Super fund adviser numbers down

The Government may be looking to superannuation funds to deliver affordable advice, but the latest data analysis has confirmed that there are now fewer financial advisers being employed by superannuation funds than in January, this year.

While the Quality of Advice Review (QAR) pointed to superannuation funds as a cost-effective advice delivery mechanism and the Assistant Treasurer and Minister for Financial Services, Stephen Jones, even canvassed the new designation of “qualified adviser’, data derived from the Financial Adviser Register suggests a different reality.

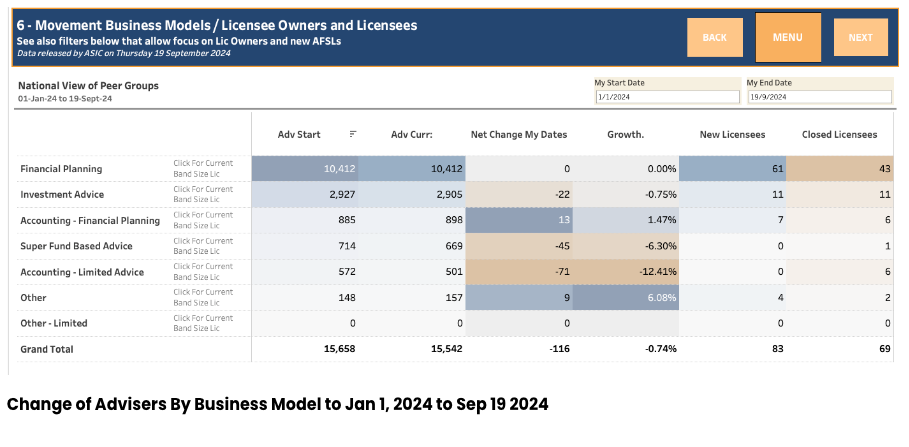

According to analysis undertaken by WealthData principal, Colin Williams the super fund based advice model composed mainly of industry funds giving advice now boasts 45 fewer advisers than on 1 January, this year, representing a 6.30% decline.

Williams attributed at least a part of this decline to the impact of superannuation fund mergers but also the reality that some advisers were providing general, intrafund advice and are no longer listed on the Financial Adviser Register.

Importantly, the same analysis shows that there has been no diminution in the number of advisers providing holistic advice, and that the number of holistic advisers employed by accounting firms has actually risen by 13.

Williams said the number of advisers working under the accounting limited advice model had continued to decline, down 71 or 12.41%

Key Adviser Movements This Week:

- Net change of advisers +5

- Current number of advisers at 15,516

- Net Change Calendar 2024 YTD (-106)

- Net Change Financial YTD +173

- 31 Licensee Owners had net gains of 36 advisers

- 27 Licensee Owners had net losses for (-32) advisers

- 1 new licensees commenced and one ceased

- 16 New entrants

- Number of advisers active this week, appointed / resigned: 74.

Growth This Week – Licensee Owners

- Four licensee owners up by net two advisers this week:

- Sherrin Partners with both advisers switching from Millenium 3 owned by WT Financial Group

- Perpetual with one adviser moving from Securinvest and the other from Grimsey Wealth

- Ord Minnett with both advisers being new entrants

- Centrepoint with one adviser moving from AMP Group and one new entrant.

- A tail of 26 licensee owners up by net one adviser including;Telstra, Lifespan, Infocus and Sequoia.

Losses This Week – Licensee Owners

- Five licensee owners were down by net two advisers

- Apex Macro Financial – both advisers yet to be appointed elsewhere

- Bennet and Co – Both advisers moved to Gamma Wealth on July 1, 2024. Bennett and Co is now down to zero advisers

- Count Limited with three advisers leaving Merit Wealth, which generally offers restricted services. One of the advisers being appointed at EMR Services and the other two not appointed elsewhere. Count Limited gained one adviser as a new entrant at Paragem.

- James Wright (Sayers Wealth) with both advisers yet to be appointed

- Stuart Aaron Mangion (Firestone Financial Services) with both advisers not appointed elsewhere.

- 22 licensee owners down by net one each including Bombora, Macquarie Group, NGAA and Shartru.

Given Jones’ push to legalise backpacker advice, there is less incentive for super funds to employ professional advisers.

Exactly, Industry Super will never increase Real Adviser numbers and only wait until BackPacker Sales Agents are allowed.

Compare the Pair, Industry Super charge every member HIDDEN COMMISSIONS for Sales Advice most members don’t use.

Most of the larger providers cannot deliver on an unreasonable service level – 8 week turnarounds for NOI confirmation letters.

They will need to have a different mindset on delivering advice.

What I can’t believe is how the Industry Funds get away with their ‘compare the pair’ adds!

How can it be fair to compare an Industry ‘Balanced’ fund which is 70 – 80% growth with a retail ‘balanced’ fund which operates on a 50 – 60% growth allocation, be a fair pair?

And naturally of course!! the adds go into hibernation as soon as the market go into free fall – amazing that eh!!