How two super funds outperformed and still failed the performance test

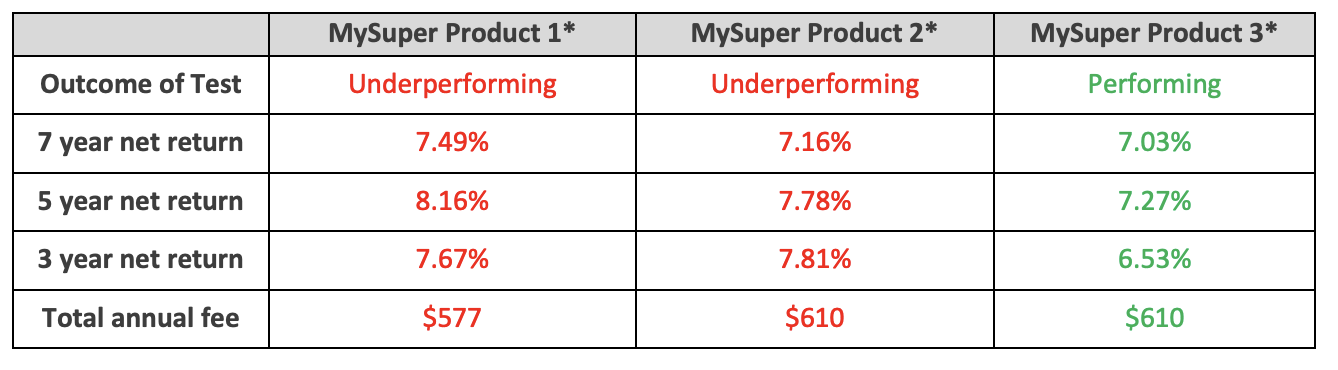

The current Your Future, Your Super (YFYS) superannuation performance test methodology is so inappropriate that the Treasury has been provided with hard evidence that two funds which were deemed to have ‘failed’ actually solidly out-performed a third fund which was passed over 7, 5, 3 and 1 year measures.

The Treasury was provided with evidence that the existing test simply ignores the investment performance of superannuation relative to their peers.

The Association of Superannuation Funds of Australia (ASFA provided the following analysis to Treasury stating that it would name the funds involved, if requested.

In doing so, ASFA said it was clear that the consequences of failing the test, ulimately being closed off to accepting new members, were inappropriate

In doing so, ASFA said it was clear that the consequences of failing the test, ulimately being closed off to accepting new members, were inappropriate

What is more, ASFA reinforced the complaints of many financial advises by pointing out that the test being overseen by the Australian Prudential Regulation Authority (APRA) actually contradicts the rules imposed by the Australian Securities and Investments Commission with respect to past performance.

“ASIC has a Regulatory Guide devoted to the use and disclosure of past performance – Regulatory Guide 53: The use of past performance in promotional material – that addresses the issue of good past performance being an unreliable predictor of future good performance over the medium to long term,” the ASFA submission said.

“In line with this, providers of financial investment products are required to issue consumer warnings to the effect that ‘past performance is not a reliable indicator of future performance’.”

“There were two MySuper products in 2021 with an identical future investment strategy – one passed the Test and the other failed. Obviously, investment performance can only be assessed in arrears, however, this serves to reinforce that the Test is not about future member outcomes but instead about past performance. Given this, it is imperative that a product that has failed the test by a specified margin have the ability to ‘show cause’ as to why it should continue to be treated as a performing product.

Elsewhere in its submission, ASFA also points to the reality that funds which fail the existing test twice are actually likely to become unattractive merger partners because it will be hard for the successor fund to argue that it will be in the best financial interests of its members.

“In some cases, successive failures of the performance test may reduce the likelihood of a fund merging as the loss of members in response to the letter and the inability to accept new members reduces the appeal of the merging fund and impedes the best financial interests analysis of the potential successor fund,” the ASFA submission said.

ASFA urged that capital gains tax (CGT) relief should be provided to make mergers more attractive.

The system is broken. Einstein famously said “Two things are infinite: the universe and human stupidity; and I’m not sure about the universe.”