Automation and head-count reductions loom for advisers

The financial and insurance services sector has been named as the one of the most ‘at risk of automation’ industries among occupations that require higher education, with significant headcount reduction across a number of professions expected over the next ten years, according to predictive analytics platform Faethem by Pearson.

The risk of automation for professions such as finance brokers or investment advisers over the next decade would stand at 59%, followed by financial investment adviser at 44%, taxation accountants at 29% and insurance brokers at 25%.

As a result of jobs impacted by technology adoption, the overall headcount for financial investment advisers was estimated to fall from 28,260 in 2022 to 24,150 in 2032. Also, 24,080 of bank workers and 7,420 of insurance consultants jobs would be impacted by technology, driving down the headcount in 2032 to 50,960 and 19,080, respectively.

According to the “The Future of Australian Jobs” report by Faethm by Pearson, the economic growth would still drive the need for some occupations, however, the nature of jobs would quickly evolve as tasks would be both automated and augmented by technology.

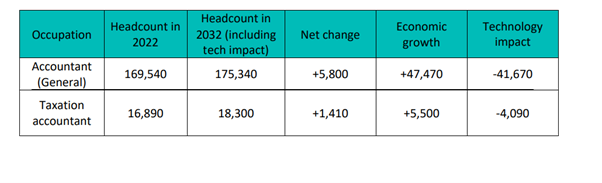

As an example of the work that can be highly automated but would still see the growth but “at a greatly reduced rate”, Dr Richard George, Chief Data Scientist, at Faethm by Pearson, nominated accountants.

“Over the next 10 years (projections to 2032), accountants will grow from 186.4K to 193.6K – approximately 0.4% annual growth rate. Put another way, if there wasn’t any technology adoption there would be another 45,000+ jobs created,” he said.

“The 45,000+ potential jobs are removed from the economic forecast to calculate our Headcount in 2032.”

George urged companies to plan carefully for retention strategies and reskilling and mentioned accountants as one of the professions with a high number of transferrable skills which would conveniently set them up for a variety of new careers, including the careers of cyber security analysts with which they shared already a number of characteristics.

This would include accounting skills such as ability to process information (compiling, coding, categorizing, calculating, auding and verifying information or data) or an ability to provide guidance and expert advice to management which were particular value in other professions.

The modelling developed by Faethm by Pearson considered the impact of new emerging technologies on future jobs in three ways: as automation, where many tasks could be considered as ‘repetitive’ or ‘robotic’, augmentation, where work tasks could be made more efficiently with the help of technology and as addition of entirely new jobs.

“The model does not predict ‘job losses’, but does predict that a lot of what we consider work today, will be replaced by technology in the future. How we respond to this transformation will determine whether jobs will be lost or ‘seamlessly’ transitioned to new jobs,” George said.

ASIC are worse than hopeless. Always have been for at least 30 years.

This is absolutely appalling.... Seriously... Canberra is a mess.

You couldn't make this incompetence up

If they are unlicensed, they clearly have nothing to do with our profession and therefore we should not be footing…

ASIC = Arrogant, Secretive, Incompetent & Corrupt