Morningstar positive on Insignia despite investor pessimism

Investors are underappreciating Insignia Financial with a turnaround already underway including with respect to its advice business, according to Morningstar.

The research and ratings house analysis represents good news for Insignia’s new chief executive, Scott Hartley, just months after taking the reins from Renato Mota.

Releasing a new analysis of Insignia, Morningstar equity analyst, Shaun Ler pointed to market perceptions of Insignia but suggested investor concerns were overblown.

On advice, Morningstar’s analysis said revenue was posed to improve as Insignia properly integrated its acquisitions and simplified.

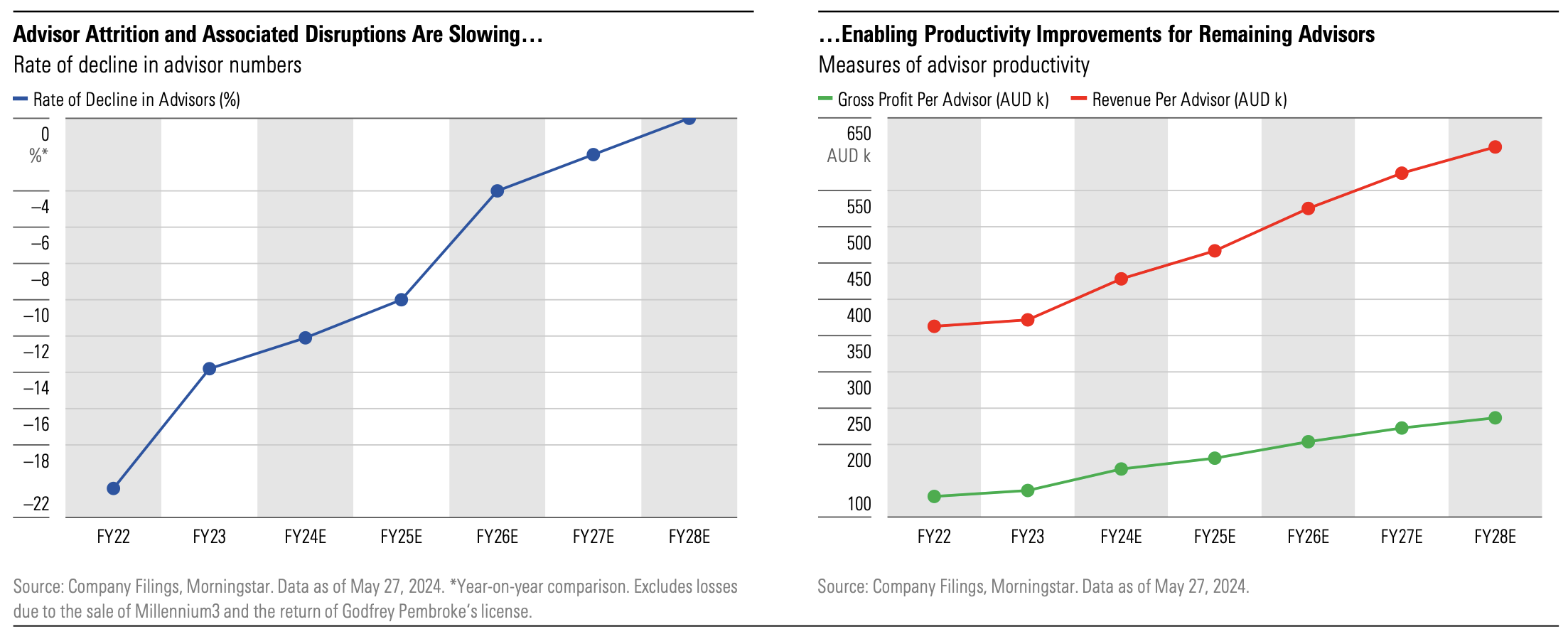

“We believe Insignia’s advisor network restructure is likely to solidify the firm’s reputation, reduce organic advisor attrition, minimize advisor workflow disruptions, and restore morale,” it said.

“Efforts to streamline working processes and new technology upgrades should improve advisor productivity.”

Looking at broader investor perceptions of Insignia, the analysis said, “Investors appear to be deterred by margin compression, sluggish flows, restructuring challenges and deteriorating debt coverage”.

Looking at broader investor perceptions of Insignia, the analysis said, “Investors appear to be deterred by margin compression, sluggish flows, restructuring challenges and deteriorating debt coverage”.

“We think these concerns are overblown, and the market underappreciates Insignia’s ability to stabilise earnings. We see cost-cuts counterbalancing tepid revenue declines.”

Indeed, the Morningstar analysis described Insignia as cheap in circumstances where market assumptions of the company are overly pessimistic suggesting it is “the pick of all asset managers” in circumstances where it is below the long-term price/earnings averages and comparable peers.

The analysis said that a turnaround is underway for Insignia with the Group cost/income ratio falling in the first half despite successive increases from first-half fiscal 2020.

“The proportion of funds in newer platforms with better features and lower fees is growing. Its platform market share looks to be steadying from consecutive declines. The advice business achieved EBITDA profitability in first half fiscal 2024 after five halves of losses,” it said.

The only reason they are trying to Tax Unrealised Capital Gains is because the Industry Funds can't easily show the…

She was also an Investment Committee Member for Dixon's.

I'll be interesting to see tranche two of the DBFO legislation shortly. I'm guessing it probably has more terrible news…

Private debt is a great example of misapplication of the term "risk" in financial planning. "Risk" is a term that…

If the above is true (and I have no doubt it is), especially about Treasury and ASIC staff being clients…