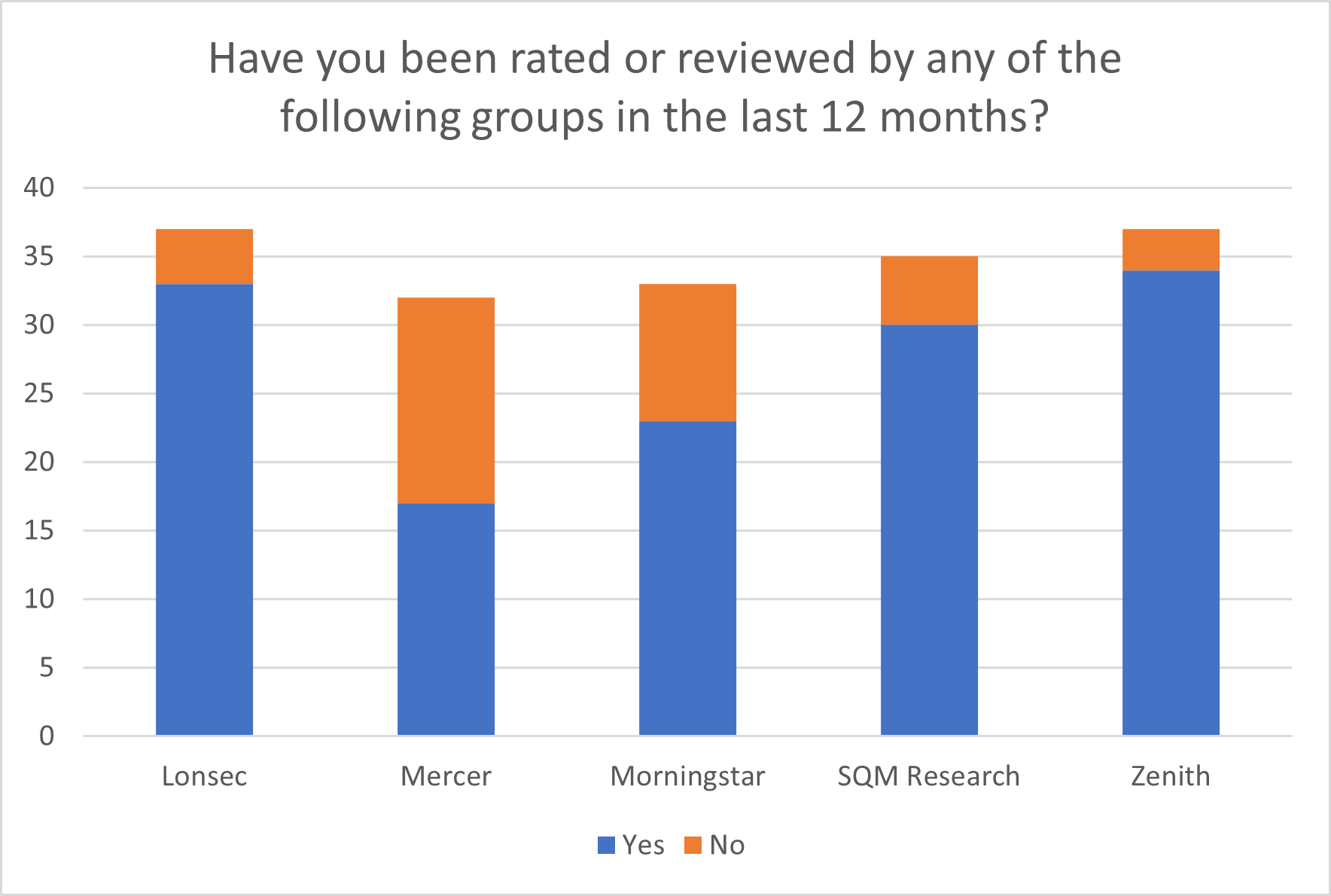

Despite such comments, the 2022 survey showed that Zenith was the most frequently used ratings house by fund managers in the last 12 months (92 per cent), closely followed by Lonsec (89 per cent).

SQM Research, labelled in the survey as “consistent, approachable and knowledgeable”, came in third at 85 per cent, while Morningstar and Mercer recorded the lowest numbers of rated funds with 70 per cent and 53 per cent, respectively. The low result for Mercer speaks to the ongoing trend from the survey and follows the research house’s changed business model, modified approach to ratings, and more focus on development of relationships related to asset consulting.

However, a consistent issue fund managers observed in research firm operations was the limited transparency offered and the aged approaches taken in relation to fund ratings.

SQM led the charge with 17 per cent of ‘Excellent’ ratings and 73 per cent of ‘Good’ ratings from survey respondents, but comments revealed the disconnect between fund manager and research house representatives on the ins-and-outs of the ratings process.

One respondent said they “felt that [the fund’s] exceptionally strong performance over a reasonable period of time warranted a higher rating, but SQM wanted to slowly move up the ratings”, while another commented on the lack of clarity in “Zenith’s focus at the review meeting… given their familiarity with our funds”.

A similar trend was also reflected in the number of hours representatives from each ratings house spent with fund managers to discuss their products, investment approaches and appropriate benchmarks or measures of performance. Morningstar and SQM Research spent the least amount of time with managers, while Lonsec spent the most amount of time and was praised for “taking the time to truly understand [a fund manager’s] strategies”.

A key trend extrapolated from the qualitative data of the survey also revealed how research firms continue to apply “outdated” views to their rating methodologies and affect their fund ratings.

One respondent commented on Morningstar’s process, stating that while the review meeting was “constructive” the research house has “a very black and white categorisation methodology for funds and, particularly, what qualifies as active and passive” which can be viewed as “an outdated approach”.

This sentiment was also shared in a comment from another fund manager representative who “recently had some funds re-categorised by two research houses”, but this process was “based on relatively outdated views on what qualifies as active and what qualifies as index [funds]”.

The results also showed there continues to be a lack of transparency and flexibility regarding definitions of asset classes and sectors, which has been interpreted by fund manager representatives who responded to the survey as a strategy to influence fund ratings.

One respondent said the “fixed interest sector is not well defined [and] research houses tend to use a ‘catch all’ category like alternative income to group non-government bond funds” which “is less than ideal”. They also revealed the flow-on effects of research houses not updating certain categories to align with sector changes, leaving “comparisons [to] become less relevant and funds [to be] seen as underperforming other [incorrectly categorised] funds”.

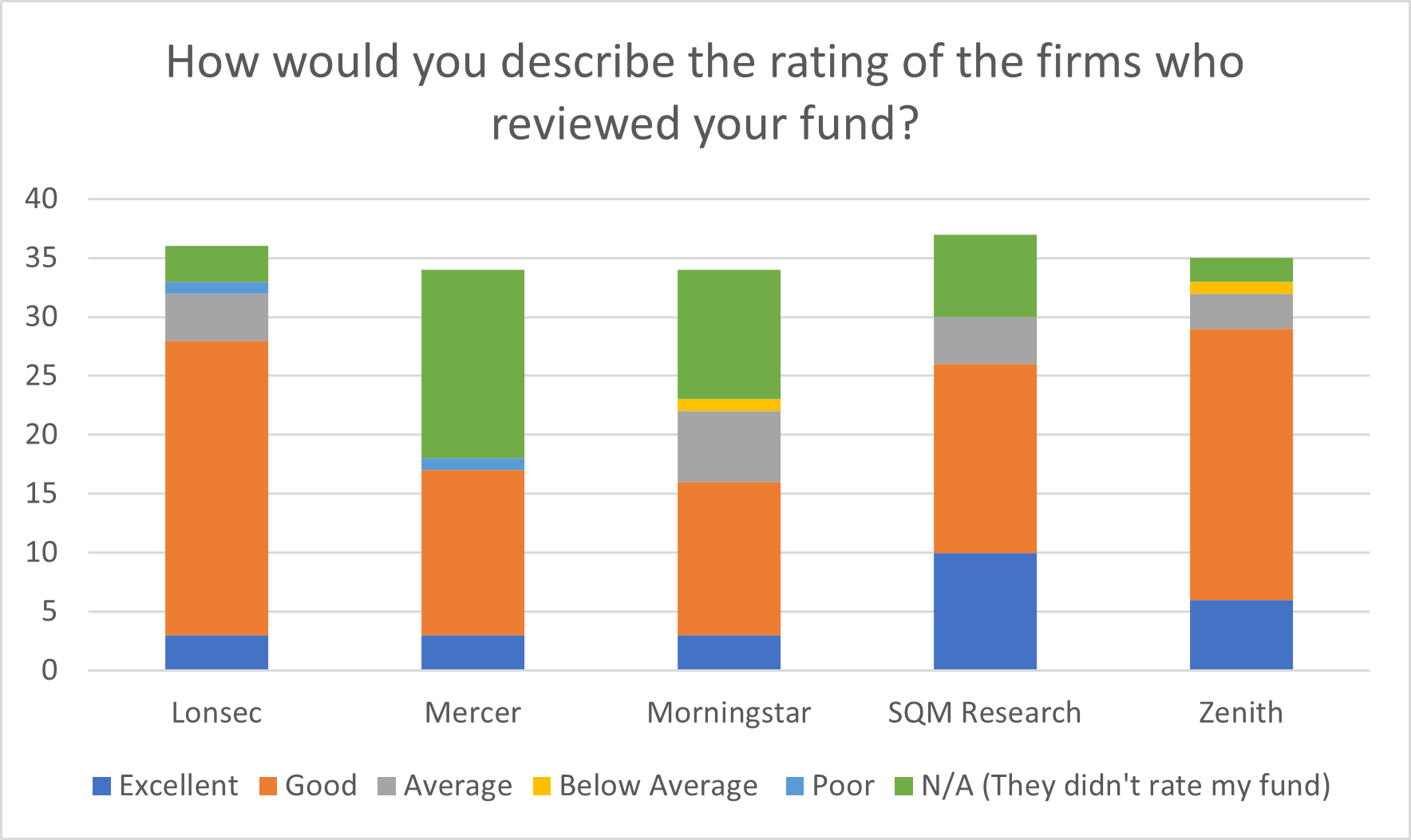

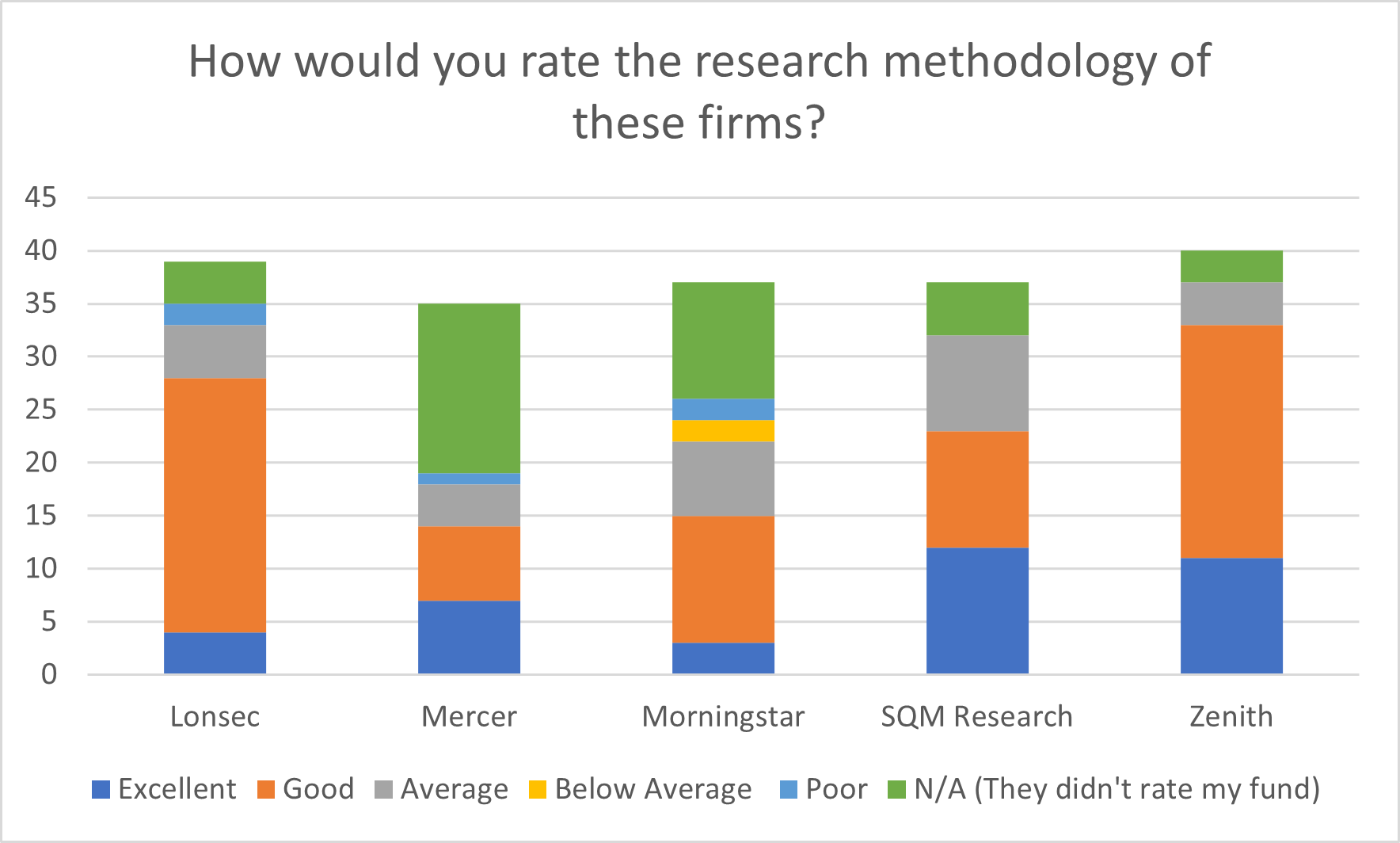

Despite sitting just behind Zenith for the best overall approach to research methodology, SQM Research did topple the Melbourne-based research house to receive the most ‘Excellent’ ratings from fund manager representatives (38 per cent to Zenith’s 30 per cent).

Lonsec also had 69 per cent of respondents rate it as ‘Good’ – more than Zenith’s 59 per cent – but had six per cent of managers rate it as ‘Poor’. Morningstar also recorded the highest number of ‘Below Average’ and ‘Poor’ responses at 16 per cent in total.

This comes as managers observed in the survey that “apart from SQM, the research houses now run model portfolios and product”, a move that has ignited concerns regarding “a conflict of interest” as research firms “turn… into potential competitors of the funds they are meant to rate”.

This sentiment was also echoed by another manager and fellow survey respondent: “From our perspective SQM is the only true-to-label research house. All other providers are inherently conflicted, as they offer investment offerings that compete directly with clients.”

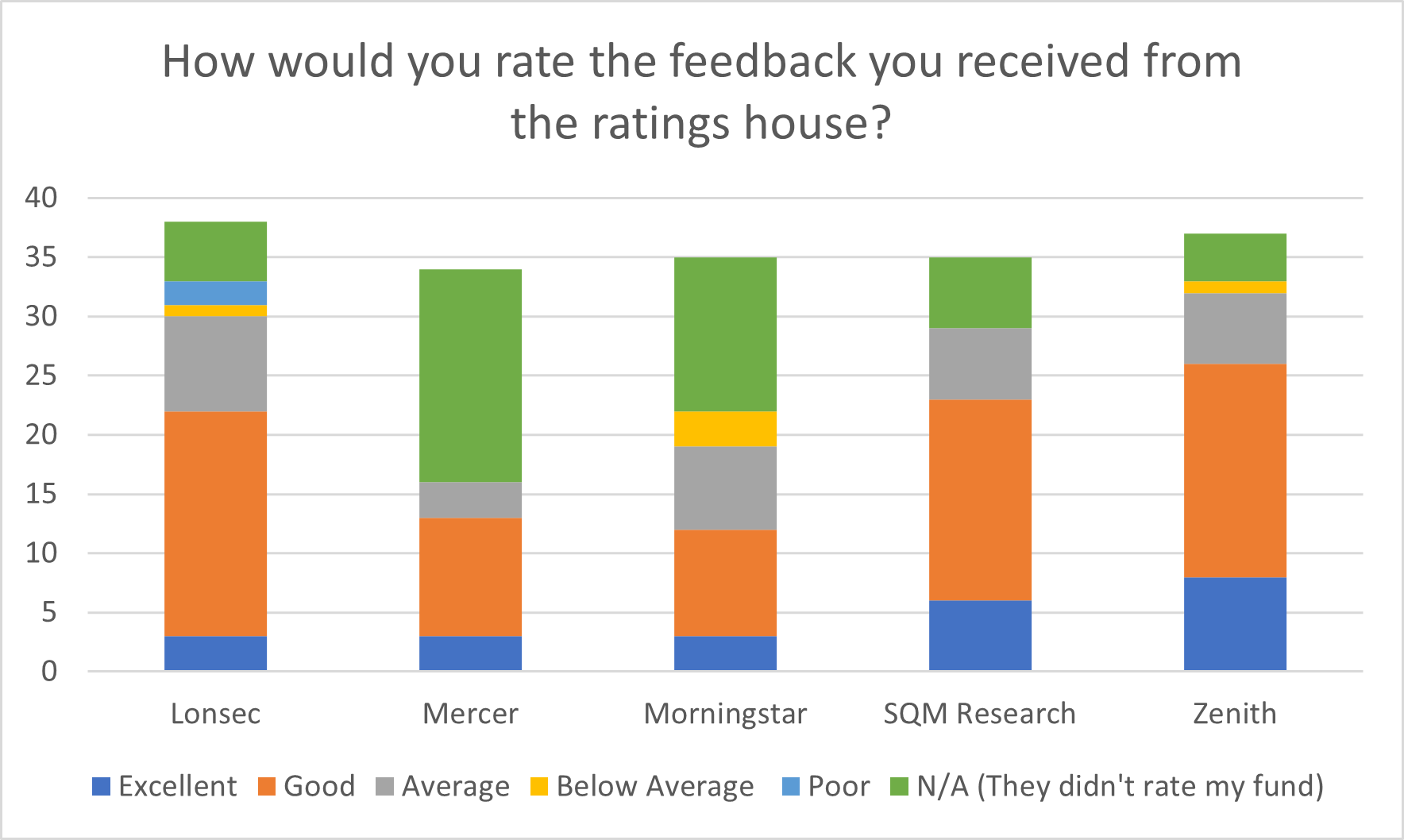

The feedback provided by ratings houses to fund managers was one of the only categories in the survey with the top spot jointly awarded to more than one firm, with Zenith (24 per cent of ‘Excellent’ ratings), SQM Research (21 per cent of ‘Excellent’ ratings) and Mercer (19 per cent of ‘Excellent’ ratings) taking the honours.

While a survey respondent felt there has been “a concerted effort amongst most research houses to improve the transparency of their views”, Zenith was praised in particular for being “much more open and transparent with their feedback”.

Lonsec’s low rating in comparison to the other firms (nine per cent of ‘Excellent’ ratings) was reiterated in the comments, as a representative stated there may be some “laziness around updating reports to reflect material enhancements or changes presented during review meetings”.

The respondent also felt Lonsec denied fund managers new insights on performance or “actual reassessment” of funds and instead “comments are simply repeated year after year”.

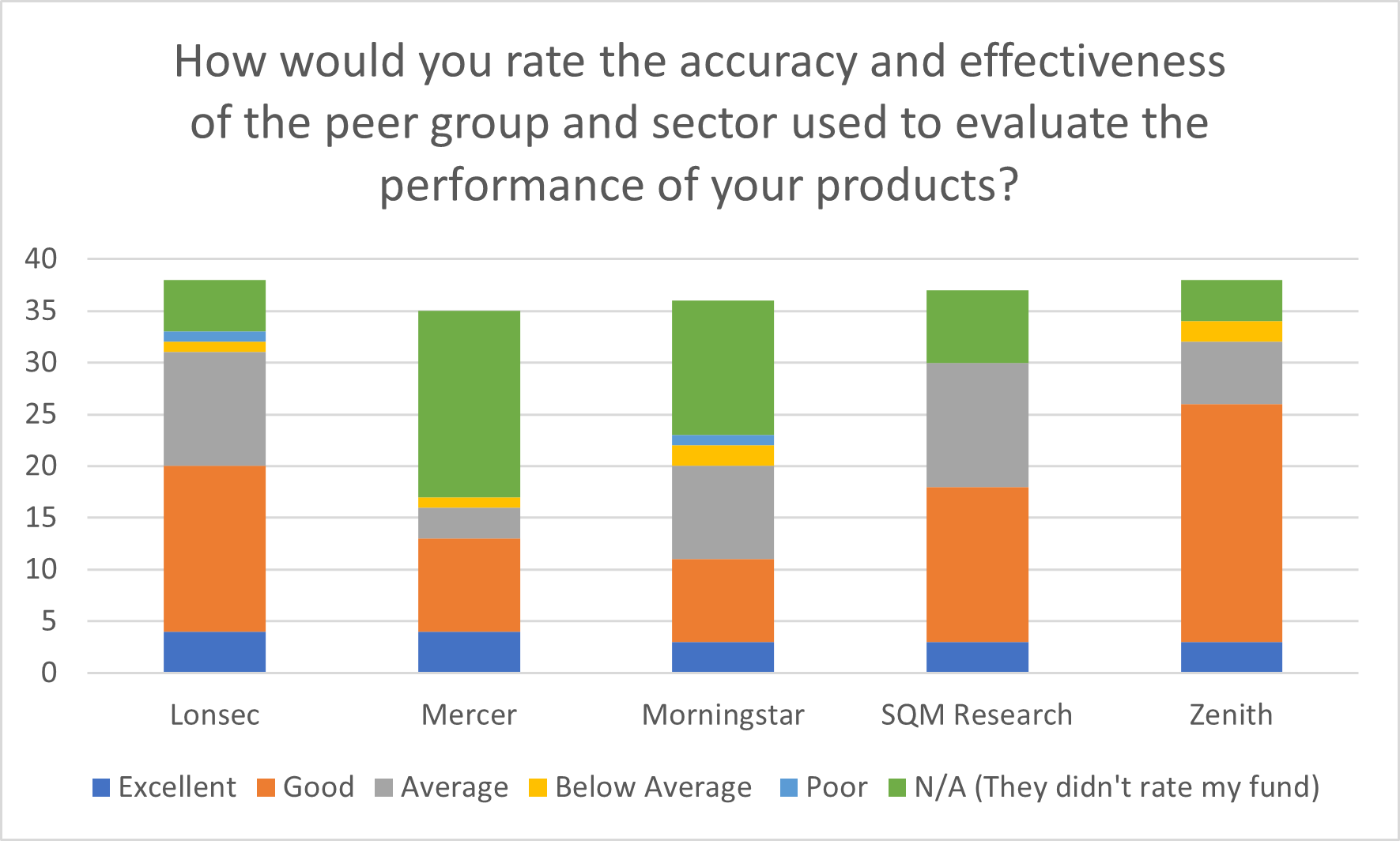

Despite its change in ratings model, Mercer also managed to claim a sole win after managers rewarded the firm for the accuracy and effectiveness of its peer group and sector used to evaluate the performance of products (24 per cent of ‘Excellent’ ratings).

The survey also found fund managers’ thoughts were split in this category, reflecting the changing nature of the sector as business models and ratings processes continue to fluctuate.

One respondent said “some research houses have very small peer groups”, leaving “unique funds” to be categorised and analysed with “other funds that are not like”; while another commented that both “Zenith and Lonsec rate a larger peer group across each category”.

Another manager said research houses had improved in this area, signalling their ability to change alongside the industry: “as an overall wider product set has become available, it has enabled greater sub-groups of funds and peers in which to categorise”.

The comments also come as the majority of fund managers indicated in the survey that their spend on research firms will change in the coming year (49 per cent responded ‘Yes’) but credited a range of reasons.

Some fund manager representatives singled out the research houses they will continue to support – Zenith and Lonsec – and made their views on the “interest dependent and driven” Mercer clear. Others said they will endeavour to get more funds or products rated to emphasise their strong performance to investors and advisers, while the rising costs of research and ratings was also highlighted – seemingly unavoidable considering the broader economic conditions.

The overall category winners are presented graphically, calculated using Financial Newswire’s proprietary scoring methodology.

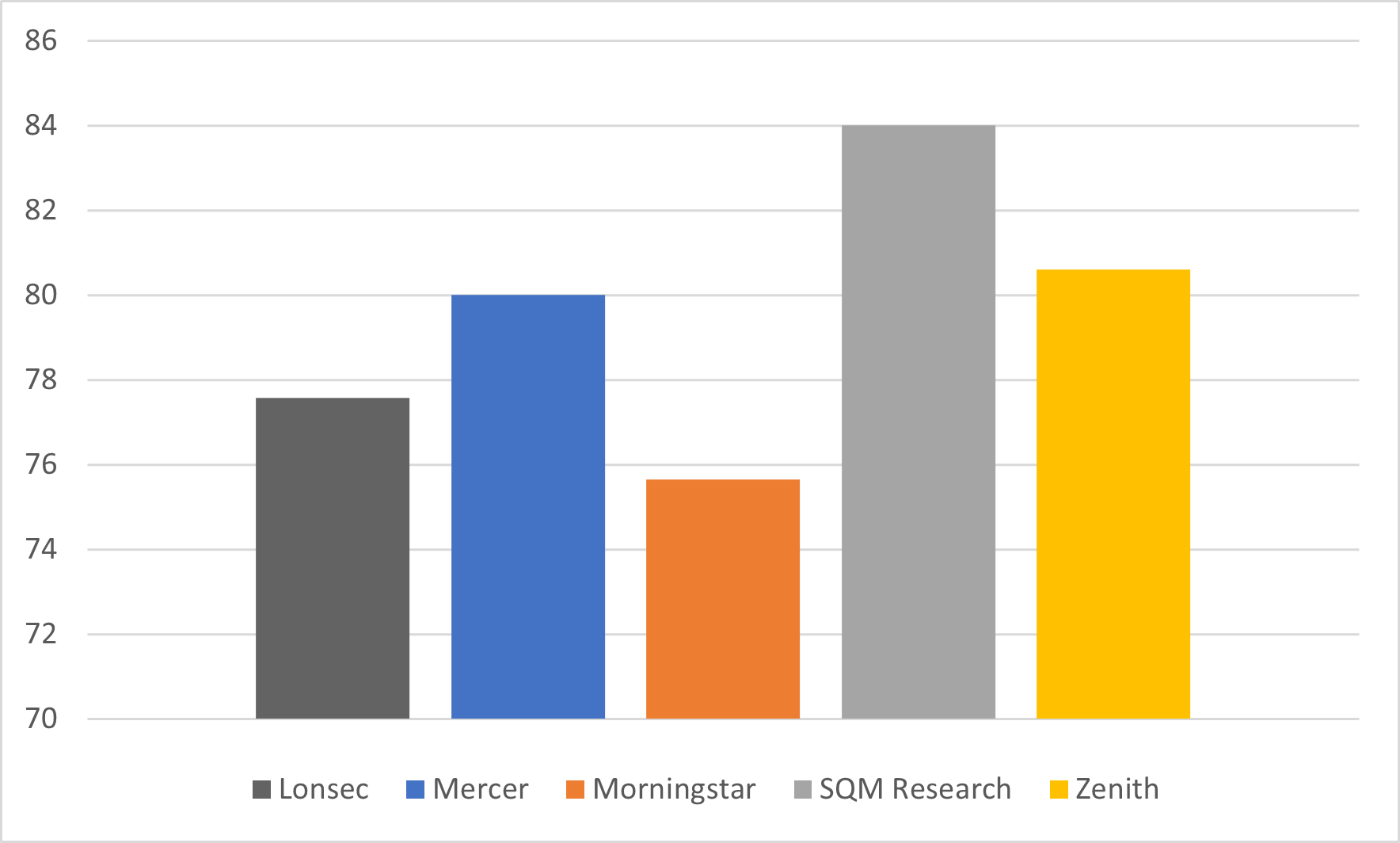

How would you rate the research methodology of these firms?

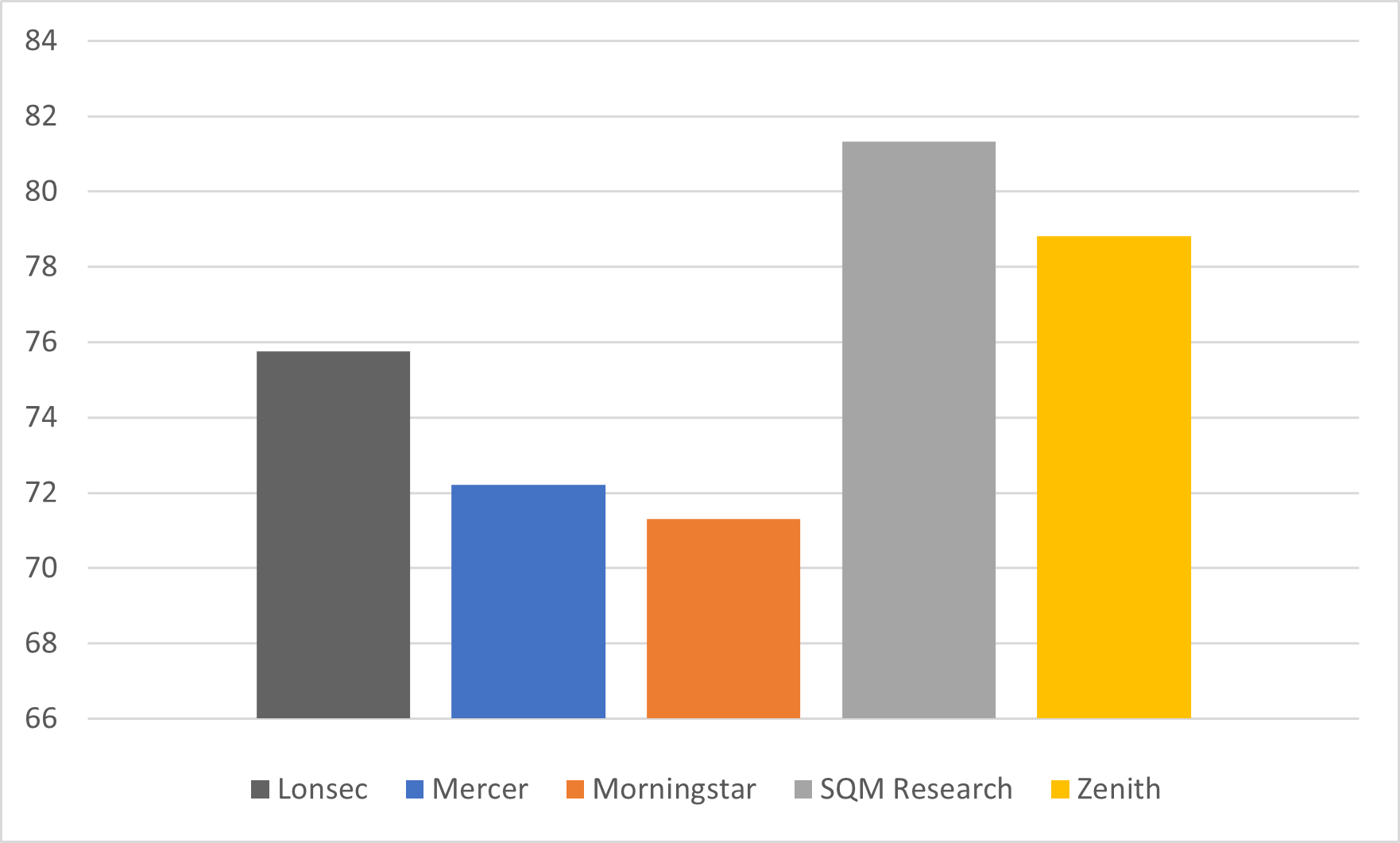

How would you describe the rating of the firms who reviewed your fund?

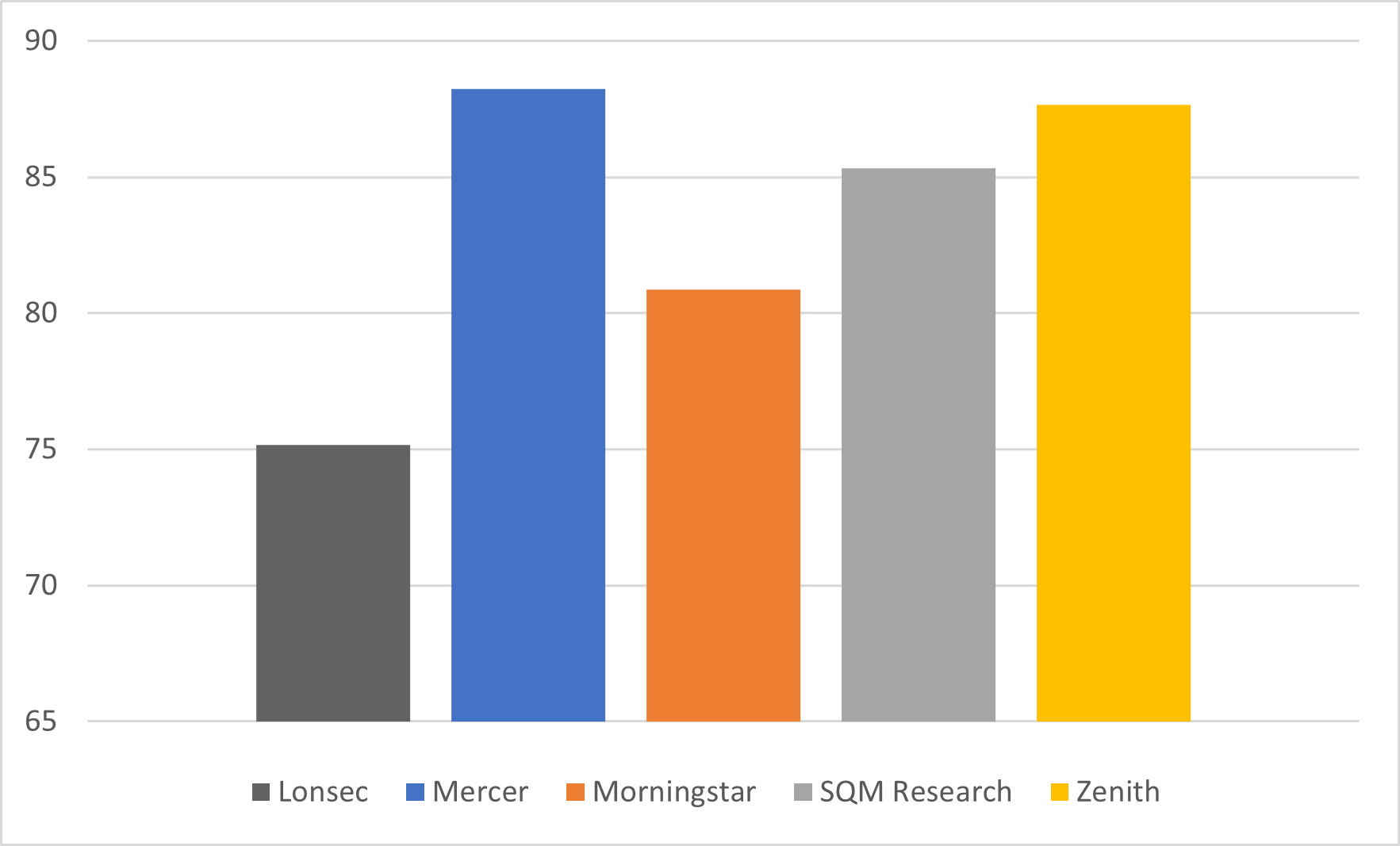

How would you rate the transparency of the rating process?

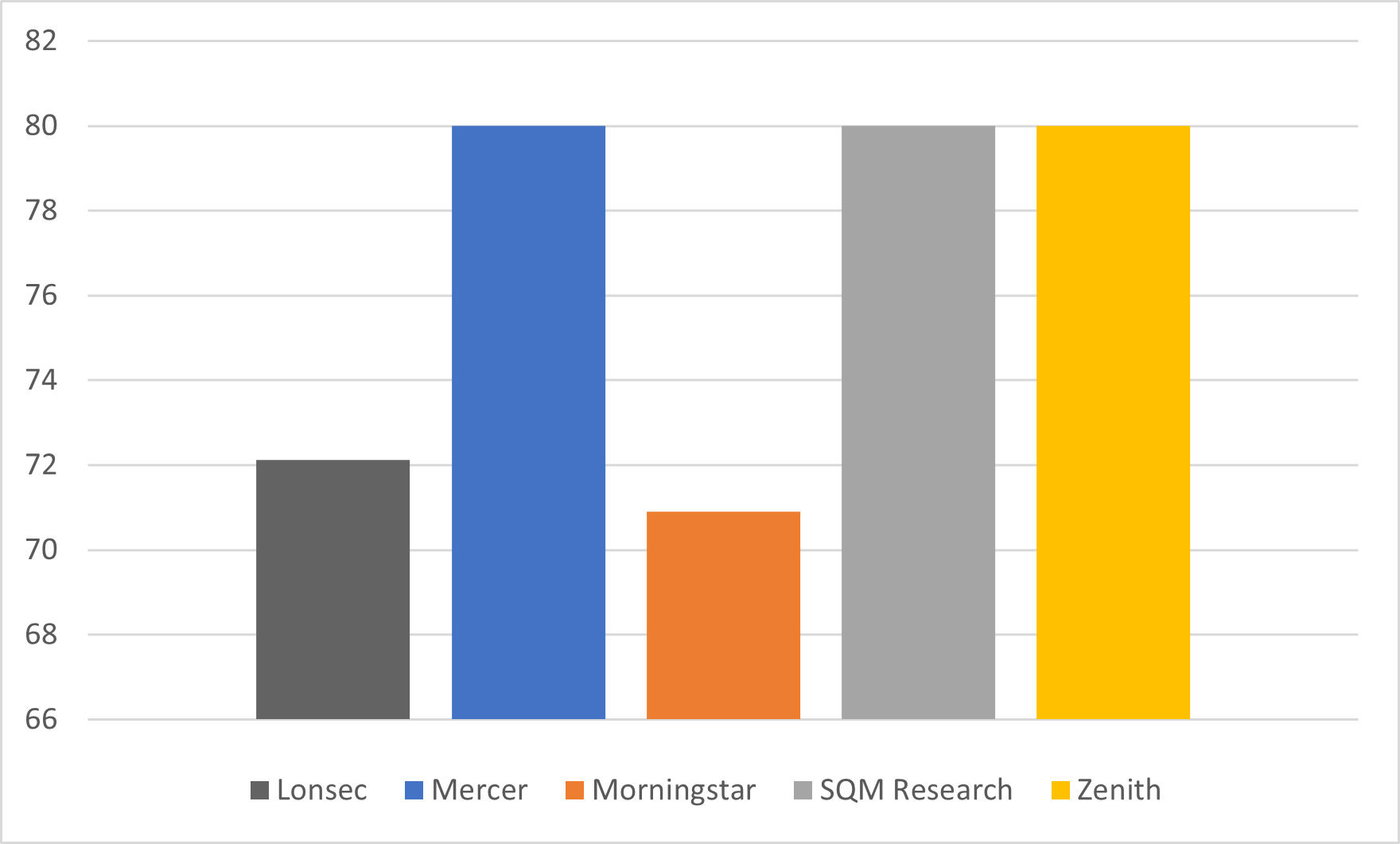

How would you rate the quality and experience of the ratings houses’ personnel with whom you dealt?

How would you rate the feedback you received from the ratings house?

How would you rate the accuracy and effectiveness of the peer group and sector used to evaluate the performance of your products?

It seems that the DBFO legislation may be designed for advice to be built off vertical integration. I wonder where…

yet banks are lending to 19 year old tradies to buy $100k cars without anyone saying boo

Well those two obnoxious pieces of adviser taxation have significantly contributed to mt departure from ther FAR, as of today.

Gone are the days when individuals take responsibility for their own choices.

Yep the product providers often thrive from buying adviser distribution. Corrupt Canberra won’t dare fix it now, especially with ISFs…