Self-licensed advisers more likely to have increased profits

Self-licensed financial advisers are more likely than their peers to have seen profit margins increase over the past 12 months, according to the latest research from Investment Trends.

According to the research, 38% of the advisers surveyed say they have been experiencing increases in business profitability and that this was more so for those who are self-licensed.

“Self-licensed advisers – a segment that continues to grow – are even more likely to have seen profit margins increase (41% reported an increase in practice revenue in 2023, compared to 39% in 2022),” the research analysis said.

The research, contained within the Investment Trends 2023 Adviser Business Model Report, also pointed to the fact that as the cost of producing advice had increased so, too, had fees.

“While the cost to produce advice has risen by 9% during the period ($3,580, up from $3,280 in 2022), advisers on average have increased their fees by 25% for upfront fees ($4,000) and 18% for ongoing relationship fees ($4,700),” the analysis said.

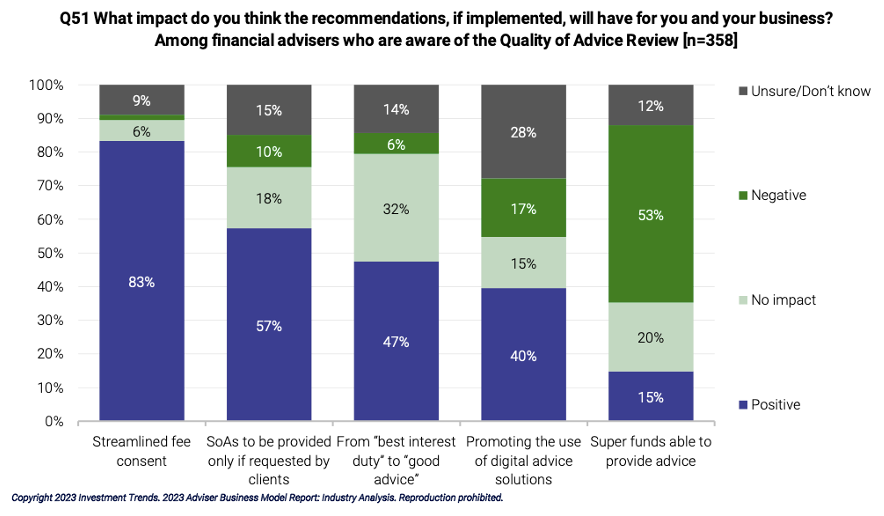

The research has also point to advisers believing that while the Quality of Advice Review (QAR) recommendations will increase the accessibility and affordability of advice, they are less certain about it improving the overall quality.

Commenting on the research, Investment Trends Head of Research, Irene Guiamatsia said advisers, and the industry as a whole, had worked hard to address issues around conflict and it was natural to seem some hesitancy around what some might construe as a return to old ways.

“The sector faces the important challenge to chart a cohesive path to a future state where different advice delivery mechanisms that can cater to different client groups and different life stages co- exist harmoniously – ultimately supporting a growing cohort of Australians with preparing for retirement”.

This says to me that self licensed are leaving something out? Maybe they are not as up to date on their compliance

This says to me that AFSL compliance by big groups is over the top and aimed at protecting the AFSL from the lowest common Adviser.

Even ASIC, Govt, Pollies and everyone else under the sun know how over cooked AFSL Adviser compliance is.

Get over it and get your own AFSL if you care.

And hopefully AFSL’s disappear one day.

Exactly. All professional advisers should be self licensed, or employed advisers. ARs and CARs evolved from tied distribution agents. But they didn’t evolve terribly far. Consequently in an era of professionalism they are a huge compliance risk with huge compliance costs. It is ultimately impractical to reconcile an AR’s autonomy with a licensee’s legal responsibilities. The AR/CAR model is steadily collapsing under its own weight.

This says to me that you need to take your big dealergroup blinkers off….