APRA’s measures finally help disability insurance profitability

The Australian Prudential Regulation Authority’s (APRA’s) regulatory intervention in the disability income insurance market and insurer capital ratios have finally paid dividends, with the sector moving further into the black

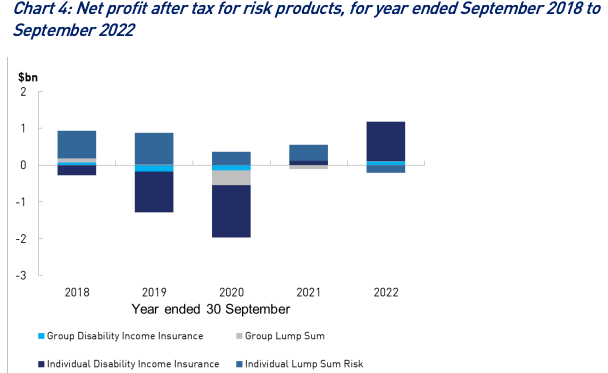

According to APRA’s September quarter life insurance data, collectively, risk products returned an improve net profit for the year ended 20 September of $977 million, compared to $435.7 million in the prior corresponding period.

It said the result was predominantly driven by the $1.1 billion profit recorded in IDII which could be attributed to “repricing activities as well as reserve releases as a result of increases in bond yields over the past 12 months”.

APRA said the only risk product to report a loss was individual lump sum which lost $207 million attributable to net policy expenses.

The regulator said that for the year ended 30 September, the industry reported a net profit after tax of $0.2 billion and a return on net assets of 0.7%.

It said this decrease in performance was driven by an investment loss of $7.5 billion due to unrealised losses on interest bearing investments.

In the group insurance space, it said Group Lump Sum and Group Disability Income Insurance (Group DII) reported profits of $7.6million and $96.8 million respectively for the year ended 30 September 2022. For both products, this is an improvement in performance in comparison to the prior year and was driven by lower net policy expenses from Group Lump Sum and reserve releases for Group DII.

FAR followed by an existing duplication where Advisers had to personally register the same info again. And now FSC want…

Licensee actions against advisers should never be publicly reported, because all but the smallest licensees are totally conflicted in their…

And how much has been applied to offset the ASIC Adviser levy as we were told would happen ? $…

Incredible that regulators are raking in hundreds of millions from the guilty, yet they force the innocent to pay compensation…

....and bugger all of that was ever from unionised industry superfunds! Not because, as they would have you falsely believe,…