Who is healthiest amongst advice licensees?

Australia’s publicly-listed financial planning licensees published a mixed bag of results to the Australian Securities Exchange (ASX) last month, but the healthiest balance sheet may not be the ultimate determinant in an expected round of mergers and acquisitions.

Analysis undertaken by Financial Newswire suggests that while chasing scale remains the focus of most of the licensees, other factors are also in play.

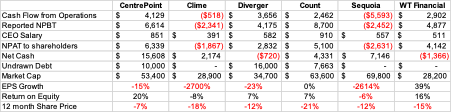

The bottom line is that with the AFSL market moving to a barbell – micro players on one side and mid-tier players on the other side, the economics of the listed mid-tier AFSL’s have been laid bare in FY23 as indicated in the below table.

The share price performance of all the listed players has been negative and worse than the small ordinaries comparative benchmark at -1.6%.

Earnings were patchy when you look through “adjustments” with the best indicator of EPS being largely negative across the sector. Given Count’s flat EPS it is surprising to see the 21% decline in the share price compared to its peers.

Amongst the worst performers was Clime and questions would now be asked as to how they will fund some $1.3M of deferred consideration owed to recent acquisitions.

CentrePoint and Diverger have new debt facilities in place and have made statements on their intention to grow via acquisition.

The key number of NPAT to shareholders shows CentrePoint in a favourable light, especially considering its cash flow from operations was some 65% more than Count and it is generating an ROE almost three times that of its rival.

Whilst not listed, Fortnum’s latest published results for FY22 show a NPBT of $422,613 which is an improvement from the large loss the previous year. Given the net asset position of $2,315,544 it will want to see its performance continue to improve as the current ratio is only just above one times and cash from operating activities was $431,224.

Whilst it doesn’t operate an AFSL, AZ Next Generation is now reporting its numbers as a large entity and its FY22 shows reported NPBT of $13.281M. With recent media speculation suggesting a $700M valuation is being sought by its owners, this is circa 52 times reported NPBT, compared to the listed players 8.07 times for CentrePoint and 7.31 times for Count.

While I applauded Peter and the AIOFP for the referral, this is exactly what the NACC is for. NACC is…

Liar, Liar, Liar, Jones has continued to add more and more Red Tape madness to the Hot Mess. “Let’s make…

It’s become a circus and Jones is the chief clown.

What amazes me is that some of the former Dixon's financial advisors who were front and centre in biased and…

Dixon Financial Advisers were just doing their jobs. Similar to the below. Licensed Financial Planners love & care about their…