ASIC gives ‘financial advisers’ central role in unsolicited advice examples

The Australian Securities and Investments Commission (ASIC) has made “financial advisers” central to a series of examples it has used within an information sheet dealing with “Unsolicited contact leading to financial advice” (INFO 282).

At the same time as financial advisers have complained about the ASIC levy funding action against unlicensed operatives, the ASIC examples place financial advisers in critical roles in each of the three scenarios it outlines.

Those examples traverse unsolicited contact from call centres and telemarketers and digital contact.

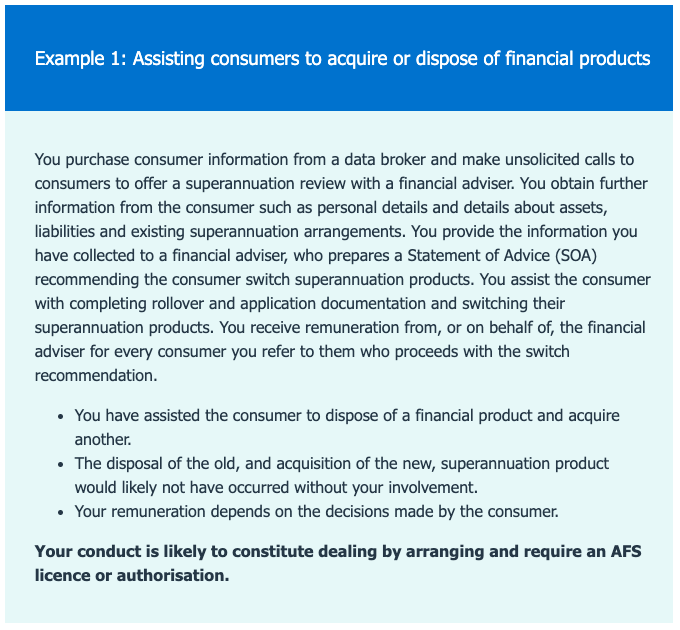

The following represent the three examples provided by ASIC:

$7.8 BILLION SCAMMED from Australians in the last 3 years and ASICs single focus remains to blame and KILL Real Advisers for everything.

ASIC why the hell are you doing about the $7.8 BILLION SCAMMED ?

Yep Nothing.

Useless, Misguided, Corrupt ASIC.

Hey ASIC what did you do about Dodgy Dixon’s MIS Fiasco ? Yep Nothing except get Real Advisers to pay for your incompetence via CSLR.

ASIC what did you do about Banks $6 Billion FFNS ? Yep Nothing until RC and then you charge obscene levies to Real Advisers to chance the banks.

Disgusting, misguided, useless and Corrupt ASIC.

Australians are being TOTALLY DUDDED by Canberra and ASIC.

What did ASIC do about Storm Financial when it was obvious they were breaking the laws at the time and causing consumer harm?

They stood by and let those consumers be harmed, then used it as justification to indiscriminately persecute all financial advisers, including the honest majority.

The Storm fiasco was the start of ASIC’s long track record of choosing to persecute honest advisers rather than protect consumers from harm. It has become ingrained in their culture. Financial advice regulation needs to be taken away from ASIC.

At least ASIC no longer hide their disdain for advisers anymore.To be fair they have made it known for a while now what they think of us. How such a biased and conflicted regulator is allowed to oversee an industry where 99% of it’s participants are doing the right thing is just plain wrong.

Why doesn’t ASIC stop wasting everyone time and just put out one single press release where they confirm their view that every single issue in the financial services industry is solely the fault of advisers. Product providers charging dead clients – advisers fault, Product failures – advisers fault, Green washing – advisers fault, Union funds breaching sole purpose test and charging fees twice – advisers fault, Action taken by accountants, lawyers, property spruikers – advisers fault, Money lost to scams from unlicensed sources – advisers fault.

Yet I received a phone call from a random yesterday who was about to send over $500k to a firm with a similar name to my financial planning business. The company was de-registered 3 years ago so its obviously a scam but ASIC won’t do anything because it doesn’t involve a financial planner. Its apparently the third time he’s almost sent money so whilst he’s a slow learner there are plenty of scammers.

I rang ASIC last year about an active scam and the attitude was pretty much “we don’t give a flying f” I was totally flawed…by the we don’t care attitude. Billions lost to scammers and they’re focussed on culling Advisers at every single angle.

The question is we know these Public Servants to be corrupt but when will they be held accountable?

PMSL….HAHAHAHAHA….”Public Servants held accountable”…..OMG my stomach hurts…You need to go into comedy.

Australia’s Sinister Institution for Corruption = ASIC