Super returns headed for double digits in 2024

Superannuation fund returns are looking set to end the year in double digit territory, according to specialist superannuation research house, Chant West.

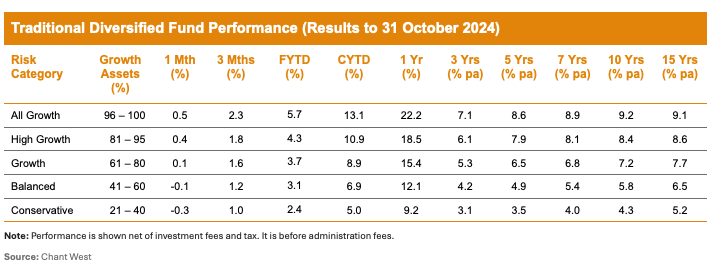

It said that while the median growth fund (61 to 80% in growth assets) was flat in October (up 0.1%) with share markets up in November Chant West is estimating that with just six weeks remaining to the end of the calendar year, the growth median is sitting at a healthy 10.3%.

Commenting on the data, Chant West senior investment research manager, Mano Mohankumar said that a final result near 10.3% would be a tremendous outcome.

“It’s well ahead of the typical long-term return objective which translates to about 6% and super fund members shouldn’t forget that this year’s result follows the better-than-expected CY23 return of 9.9%,” he said. “Given the strength of share markets over the past two years, super fund members in higher risk portfolios would have fared even better.”

“In October, both shares and bonds fell as stronger than expected economic data resulted in markets dialling back expectations on the rate of policy easing by the US Federal Reserve. At its most recent meeting in November, the Fed followed up its September 0.5% interest rate cut with a less aggressive reduction of 0.25%, bringing the target range to 4.5% – 4.75%. Also weighing on markets during the month was uncertainty leading up to the US Presidential election, which we now of course know the result of.”

Mohankumar said that despite the negative month for shares and bonds, super funds were able to produce a flat return in October, largely due to the diversification provided by foreign currency exposure.

“Over the month, Australian shares retreated 1.3%. International shares were down 0.9% in hedged terms, but the depreciation of the Australian dollar (down from US$0.69 to US$0.65) turned that into a healthy gain of 3.9% in unhedged terms. Super funds on average have about 70% of their international shares exposure unhedged. Australian and international bonds slipped 1.9% and 1.5%, respectively, as bond yields rose.”

The PHD in economics is the scariest. How many academics actually understand the real world

Money is leaving at a slower rate with this being considered by AMP management as a positive. Australia's Money Pit…

"Our recently launched digital advice solution for AMP Super members is providing simple, intuitive retirement advice at no extra cost.”…

Assistant to Bill Shorten...FoFA, A time when dozens of submissions were made, 90 odd submissions ranging from clients be sent…

Only way to get that 1.25 times back will be to move clients from Brighter Super into their SMA on…