HUB24 leverages licensee relationships to post record inflows

Publicly-listed platform company HUB24 Limited has posted a 24% increase in net profit after tax of $47.2 million while defining the evolving shape of the financial planning profession and the substantial exit of AMP and Insignia as a significant growth opportunity.

The profit was recorded on the back of record annual platform net inflows to up 62% to $15.8 billion with the company claiming to have access

Releasing its full-year results to the Australian Securities Exchange (ASX), HUB24 told analysts and investors that business models in the advice profession are evolving with the emergence of a new category of mid-to-large sized independent advice firms which are willing to invest in technology and data solutions.

HUB24 said that it had been collaborating with licensees to develop solutions and that this had led to a significant increase in the number of advisers using the platform.

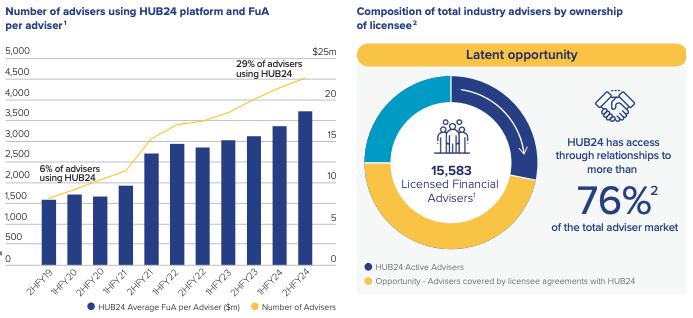

“As at June 2024 there were 4,525 (29% of total advisers) who were actively using the HUB24 platform which has grown from 1,625 (6% of total advisers) as at June 2019,” it said, noting that net adviser growth over this period had bene approximately 580 a year.

It said the average funds under advice per adviser using the platform had increased to $19 million from $8 million in 2019 and that, in addition, 68% of net inflows in FY24 were from advisers who had begun using the HUB24 platform prior to FY24.

On the back of its $47.2 million net profit, the directors determined a final dividend of 19.5 cents per share fully franked.

The company said that based on its expectation of strong net inflows, the company is now targeting platform FUA in the range of $115-$123 billion by FY26.

Wow, who could not see this coming. The YFYS test was always going to result in super funds herding. The…

Excess Govt Regulation strikes yet again. Canberra’s bureaucratic buffoons can’t help themselves inventing more Regs, more Red Tape and more…

We’re all in this together hey Industry Super members. Industry Super Trustees, Union & Bikie representatives clip the members funds…

It is time for super funds to be regulated to higher standard. It appears ridiculous that one could argue that…

Every single union fund will fail APRAs guidance on the valuation approach for their significant holdings of unlisted assets. Yet…