ASIC admits consultation on super advice fees bill

The Australian Securities and Investments Commission (ASIC) has confirmed it was consulted by the Government on the legislation underpinning the payment of advice fees from superannuation accounts but is keeping the exact details vague.

The regulator has acknowledged that it was consulted in relation “extracts” from the exposure draft of the Treasury Laws Amendment (Delivery Better Financial Outcomes and other Measures) Bill but did not explain what those “extracts’ covered.

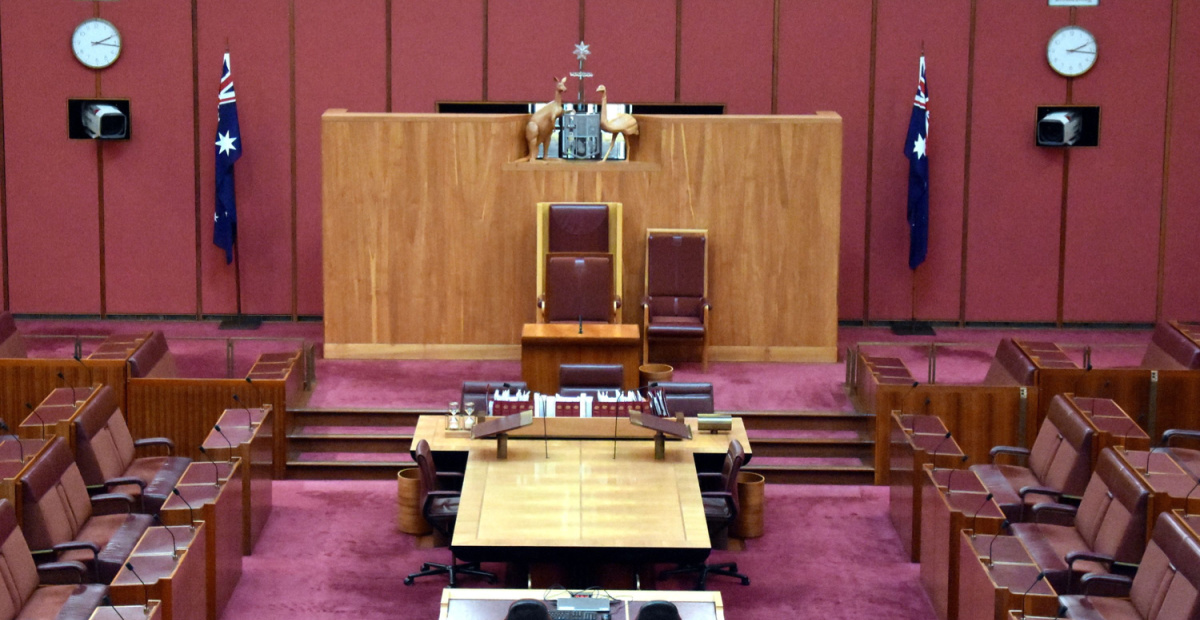

ASIC’s response to a question on notice from a recent Senate Economics Legislation Committee hearing comes against the background of financial advice organisations expressing concern about the regulator’s current interpretation of the legislation and how that interpretation might change in the future.

The Financial Advice Association of Australia and the Joint Licensees Group have both urged the Government to bring forward specific amendments confirming the status of advice fees paid from superannuation accounts.

Both organisations have argued that the current legislation creates significant uncertainty.

NSW Liberal Senator, Andrew Bragg asked ASIC during the committee hearing whether the regulator had checked the Bill and provided “advice on it before the exposure draft was released”.

ASIC confirmed its involvement stating: “Prior to the release of the exposure draft of the Treasury Laws Amendment (Delivery Better Financial Outcomes and Other Measures) Bill, ASIC was consulted in relation to extracts from the exposure draft”.

“The purpose of this consultation was to allow ASIC to advise whether ASIC was able to interpret and administer the legislation in accordance with Government’s stated policy intent. ASIC confirmed that this was the case in relation to the relevant extracts,” the formal response to Bragg’s question on notice said.

Along with the FAAA and Joint Licensees Group the Financial Services Council (FSC) and the Law Council of Australia have urged the need for specific legislative amendments to reinforce the legal status of the payment of advice fees from super accounts.

Let’s get real. ASIC has huge influence over the design, interpretation, and selective enforcement of financial services regulation.

Consequently the regulatory environment we have is not aligned to the best interests of consumers or the intentions of their elected representatives. It is aligned to the biases and and prejudices of ASIC employees.

ARROGANT

SECRETIVE

INCOMPETENT &

CORRUPT

Yep that’s our ASIC

How are these bureaucratic institutions allowed to operate as they do ?

They truely act and believe they are above the law, above the Australian people, above the politicians and most certainly with Both knees on Real Advisers necks

Wow! and ASIC said they’re not involved in policy formulation just enforcing the law! Trust level in ASIC for me just went south.

It’s Really starting to lend weight to the suspicion that this is a coordinated attempt to make FP irrelevant.

Plain as day ASICs overreach is in collusion with Industry funds unfounded anti adviser bias which has killed our profession. Wile also thieving us from over taxing advisers to litigate our own AND all and sundry. Treasury and ASIC got us to where we are. Why repeat the failure? By accident, no. It’s intentionL and 3 years of posturing and wasting time in consultation to ignore everyone is a disgrace Jones. Disgustingly incompetent by all parties who are incapable of respecting the Advice profession who has funded ASIC for too long.

Make no mistake.

ASIC is working against the interests of consumers and superannuants.

So secretive about this.

Disgusting and vile.

BTW – Where is that red tape relief ?

This is what happens when ideological factions crawl into the machinery of power. They work together to work around the law and subvert it, but in some instances, like this one, they get the opportunity to change direct language in the law and then pretend that “nothing is changing.”

ASIC is not meant to write law. During the Senate hearing, Alan Kirkland framed it as nothing out of the ordinary, appearing quite casual about it. Kirkland should state on the public record who at ASIC was involved in the “consultation,” what his own role was—directly or indirectly—what language was first shown to ASIC, and what ASIC’s recommended changes were, along with all the people involved in that recommendation.

It seems to be forgotten that it was only in 2021 when, as Choice chief executive, Alan Kirkland said the financial advice industry is still “too conflicted to be trusted.” It is likely he got the job at ASIC exactly because of these views. This involvement raises serious questions about the impartiality and integrity of the process behind this legislation. The financial advice profession deserves transparency and accountability, not backdoor dealings and ideological agendas.

Well said! though I hold little hope for transparency as Hubris runs deep within ASIC and it’s allies now.

I concur Peter, the major issue though is when was the de rigueur is anything but “backdoor dealings and ideological agendas”.

I’m sure Kirkland’s comments were either a deeply held misconception or virtue signaling for personal gain.

I’ve been around almost 25 years now. Never seen anything but this.

Can someone explain how and why Alan Kirkland was appointented an ASIC commissioner, considering ASIC were funding his “consumer group”, CHOICE. Seems like a rather conflicted appointment.

Seems to be the pathway now. Perhaps Super Consumers Australia will also have someone promoted to ASIC in due course.