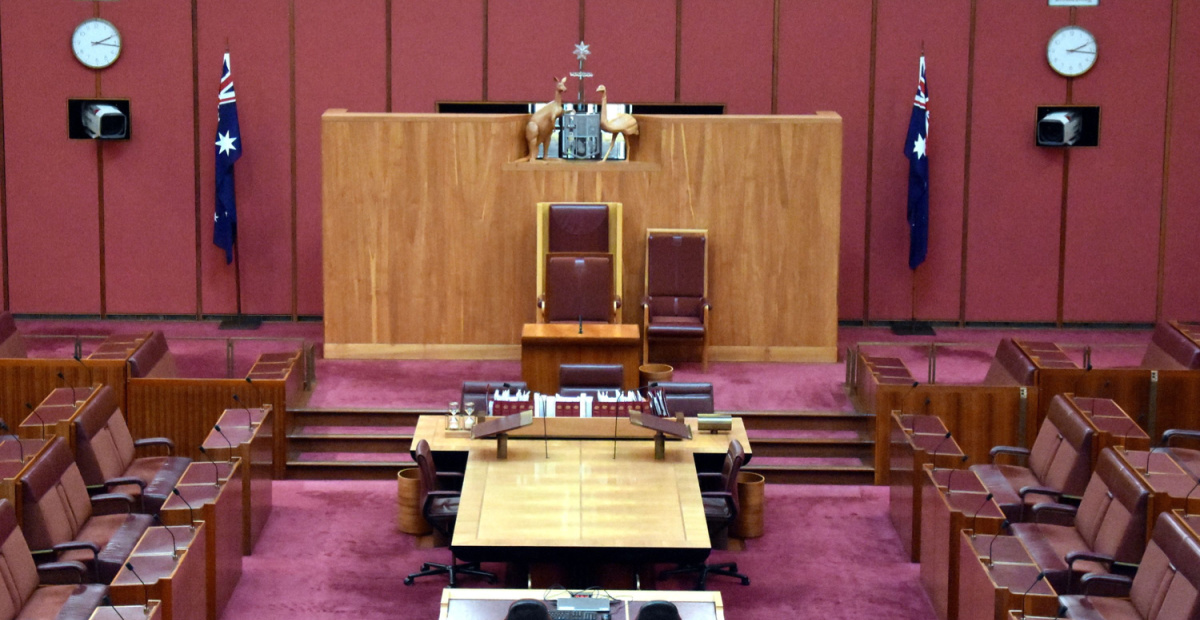

Industry unites to persuade Senate on super advice fees

The major advice representative organisations plus the major licensee, Insignia Financial, have moved to persuade the Senate to amend legislation to ensure the payment of superannuation advice fees.

Both the Joint Associations Working Group (JAWG) and Insignia chief executive, Scott Hartley have reinforced the issue ahead of next week’s (13 June) review of the Government’s legislation by the Senate Economics Legislation Committee.

Further, the JAWG has produced advice from senior legal counsel making clear that further legislative amendments are necessary because the Government’s approach does not go far enough.

The JAWG has used a late submission to the committee to identify what it describes as the three critical issues:

- Increased Compliance Burdens: The requirement for superannuation trustees to verify each piece of advice individually is impractical. This measure drastically increases administrative costs, which will inevitably be passed on to consumers, reducing the value of their superannuation savings.

- Restrictions on General Advice: The current provisions inadvertently limit the ability to charge for general advice services, contrary to the policy objectives of the Quality of Advice Review. This restriction reduces access to crucial financial advice for many superannuation members, impacting their ability to make informed financial decisions.

- Chilling Effect on Advice Accessibility: The increased compliance burden and potential legal risks may lead trustees to stop facilitating advice fee deductions from members’ accounts altogether. This outcome would severely restrict consumers’ access to affordable, high quality financial advice funded through their superannuation.

“The consequences of these issues are far-reaching and negatively impact consumers by increasing costs, reducing access to necessary advice, and creating uncertainty. To address these challenges and protect consumer interests, at a minimum the following amendments would need to be considered:

- Allow deductions for both personal and general advice, ensuring continuity with existing legal provisions.

- Clarify in the legislation rather than in the Explanatory Memorandum that trustees are not required to check every individual piece of advice, enabling them to maintain a risk-based compliance approach.

- Ensure the law preserves current tax practices relating to advice fee deductions and provides clarity on GST treatment.

For his part, Hartley backed the need for amendments to the legislation in circumstances where amendments to the legislation’s Supplementary Explanatory Memorandum does not go far enough.

“We acknowledge amendments the Government has made to the Bill’s Supplementary Explanatory Memorandum. However, this does not resolve the issue with the current drafting which may place an undue burden on superannuation trustees before they are able to satisfy members requests for payment of advice – a burden which may ultimately lead to higher costs for superannuation members.”

The JAWG is made up of: Boutique Financial Planning Principals Association Inc. (BFP) CFA Societies Australia Chartered Accountants Australia and New Zealand (CA ANZ) CPA Australia Financial Advice Association of Australia (FAAA) Financial Services Council (FSC) Financial Services Institute of Australasia (FINSIA) Stockbrokers and Investment Advisers Association (SIAA) Institute of Public Accountants (IPA) Licensee Leadership Forum (LLF) Self Managed Super Fund Association (SMSFA) The Advisers Association Ltd (TAA)

Government, Treasury, and ASIC are all adamant that the proposed legislation is sufficiently clear, and won’t hinder the provision of advice. But like much financial services legislation it is ambiguous enough for regulators to interpret according to their own biases and prejudices.

ASIC claims they don’t design the laws they just enforce them. But ASIC provides significant input into law design, and ASIC input is acted upon rather than politely listened to then ignored as happens with FAAA. And when laws are ambiguous, ASIC effectively has licence to do what they always wanted anyway.

This situation will be no different. None of Government, Treasury, or ASIC wants consumers to be able to pay for independent professional advice from their super. This legislation, combined with ASIC’s guaranteed bias in enforcing it, is deliberately designed to stop consumers from doing so. The only reason they don’t put an outright ban on it is consumers would be outraged. So they are banning it by stealth.

Exactly, Govt, Treasury & ASIC are Regulatory Capture Corrupted to support All things Industry Super.

That includes making Real Advice harder and more costly.

At the same time these Left Wing Corrupted Zealots will green light the most conflicted, vertically owned Industry Fund Product Sales by Uneducated, Unqualified Back Packers and All paid for via HIDDEN COMMISSIONS charged to every member when most members pay this HIDDEN COMMISSION for no Service.

CANBERRA IS BEYOND CORRUPTED and it must be Stopped !!!! .

I think the governement are using industries as a extra tax cash cow. take a look at the numbers – what is the saying follow the money!

https://michaelwest.com.au/asic-big-fat-cash-cow-or-world-class-regulator/

Stephen Jones and Labor are limiting retiree access to their pension accounts. If an Australian is in pension phase, then there is no role for the government, or their big bureaucracies, to control how a retiree spends their own funds. It is shameful that Stephen Jones and Labor have an agenda to start dictating how retirees can access their super pension accounts.

While I agree with your premise, why not just increase the pension by the monthly fee and charge a DDR.

Yep but previously the client was saving 7.5% GST via RITC.

If they want a fortnightly quarterly or half yearly or annual payment, then what ? Why should we be the ones forced to work around when all the Academic Evidence supports the value of Advice on an ongoing nature. The Government should be doing everything in it’s power to back access to advice, not trying to lock retiree”s money away.

I always thought that I paid my FAAA membership for them to lobby on my behalf. I have no idea what they have done for the last 10 years and the writing should have been on the wall when Anderson grand standed to retain commissions years after the horse had bolted.

This will be my first year in 25 years in the industry that I won’t be renewing my membership

Unfortunatey there are too many product companies that pay their employees’ and ARs’ memberships for them, so that FAAA will lobby on the product companies’ behalf.

Same. Complete waste of money. The only FAAA members left will be working for Hesta. Plus the other members without formal educational qualifications that need to buy some credentials.

ASIC are by law a regulator which means they must regulate on the basis of the laws over which they have responsibility. In theory they should not be involved in policy development.

Anyway who thinks ASIC are not up to their necks in harassing Ministers, Treasury and anyone else involved in financial services supervision, has got rocks in their head. ASIC are in this fiasco up to their eyeballs..

And, because ASIC have brought loyalty just like Gina Hancock and the swimmers, all those consumer groups funded by ASIC from our advisor Levy are lining up behind anything ASIC says. And then there’s their ultra close relationship, at least ideologically, with the industry funds

As they used to say in the Dick Tracey comic strip, you can’t fight City Hall

You’re right ASIC shouldn’t be involved in policy development. The further problem of course is their track record of changing interpretations retrospectively on certain laws. Which is why the industry is rightly worried about these new laws around advice fees. It’s fine for the minister to say he doesn’t think it will change much and is just “clarifying the existing situation” but if fund managers are concerned about being seen by ASIC to not be meeting the ambiguous standards they just wont allow fees to be charged.

These changes add no value, do nothing to protect consumers and just increase red tape further. It’s staggering that after 2 years in office this is the only thing MP Jones has to his name.

He is quite clearly incapable of the comprehensive legislative reform required to fix the mess created over the last decade so instead he’s tinkering around the edges to look like he’s doing something.

Or, perhaps it’s intentional and part of the broader attempt to keep undermining independent advisers until we can no longer operate. No other industry in this country faces the same level of absurd red tape.

Why is the group with this level of resources make a “late” submission?

Have we not seen the point which is to provide industry funds Trustees with the opportunity of frustrating any attempt to deduct fees from a memebrs account and to thwart any attempts by way of advice which might culminate in the movement of funds from an industry arrangement.

The very idea that some nobody from an industry fund seeks to sit in judgement on the adequacy of an advice document would be laughable except that is what Jones as an apparatchik of the industry funds is seeking to achieve.