‘Failed’ super fund ranks best on fees

The Australian Prudential Regulation Authority’s (APRA’S) push for superannuation funds to merge to gain scale and therefore become more cost-effective has been confounded by the last fee survey data produced by SuperRatings.

The data relating to superannuation fees to the end of June, this year, reveals many small to medium funds as having the lowest fees while some of the largest entities are seen as decidedly more expensive.

It also reveals the manner in which the superannuation performance test has had an impact with a number of funds reducing their fees in a bid to ensure that they pass.

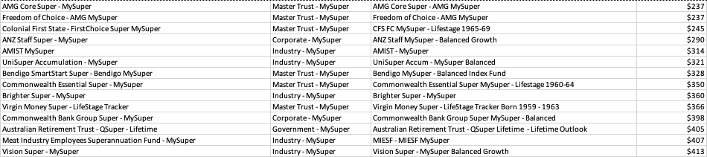

Australia’s second-largest fund, the Australian Retirement Trust which resulted from the merger of QSuper and SunSuper ranked at 13 in terms of overall fees, while AMG Super which suffered the ignominy of being one of 13 funds which failed the superannuation fund performance test topped the SuperRatings fee list with two products.

The third ranked product was Colonial First State’s FirstChoice MySuper product while UniSuper’s Accumulation MySper product ranked seventh and big retail industry fund, REST ranked 19th.

Where scale is concerned, relatively minnows such as AMIST finished in six place while small NSW electricity fund NESS Super ranked at 17.

According to the SuperRatings data, the average fee charged to members by superannuation funds for the period was $499 a year, while the median fee was $488.

What is more, the data show that industry superannuation fund products were just likely to be expensive in terms of fees as their retail fund counterparts, with the Maritime Super MySuper product calculated to have a fee of $699, compared to AMG MySuper’s annual fee of $237.

As well, when it came to the Top 15 funds with the lowest fees, retail master trusts outnumbered industry funds.

The superannuation performance test relates not just to fees but also take accounts of investment returns.

Wait this can’t be true, union funds ads keep telling me they are low cost. Could they actually be lying or misleading the public? Surely if this they case ASIC would do something about it. If not why not? Could it be that they are biased?

Bravo, brilliantly put.

not biased, corrupt and worthy of a ICAC investigation.

The super fee discussion is the biggest scam in the financial industry.

I always enjoy my discussion on why my clients might want low fees….

You have company A, B and C who charge 0.8%, 1.2% AND 1.6% respectively…which fund do you want to be in?

Ah, you have selected fund A and have obviously been watching those dumb “compare the pair adds again?’

Let me explain Mr and Mrs Client. All three of my hypothetical companies are one and the same company. The difference is that to attract the best fund managers you need to offer a competitive package. Hence these fund managers receive a bonus when they exceed certain benchmarks…so, for example, when our first company delivers you a 5% return after fees you might have paid a typical 0.8% (A), when the fund (B) performed at 10% after fees you paid 1.2% and when your fund exceeded 15% after fees you paid 1.6% in fees…now lets compare the pair!

Hardly surprising that failing/failed funds have reduced their fees…. AMG did this and failed again… reduce fees to pass the performance test. How long can retail funds continue offering their products and at a reduced rate when they are losing market share and underperformance relative to peers is rife. Alt and unlisted assets all the way, shame retail funds do not have the cashflow required to invest more in this space.

discussing fees in isolation is doomed to a polarised debate. It is the net outcome after performance, fees and taxes that matters. Regardless of whether you are with a Retail Fund or a Profit for Member Fund – after fee performance is what you get.

Personally I like the irony of EISS Super fund advertising their award winning long term performance only for that option to be shut down by APRA…and these are the guys the QAR reform think it’s ok to give carve outs too, and recruit used carsalesmen, because they’re responsible enough to supervise their staff.

The irony of all this ,

I was told that one pays for what you receive ,

so pay monkeys and receive ??