Outflows see Vanguard drop down sustainable fund rankings

Research and ratings house, Morningstar has pointed to “huge second-quarter outflows” having seen Vanguard fall down the rankings of Australia’s sustainable share managers.

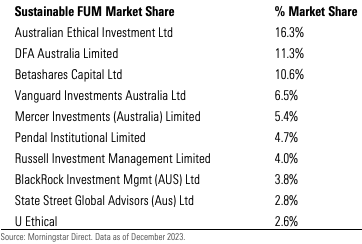

Morningstar’s Global Sustainable Fund Flows report for the final quarter of 2023 emphasised the continuing concentration of the Australian sustainable funds market with the top 10 firms accounting for more than two-thirds of total assets in sustainable funds.

In terms of market share it said that Australian Ethical had continued to be the dominant manager, while Dimensional had supplanted Vanguard in second place as a result of the second quarter outflows.

It said Betashares had taken second position, with Vanguard dropping to fourth position.

The Morningstar analysis said global sustainable funds experienced net quarterly outflows for the first time on record in the final quarter of last year, with investors withdrawing $US2.5 billon while the broader market of open-end funds and exchange traded funds also suffered redemptions against a continuously challenging macroeconomic backdrop.

Where Australia and New Zealand was concerned it said sustainable funds attracted $IS567 million of subscriptions which represented a strong recovery from the muted flows reported in the previous quarter of just $US30.1 million.

It said the total size of Australian sustainable investments is estimated at $US31.2 billion as at 30 November, last year – $US100 million higher than the previous quarter.

Morningstar senior manager research analyst, Shamir Popat said that while global sustainable funds reported negative outflows, the Australian and New Zealand market continues to report positive inflows despite the challenging conditions.

Dixon Financial Advisers were just doing their jobs. Similar to the below. Licensed Financial Planners love & care about their…

Yeah, it'll get there no doubt... 25,000 - unqualified hacks peddling product 5,000 - fully qualified advisers

How much financial damage caused ? How many client losses ? So ASIC how come Dodgy Dixon’s have had no…

The evidence is mounting.

It is not the fault of advisers who care and do right by their clients. ASIC is culpable for failing…