Insto investors spooked even before Trump’s tariffs

Institutional investors were turning significantly risk-averse well before US President, Donald Trump, announced his controversial tariff approach, according to the latest State Street Institutional Investor Indicators.

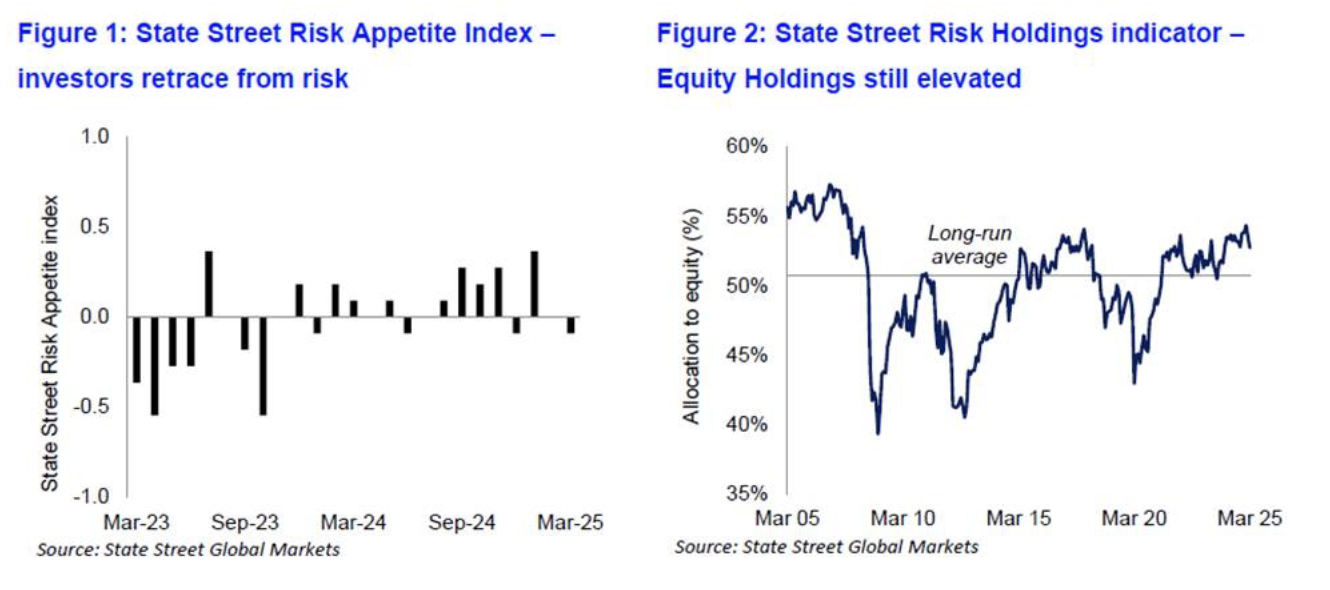

The indicators, released by State Street Global Markets, revealed that the State Street Risk Appetite Index fell to -0.09 in March, as investors continued to retreat from risk assets to embrace a more cautious and defensive multi-asset stance.

The shift represents a reversal of what had been post-global financial crisis highs earlier this year, with the analysis showing that during March, outflows from equities of 0.75% were offset by inflows into bonds and cash of 0.4% and 0.35%, respectively.

Commenting on the data, State Street Global Markets Head of APAC Macro Strategy, Dwyfor Evans said March had seen progressive deterioration in risk appetite amongst institutional investors.

“A centrepiece of the narrative was policy uncertainty around trade and protectionism, with a dual-pronged potential impact around (slower) growth and (higher) inflation,” he said. “Most notably around investor caution was a continued unwind in USD overweight positioning, which bucks the usual safe haven trend associated around risk aversion.”

“Investor caution prompted a further retracement out of equities and into bonds and cash in approximately equal increments. This is a trend that signals the usual equities to bonds rotation witnessed during a monetary easing cycle and which infers expectations around growth slowdown are stronger than upside inflation surprises at this juncture.”

“The impact of China’s policy stimulus continues to play out in the region, but as a predominantly mercantilist region, fears around trade protectionism run deep. The impact on investor behaviour has been mixed within the region: explicit fears of tariffs on China was offset to some degree by renewed optimism around the Tech and IT sector and China’s attempts to pivot trade away from developed markets in recent years,” Evans said.

“Stronger equity inflows to China have part-rotated from elsewhere in the region, most notably India. Expectations on further Bank of Japan rate tightening saw much stronger flows into the JPY, which also gained as a safe haven during these more turbulence investors flow patterns.”

I think these numbers are too low. Especially if you live in major cities. I try to ensure none of…

Are Interprac / Sequoia going to pay the 10’s of $$ millions in AFCA complaints ? Even after Macquarie &…

Always back self interest when a body is marketing a submission to the government

In other words the system is achieving what the government wanted to happen.

Every day I come on here it feels like it is just the SMC trying to lobby to make one…