Super returns headed for 8% EOFY

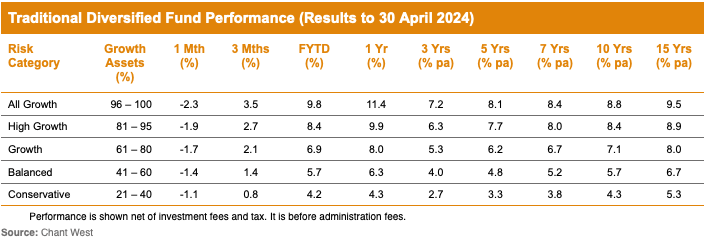

Superannuation fund investment returns appear to be on track to end the financial year up 8% despite a lack-lustre April.

According to the latest data from specialist superannuation research and ratings house, Chant West, the median growth fund (61% to 80% growth assets) was down 1.7% in April after five consecutive months of positive returns.

However, the analysis said that with markets again so far in May, Chest West estimated the median growth fund’s financial year return would be around 8%.

Commenting on the data, Chant West senior investment research manager, Mano Mohankumar said the April returns had been impacted by the fact that both share markets and bond markets had been down in the face of expectations that the US Federal Reserve would not be delivering on expected rate cuts.

“Over the month, Australian shares fell 2.9%. International shares slipped 3.2% and 3.3% in hedged and unhedged terms, respectively. Bonds too had a disappointing month as Australian and international bonds fell 2% and 1.7% respectively, as bond yields rose,” he said

“However, the big story is the healthy return over the financial year to date, despite all of the uncertainty around inflation and expectations of when the Fed will start cutting rates, not to mention ongoing geopolitical tensions.”

“The return experience over FY23 and FY24 so far collectively represents a healthy reward for members who have remained patient and maintained a long-term focus,” Mohankumar said.

“If you think back to nearly two years ago, FY22 closed with a particularly disappointing June quarter amid surging inflation and uncertainty as to when interest rate rises might come to an end. At that time, I don’t think anyone could have foreseen a return of nearly 18% over the subsequent two years. It’s just another important reminder to put short-term noise aside and focus on the long game,” he said.

“Over the long term, super funds continue to meet their return and risk objectives and our estimate of 8% for FY24 puts super funds on pace for a 13th positive return out of 15 years,” Mohankumar said.

@Anon2 If these were obscure funds that came out of nowhere, how much warning would you need to tread carefully?…

@Phil, Advisers don't need to be clairvoyants but you're not doing your job unless you do your own research. You…

@Overreach Again, I wouldn't be too worried about ASIC or any other regulatory body that thinks they can change a…

Overreach. It is NOT the regulators role to designate how to run private enterprise particularly when asleep at the wheel…

Why does the headline say stop Div 296? Surely the sensible lobbying approach is to amend Div 296, to remove…