Long-term insto investors start 2025 solidly overweight equities

Long-term institutional investors have begun 2025 with their biggest overweight position in equities in 16.5 years, according to State Street Global Markets.

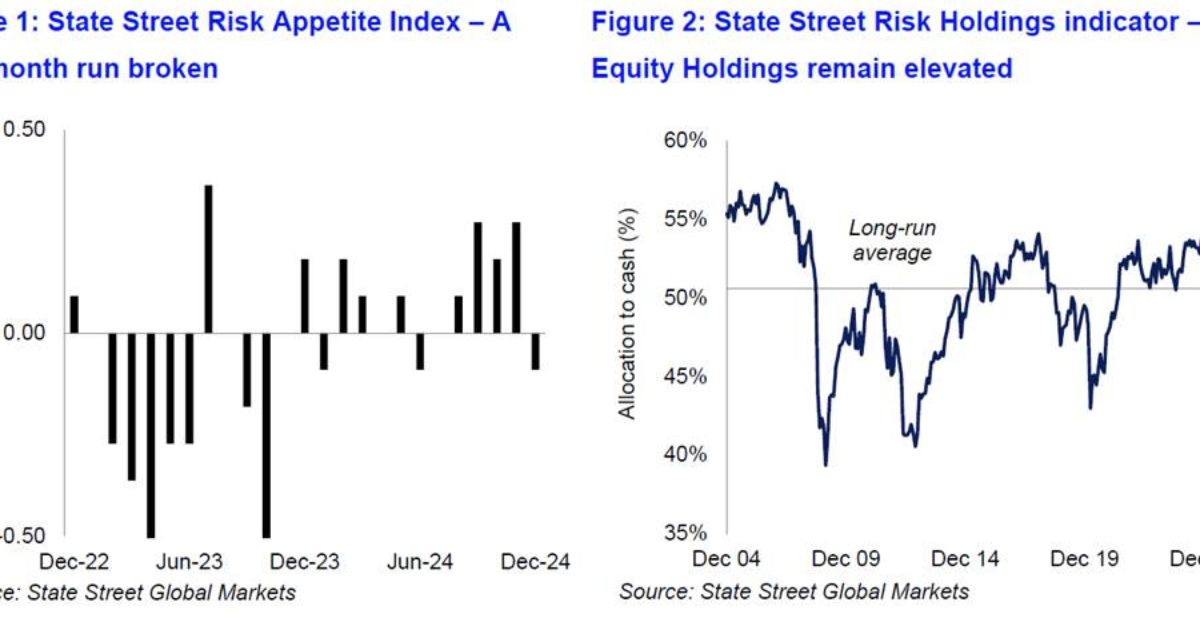

The latest State Street Institutional Investor Indicators saw the risk appetite index fall to -0.09 in December with institutional investors breaking four consecutive months of risk seeking activity.

However, the analysis said that indicators showed that long term investor allocations to equities were largely unchanged remaining t the highest level in sixteen and a half years.

Commenting on the data, State Street Global Markets head of Macro Strategy, Michael Metcalf said three things stand out from investor behaviour in December.

“The first is that when investors looked to reduce risk into year-end they were still more inclined to do so from sovereign bonds than they were from equities. With the allocation to equities largely unchanged in the month, this means long-term investors still begin 2025 with their biggest overweight in equities in sixteen and a half-years,” he said.

“The second is that long-term investors’ overweight in equities remains highly concentrated, but investors are beginning to do something about it. Across the regions we track, the US is the only zone investors are overweight, but the size of the overweight was at least reduced across the month of December and as was the underweight in both Chinese and Japanese equities.”

“This reduction could reflect sensible risk management, but could also reflect uncertainties surrounding US monetary, fiscal and trade policy, alongside hopes that Chinese stimulus measures will finally turnaround sentiment,” Metcalf said.

“The third is that as optimistic investors are about equities, long-term investor pessimism toward sovereign fixed income markets remains entrenched. It is telling as risk was reduced into year-end it was allocations to fixed income which fell. Concerns about holding duration come from fears of a resumption of both inflation and unsustainable fiscal deficits.”

The PHD in economics is the scariest. How many academics actually understand the real world

Money is leaving at a slower rate with this being considered by AMP management as a positive. Australia's Money Pit…

"Our recently launched digital advice solution for AMP Super members is providing simple, intuitive retirement advice at no extra cost.”…

Assistant to Bill Shorten...FoFA, A time when dozens of submissions were made, 90 odd submissions ranging from clients be sent…

Only way to get that 1.25 times back will be to move clients from Brighter Super into their SMA on…