Pre-election Budget focused on tax cuts

The financial services sector has found itself largely unaffected by a Federal Budget aimed squarely at the upcoming Federal Election with cost of living measures such as further tax cuts, energy rebates and housing.

The centrepiece of the Budget is another round of tax cuts which the Treasurer, Jim Chalmers, admitted would be phased in over two years.

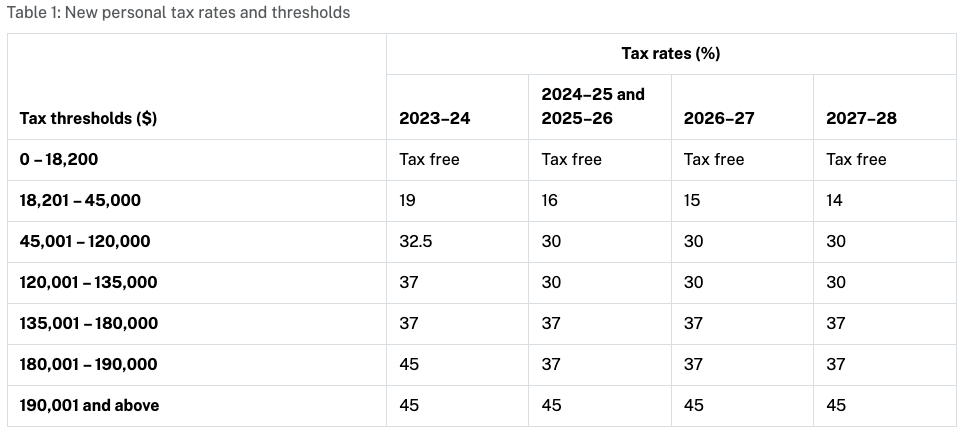

Chalmers aid that the next found of tax cuts will work as follows:

- From 1 July 2026, we will reduce the 16 per cent tax rate to 15 per cent (for income between $18,201 and $45,000).

- From 1 July 2027, this tax rate will be reduced further to 14 per cent.

“The Government’s personal income tax reforms lower the first tax rate from 19 to 14 per cent, the second tax rate from 32.5 to 30 per cent, and lift two thresholds.,” Chalmers said.

The changes to the personal income tax system will cost $17.1 billion over the forward estimates.

It was a measure of the Budget that the Financial Advice Association of Australia (FAAA) says there was very little for financial services, let alone financial advisers, and nothing to address the serious issue of the ever-increasing cost of providing advice, including the growing costs arising from the Compensation Scheme of Last Resort (CSLR).

Some areas that could affect financial advisers in their work with clients include:

- The Tax Practitioner Board is being beefed-up from 1 July 2025, with additional focus on tax practitioner compliance. The government expects this to increase tax receipts by $47 million.

- Surprise tax cuts were announced, with all Australian income tax payers to get a 1% tax cut in the first tax bracket next financial year and another 1% the year after. The 1% cut equates to $268 per annum per tax payer.

- A raft of measures to enforce the ban on foreign home ownership were announced.

- $717 million additional funding is amongst a suite of spends to better enable the ATO to clamp down on tax avoidance.

- ASIC will receive $207 million to spend on updating its business registers.

The PHD in economics is the scariest. How many academics actually understand the real world

Money is leaving at a slower rate with this being considered by AMP management as a positive. Australia's Money Pit…

"Our recently launched digital advice solution for AMP Super members is providing simple, intuitive retirement advice at no extra cost.”…

Assistant to Bill Shorten...FoFA, A time when dozens of submissions were made, 90 odd submissions ranging from clients be sent…

Only way to get that 1.25 times back will be to move clients from Brighter Super into their SMA on…