Age and choice rule on super balances

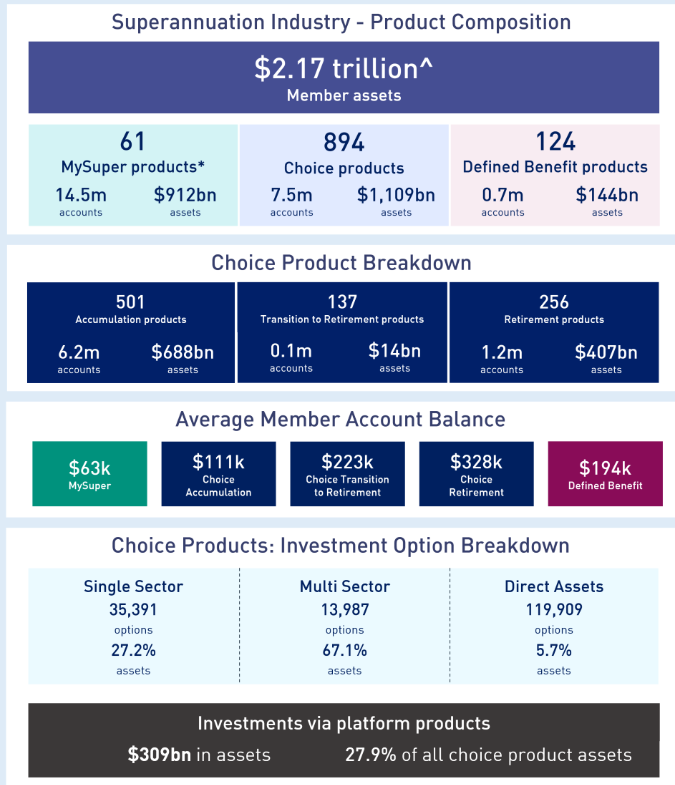

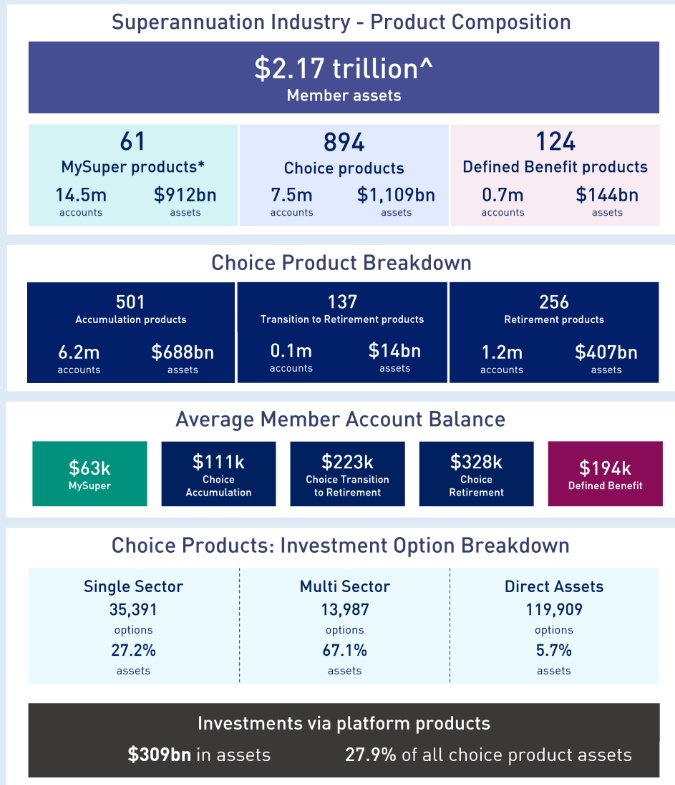

Member assets in Australian superannuation funds total over $2.17 trillion and the biggest member balances are in the choice sector, according to the latest data released by the Australian Prudential Regulation Authority.

The data covering the September quarter last year, reveals that while there are nearly double the number of accounts in the MySuper space, it boasts substantially less in assets with 14.5 million MySuper accounts adding up to $912 billoin in assets while just 7.5 million choice accounts accounted for $1,109 billion.

This is explained by the fact that the average member account balance in MySuper is $63,000, compared to $111,000 in choice accumulation products, $223,000 in coice transition to retirement and $328,000 in choice retirement.

The APRA data also points to the growing importance of platforms in the superannuation mix, with investments via platform products accounting for 27.9% of all choice product assets or $309 billion in assets.

The degree to which the Australian superannuation sector is consolidating has also been revealed by the APRA data which pointed to 61 MySuper products, 894 Choice products and 124 Defined Benefit products.

The APRA data analysis has confirmed the long-standing trend of superannuation account balances being greatest between age 60 and age 80.

Bankrupt them. Simple.

Right...FSP's only off shore services because they need to keep a lid on ever increasing costs like ASIC Industry Levy…

So the very same ASIC that said it is too risky to have Australian based Accountants doing the SMSF Financials…

So you reckon 1,000 paraplanners, compliance officers, customer service representatives, responsible managers, and BDMs have continued on FAR, regardless of…

I’m yet to see one that can’t be climbed or tunnelled under