Small advice licensee numbers too big to ignore

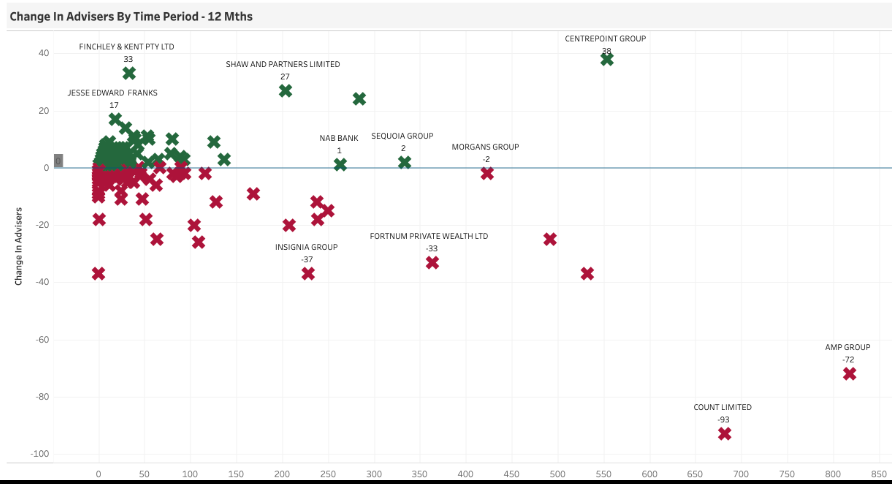

The degree to which the number of small licensees is growing to represent a significant proportion of the Australian financial planning profession has been made clear in the latest analysis from WealthData.

Coming just weeks after the two dominant players in the Australian wealth management industry, AMP Limited and Insignia Financial, implemented strategies which substantially lowered their balance sheet exposure to financial advice, the WealthData analysis has reinforced the changing dynamics and the continuing growth among smaller licensees.

WealthData principal, Colin Williams said that, increasingly, large licensee owners were looking like outliers.

Financial Newswire’s own research reveals that the 10 largest financial planning licensees now account for just under a third of the 15,512 current registered on the Financial Adviser Register (FAR).

Key Adviser Movements Last Week:

- Net change of advisers +5

- Current number of advisers at 15,512

- Net Change Calendar 2024 YTD (-109)

- Net Change Financial YTD +172

- 34 Licensee Owners had net gains of 41 advisers

- 20 Licensee Owners had net losses for (-36) advisers

- 3 new licensees commenced and zero ceased

- 10 New entrants

- Number of advisers active this week, appointed / resigned: 69

Growth Last Week – Licensee Owners

- Lifestyle Asset Management were up by five advisers who moved across from Maven Capital controlled by Craig Burbury.

- Bombora up by three with two advisers moving from Pareto Group, plus one new entrant

- Picture Wealth up by two with one adviser from Wealth Today, controlled by WT Financial Group and one new entrant

- A long tail of 31 licensee owners up by net one each including Morgans, Count and Viridian.

Losses Last Week – Licensee Owners

- Craig Burbury (Maven Capital), down by net 7. As mentioned above, five moved to Lifestyle Asset Management and the other two have yet to be appointed elsewhere

- Financial Services Group down by five, all yet to be appointed elsewhere

- AMP Group down by four and none showing as being appointed elsewhere

- Capstone down by three, one still showing as ceased, one moved to CFG Advice and one joined Wealth Today owned by WT Financial Group

- Pareto Group down by two, both joining Bombora

- 15 licensee owners down by one each including Lifespan, Rhombus and ANZ Banking Group.

CSLR is essentially the Target Toaster refund approach to Financial Services - basically the client says to AFCA 'Hey my…

Why isn't the accountant fined they setup the SMSF? why isn't the bank fined to giving out the loan to…

So APRA finally acts on the decades long problem of union funds making up valuation on unlisted assets and the…

CSLR is wrong in every aspect. Essentially it is a system for rogue operators like Dixon's to fleece clients knowing…

There's an even bigger sustainabilty risk to CSLR than dodgy vertically integrated firms like Dixons. CSLR has just paid $64K…