Platforms account for quarter of choice super assets

Platforms now account for more than a quarter of superannuation choice investments flows, according to the latest data from the Australian Prudential Regulation Authority (APRA).

The June quarter data, published by APRA this week, reveals that investment via platform products now account for 28.6% of all choice product assets or $346.8 billion.

This has to be seen in the context of total superannuation member assets of $2.37 trillion, with choice products accounting for $1,211 billion of those assets, compared to $1.012 billion in MySuper products.

As APRA moves further down the path of applying the superannuation performance test to choice products, the data has also emphasised the magnitude of the task in front of the regulator with 812 choice products in the market across $7.3 million member accounts.

This compares to just 57 MySuper products across 14.7 million member accounts.

The complexity is also emphasised by the fact that the vast majority of choice investments are held in 12,511 multi-sector product options, accounting for 66.4% of assets.

The impact is further defined by the fact that the average member account balance in MySuper products is $69,000 compared to $126,000 in choice accumulation products.

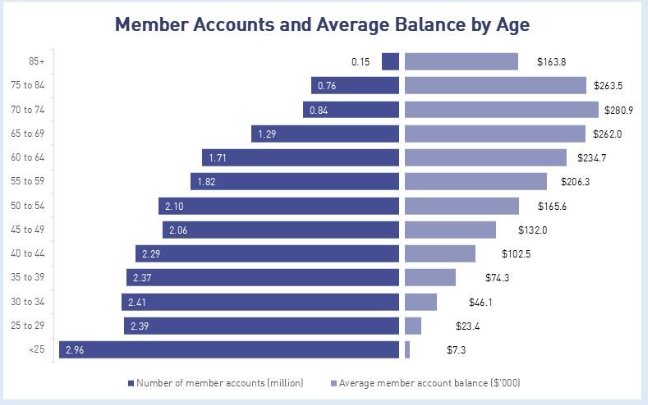

The data also confirms that those aged over 60 have the highest account balances, peaking at those aged 70 to 74 where 840,000 people have an average account balance of just under $281,000.

These funds should be a lot more concerned about their investment returns, which are starting to look very sick. Waiting…

How deluded is this guy! Scandal after scandal and he thinks he has done a good job.

Phoenix has already begun ''Sequoia declined to confirm whether the end of the cross guarantee was part of a plan…

He “addressed regulatory through our simplification work”. This just shows how out of touch and clueless he is. We had…

Another failed bureaucrat blowing his own trumpet as $$Billions blow up from MIS fraud & failures, that ASIC were warned…